Summary

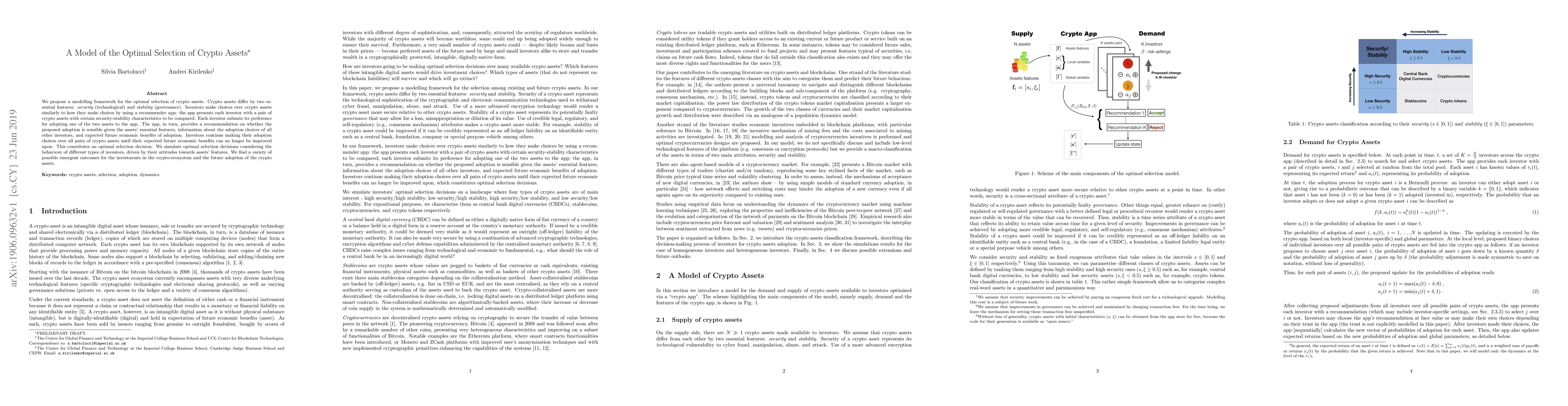

We propose a modelling framework for the optimal selection of crypto assets. Crypto assets differ by two essential features: security (technological) and stability (governance). Investors make choices over crypto assets similarly to how they make choices by using a recommender app: the app presents each investor with a pair of crypto assets with certain security-stability characteristics to be compared. Each investor submits its preference for adopting one of the two assets to the app. The app, in turn, provides a recommendation on whether the proposed adoption is sensible given the assets' essential features, information about the adoption choices of all other investors, and expected future economic benefits of adoption. Investors continue making their adoption choices over all pairs of crypto assets until their expected future economic benefits can no longer be improved upon. This constitutes an optimal selection decision. We simulate optimal selection decisions considering the behaviour of different types of investors, driven by their attitudes towards assets' features. We find a variety of possible emergent outcomes for the investments in the crypto-ecosystem and the future adoption of the crypto assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)