Authors

Summary

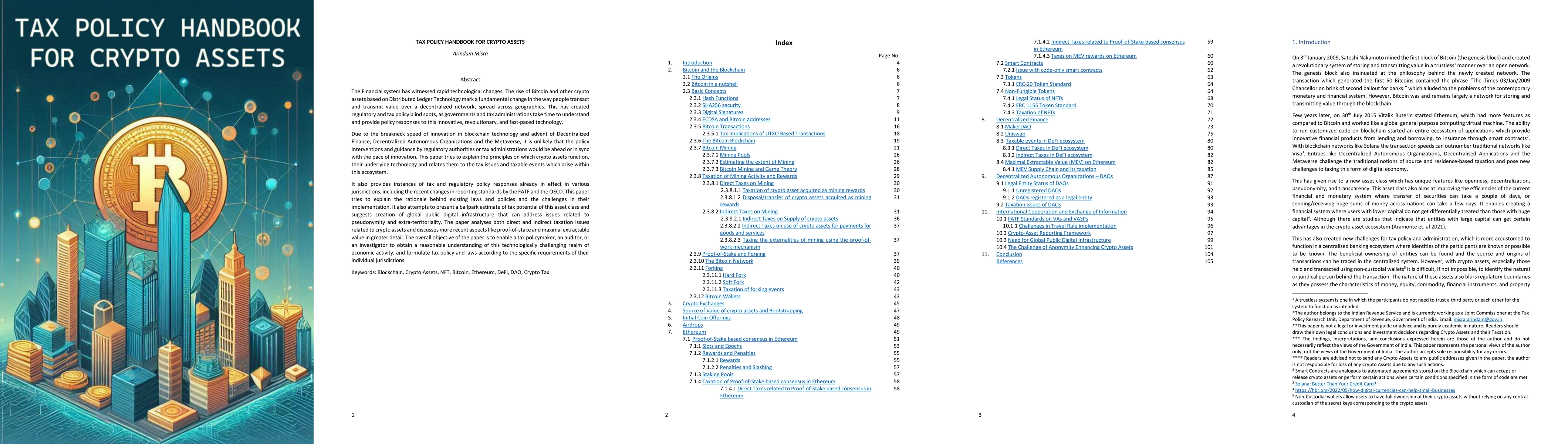

The Financial system has witnessed rapid technological changes. The rise of Bitcoin and other crypto assets based on Distributed Ledger Technology mark a fundamental change in the way people transact and transmit value over a decentralized network, spread across geographies. This has created regulatory and tax policy blind spots, as governments and tax administrations take time to understand and provide policy responses to this innovative, revolutionary, and fast-paced technology. Due to the breakneck speed of innovation in blockchain technology and advent of Decentralized Finance, Decentralized Autonomous Organizations and the Metaverse, it is unlikely that the policy interventions and guidance by regulatory authorities or tax administrations would be ahead or in sync with the pace of innovation. This paper tries to explain the principles on which crypto assets function, their underlying technology and relates them to the tax issues and taxable events which arise within this ecosystem. It also provides instances of tax and regulatory policy responses already in effect in various jurisdictions, including the recent changes in reporting standards by the FATF and the OECD. This paper tries to explain the rationale behind existing laws and policies and the challenges in their implementation. It also attempts to present a ballpark estimate of tax potential of this asset class and suggests creation of global public digital infrastructure that can address issues related to pseudonymity and extra-territoriality. The paper analyses both direct and indirect taxation issues related to crypto assets and discusses more recent aspects like proof-of-stake and maximal extractable value in greater detail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersSimple and Effective Portfolio Construction with Crypto Assets

Stephen Boyd, Kasper Johansson

Environmental-Social-Governance Preferences and Investments in Crypto-Assets

d'Artis Kancs, Pavel Ciaian, Andrej Cupak et al.

No citations found for this paper.

Comments (0)