Summary

Despite being described as a medium of exchange, cryptocurrencies do not have the typical attributes of a medium of exchange. Consequently, cryptocurrencies are more appropriately described as crypto assets. A common investment attribute shared by the more than 2,500 crypto assets is that they are highly volatile. An investor interested in reducing price volatility of a portfolio of crypto assets can do so by constructing an optimal portfolio through standard optimization techniques that minimize tail risk. Because crypto assets are not backed by any real assets, forming a hedge to reduce the risk contribution of a single crypto asset can only be done with another set of similar assets (i.e., a set of other crypto assets). A major finding of this paper is that crypto portfolios constructed via optimizations that minimize variance and Conditional Value at Risk outperform a major stock market index (the S$\&$P 500). As of this writing, options in which the underlying is a crypto asset index are not traded, one of the reasons being that the academic literature has not formulated an acceptable fair pricing model. We offer a fair valuation model for crypto asset options based on a dynamic pricing model for the underlying crypto assets. The model was carefully backtested and therefore offers a reliable model for the underlying crypto assets in the natural world. We then obtain the valuation of crypto options by passing the natural world to the equivalent martingale measure via the Esscher transform. Because of the absence of traded crypto options we could not compare the prices obtained from our valuation model to market prices. Yet, we can claim that if such options on crypto assets are introduced, they should follow closely our theoretical prices after adjusting for market frictions and design feature nuances.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

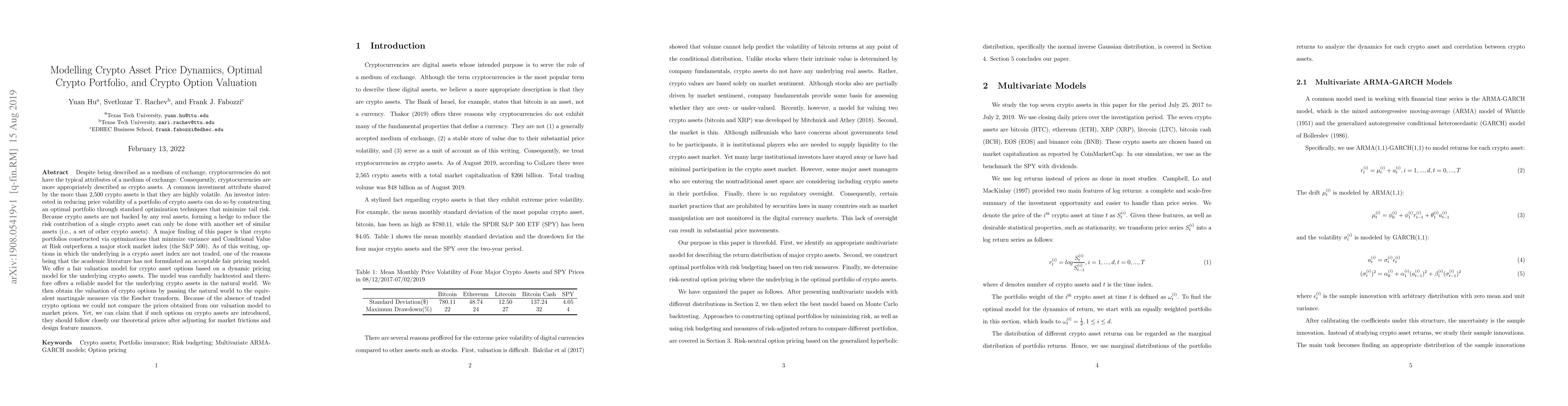

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCollateral Portfolio Optimization in Crypto-Backed Stablecoins

Anwitaman Datta, Bretislav Hajek, Daniel Reijsbergen et al.

Modelling crypto markets by multi-agent reinforcement learning

Stefano Palminteri, Boris Gutkin, Johann Lussange et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)