Summary

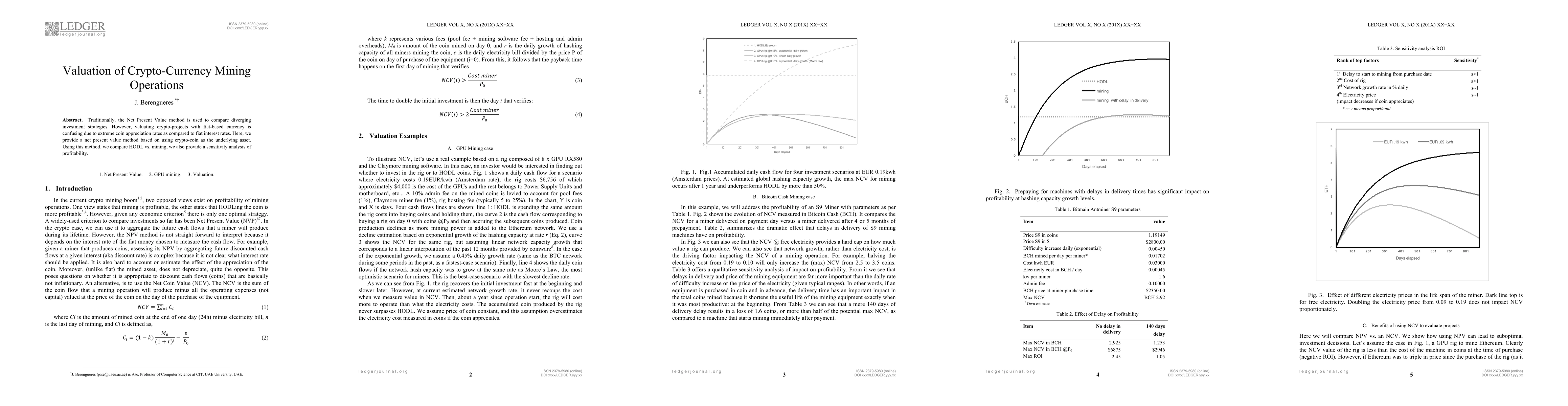

Traditionally, the Net Present Value method is used to compare diverging investment strategies. However, valuating crypto-projects with fiat-based currency is confusing due to extreme coin appreciation rates as compared to fiat interest rates. Here, we provide a net present value method based on using crypto-coin as the underlying asset. Using this method, we compare HODL vs. mining, we also provide a sensitivity analysis of profitability

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDifferential Evolution VQE for Crypto-currency Arbitrage. Quantum Optimization with many local minima

Guillermo Botella, Alberto del Barrio, Gines Carrascal et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)