Summary

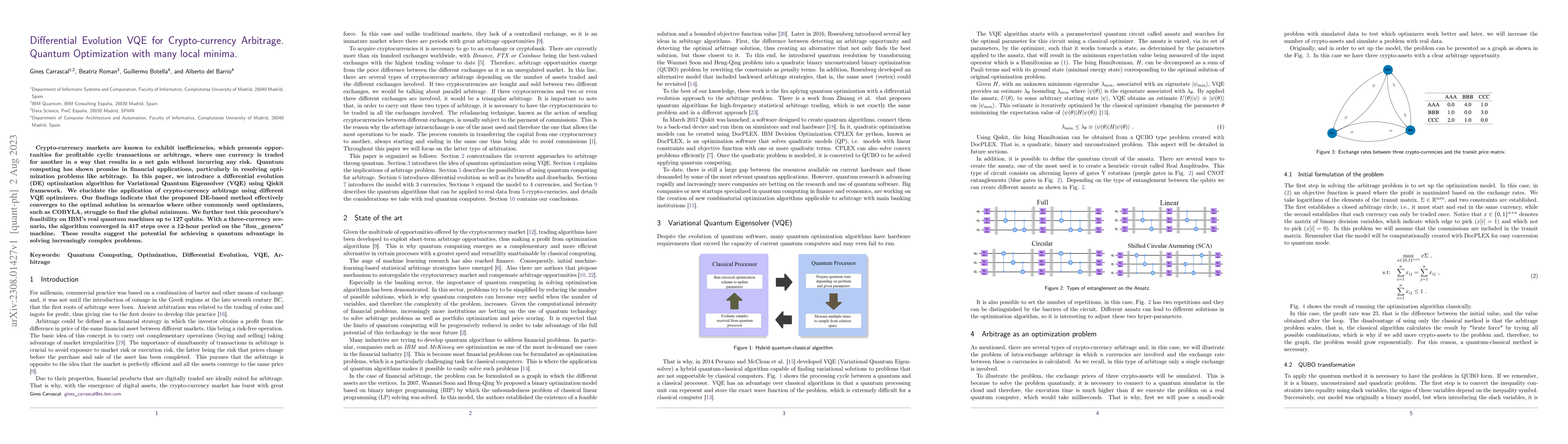

Crypto-currency markets are known to exhibit inefficiencies, which presents opportunities for profitable cyclic transactions or arbitrage, where one currency is traded for another in a way that results in a net gain without incurring any risk. Quantum computing has shown promise in financial applications, particularly in resolving optimization problems like arbitrage. In this paper, we introduce a differential evolution (DE) optimization algorithm for Variational Quantum Eigensolver (VQE) using Qiskit framework. We elucidate the application of crypto-currency arbitrage using different VQE optimizers. Our findings indicate that the proposed DE-based method effectively converges to the optimal solution in scenarios where other commonly used optimizers, such as COBYLA, struggle to find the global minimum. We further test this procedure's feasibility on IBM's real quantum machines up to 127 qubits. With a three-currency scenario, the algorithm converged in 417 steps over a 12-hour period on the "ibm_geneva" machine. These results suggest the potential for achieving a quantum advantage in solving increasingly complex problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCurrency Arbitrage Optimization using Quantum Annealing, QAOA and Constraint Mapping

Frank Mueller, Sangram Deshpande, Elin Ranjan Das

Using Differential Evolution to avoid local minima in Variational Quantum Algorithms

Daniel Faílde, Andrés Gómez, Mariamo Mussa Juane et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)