Summary

Currency arbitrage leverages price discrepancies in currency exchange rates across different currency pairs to gain risk-free profits. It involves multiple trading, where short-lived price discrepancies require real-time, high-speed processing of vast solution space, posing challenges for classical computing. In this work, we formulate an enhanced mathematical model for the currency arbitrage problem by adding simple cycle preservation constraints, which guarantee trading cycle validity and eliminate redundant or infeasible substructures. To solve this model, we use and benchmark various solvers, including Quantum Annealing (QA), gate-based quantum approaches such as Variational Quantum Algorithm with Adaptive Cost Encoding (ACE), as well as classical solvers such as Gurobi and classical meta heuristics such as Tabu Search (TS). We propose a classical multi-bit swap post-processing to improve the solution generated by ACE. Using real-world currency exchange data, we compare these methods in terms of both arbitrage profit and execution time, the two key performance metrics. Our results give insight into the current capabilities and limitations of quantum methods for real-time financial use cases.

AI Key Findings

Generated Oct 18, 2025

Methodology

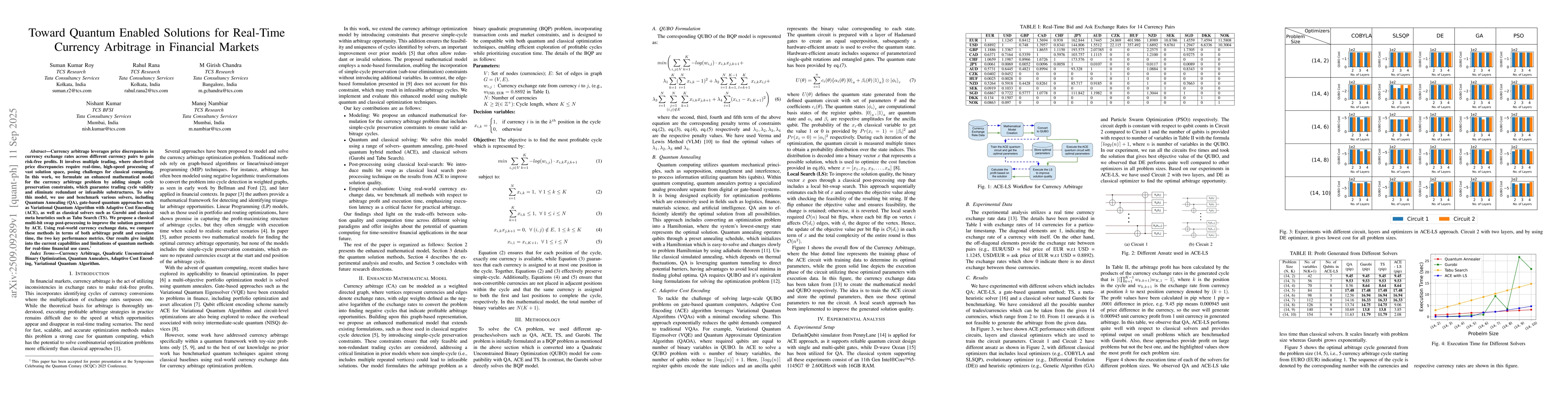

The research employs a combination of quantum computing techniques (Quantum Annealing and Variational Quantum Algorithm with Adaptive Cost Encoding) alongside classical solvers (Gurobi and Tabu Search) to solve the currency arbitrage problem. The model is formulated as a Binary Quadratic Programming (BQP) problem with simple-cycle preservation constraints, and post-processing with classical local search is applied to enhance solution quality.

Key Results

- Quantum Annealing (QA) and ACE-LS outperformed classical solvers (Gurobi and TS) in execution time, with linear scaling compared to Gurobi's exponential growth.

- ACE-LS achieved comparable solution quality to classical benchmarks while maintaining faster execution times, especially for larger problem sizes.

- Real-world currency exchange data demonstrated that QA and ACE-LS can identify profitable arbitrage opportunities within feasible timeframes for practical financial applications.

Significance

This research highlights the potential of quantum and hybrid quantum-classical methods for real-time financial applications like currency arbitrage, where speed and accuracy are critical. It provides insights into the current capabilities and limitations of quantum computing for time-sensitive financial use cases.

Technical Contribution

The paper introduces an enhanced mathematical model for currency arbitrage with simple-cycle preservation constraints, ensuring valid trading cycles and eliminating infeasible substructures. It also proposes a classical multi-bit swap post-processing technique to improve the quality of solutions generated by quantum algorithms.

Novelty

The work introduces simple-cycle preservation constraints in the currency arbitrage model, which is a critical improvement over prior models that often allowed redundant or invalid solutions. Additionally, it combines quantum and classical post-processing techniques to optimize solution quality and execution time.

Limitations

- Quantum methods like QA and ACE-LS do not always achieve the best profit values compared to classical solvers on large-scale problems.

- Execution time for quantum approaches remains higher than classical methods for smaller problem sizes, limiting their immediate practicality in microsecond-level arbitrage.

Future Work

- Implementing ACE-LS on real quantum hardware to validate performance in practical scenarios.

- Exploring advanced hybrid classical-quantum algorithms to further reduce execution times and improve solution quality.

- Investigating quantum domain-based local search approaches to minimize classical overhead and enhance efficiency.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCurrency Arbitrage Optimization using Quantum Annealing, QAOA and Constraint Mapping

Frank Mueller, Sangram Deshpande, Elin Ranjan Das

Differential Evolution VQE for Crypto-currency Arbitrage. Quantum Optimization with many local minima

Guillermo Botella, Alberto del Barrio, Gines Carrascal et al.

Discretization of continuous-time arbitrage strategies in financial markets with fractional Brownian motion

Ralf Wunderlich, Kerstin Lamert, Benjamin R. Auer

Comments (0)