Summary

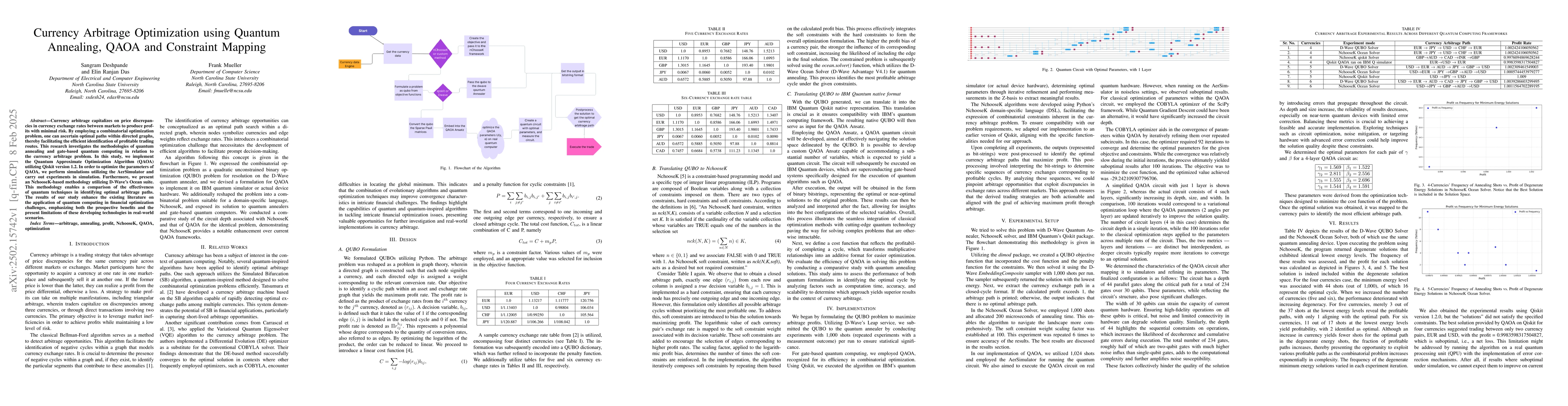

Currency arbitrage capitalizes on price discrepancies in currency exchange rates between markets to produce profits with minimal risk. By employing a combinatorial optimization problem, one can ascertain optimal paths within directed graphs, thereby facilitating the efficient identification of profitable trading routes. This research investigates the methodologies of quantum annealing and gate-based quantum computing in relation to the currency arbitrage problem. In this study, we implement the Quantum Approximate Optimization Algorithm (QAOA) utilizing Qiskit version 1.2. In order to optimize the parameters of QAOA, we perform simulations utilizing the AerSimulator and carry out experiments in simulation. Furthermore, we present an NchooseK-based methodology utilizing D-Wave's Ocean suite. This methodology enables a comparison of the effectiveness of quantum techniques in identifying optimal arbitrage paths. The results of our study enhance the existing literature on the application of quantum computing in financial optimization challenges, emphasizing both the prospective benefits and the present limitations of these developing technologies in real-world scenarios.

AI Key Findings

Generated Jun 11, 2025

Methodology

This research investigates the application of quantum annealing and gate-based quantum computing, specifically the Quantum Approximate Optimization Algorithm (QAOA), for optimizing currency arbitrage paths. It compares the effectiveness of these quantum techniques with a constraint mapping (NchooseK) methodology using D-Wave's Ocean suite.

Key Results

- D-Wave quantum annealer exhibited rapid convergence to optimal solutions for currency arbitrage problems.

- QAOA implementation using Qiskit tended to get trapped in local minima, resulting in suboptimal trading paths.

- NchooseK approach provided intuitive formulation but suffered from degenerate minimum energy solutions due to soft constraint penalties.

Significance

The study enhances the understanding of quantum computing applications in financial optimization challenges, highlighting both the potential benefits and current limitations of these technologies in real-world scenarios.

Technical Contribution

The research presents a detailed comparison of quantum annealing, QAOA, and constraint mapping techniques for solving currency arbitrage optimization problems, providing insights into their respective strengths and weaknesses.

Novelty

This work stands out by integrating classical optimization methods with cutting-edge quantum technologies to tackle complex, otherwise intractable, financial optimization problems, specifically currency arbitrage.

Limitations

- QUBO formulation lacks inherent intuitiveness and is heavily dependent on sophisticated mathematical frameworks.

- Efficacy of solutions is significantly affected by variables like the number of shots and prioritization of penalty constraints.

Future Work

- Improve NchooseK algorithm by dynamically modifying parameters including soft constraint penalties, D-Wave shot counts, and annealing time.

- Extend the algorithm to handle larger sets of currencies to uncover more profitable arbitrage opportunities.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDifferential Evolution VQE for Crypto-currency Arbitrage. Quantum Optimization with many local minima

Guillermo Botella, Alberto del Barrio, Gines Carrascal et al.

No citations found for this paper.

Comments (0)