Summary

The minimum (worst case) value of a long-only portfolio of bonds, over a convex set of yield curves and spreads, can be estimated by its sensitivities to the points on the yield curve. We show that sensitivity based estimates are conservative, \ie, underestimate the worst case value, and that the exact worst case value can be found by solving a tractable convex optimization problem. We then show how to construct a long-only bond portfolio that includes the worst case value in its objective or as a constraint, using convex-concave saddle point optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

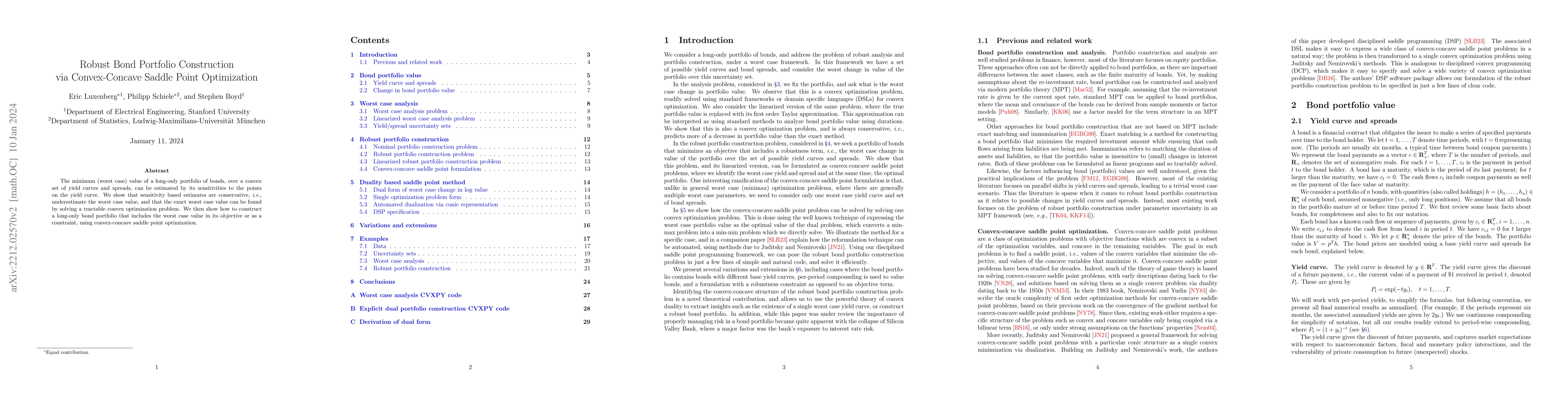

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNonsmooth convex-concave saddle point problems with cardinality penalties

Xiaojun Chen, Wei Bian

Online Saddle Point Problem and Online Convex-Concave Optimization

Qing-xin Meng, Jian-wei Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)