Summary

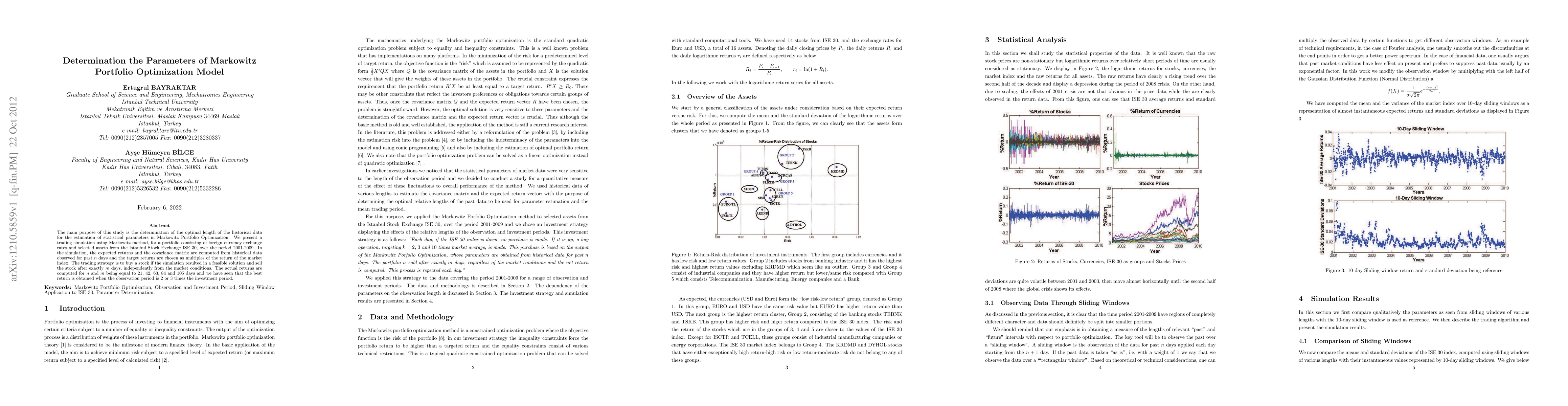

The main purpose of this study is the determination of the optimal length of the historical data for the estimation of statistical parameters in Markowitz Portfolio Optimization. We present a trading simulation using Markowitz method, for a portfolio consisting of foreign currency exchange rates and selected assets from the Istanbul Stock Exchange ISE 30, over the period 2001-2009. In the simulation, the expected returns and the covariance matrix are computed from historical data observed for past n days and the target returns are chosen as multiples of the return of the market index. The trading strategy is to buy a stock if the simulation resulted in a feasible solution and sell the stock after exactly m days, independently from the market conditions. The actual returns are computed for n and m being equal to 21, 42, 63, 84 and 105 days and we have seen that the best return is obtained when the observation period is 2 or 3 times the investment period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarkowitz Portfolio Construction at Seventy

Stephen Boyd, Philipp Schiele, Kasper Johansson et al.

Comparison of Markowitz Model and Single-Index Model on Portfolio Selection of Malaysian Stocks

Zhang Chern Lee, Wei Yun Tan, Hoong Khen Koo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)