Summary

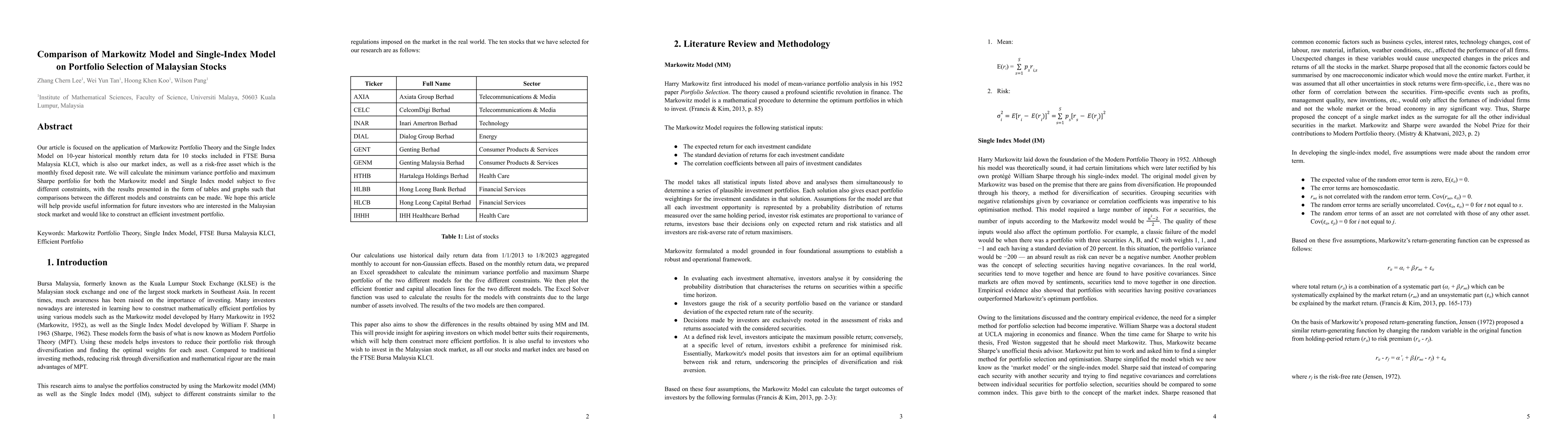

Our article is focused on the application of Markowitz Portfolio Theory and the Single Index Model on 10-year historical monthly return data for 10 stocks included in FTSE Bursa Malaysia KLCI, which is also our market index, as well as a risk-free asset which is the monthly fixed deposit rate. We will calculate the minimum variance portfolio and maximum Sharpe portfolio for both the Markowitz model and Single Index model subject to five different constraints, with the results presented in the form of tables and graphs such that comparisons between the different models and constraints can be made. We hope this article will help provide useful information for future investors who are interested in the Malaysian stock market and would like to construct an efficient investment portfolio. Keywords: Markowitz Portfolio Theory, Single Index Model, FTSE Bursa Malaysia KLCI, Efficient Portfolio

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)