Tomas Espana

3 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

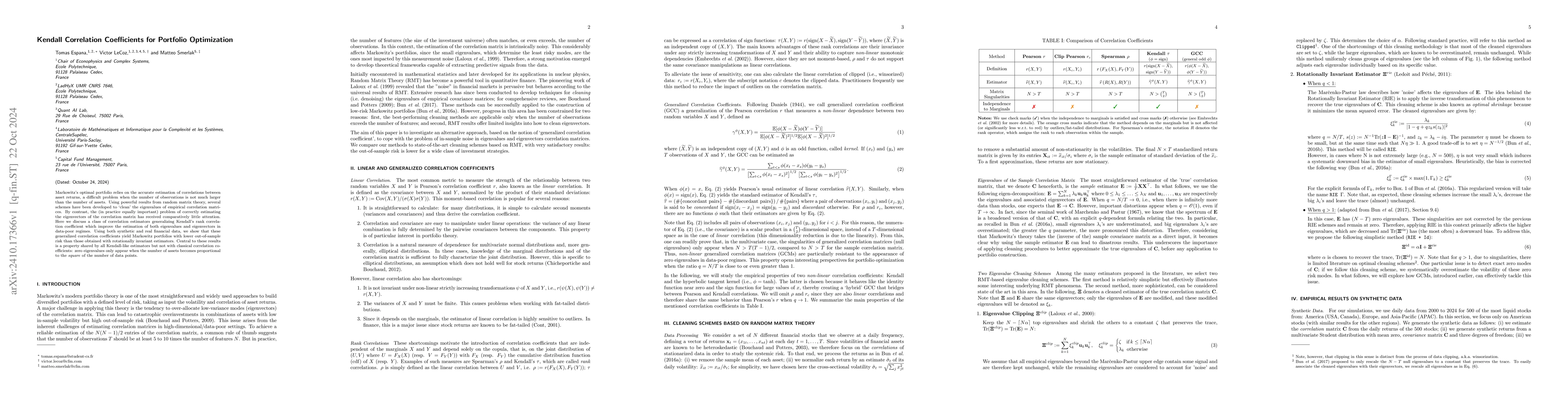

Kendall Correlation Coefficients for Portfolio Optimization

Markowitz's optimal portfolio relies on the accurate estimation of correlations between asset returns, a difficult problem when the number of observations is not much larger than the number of assets....

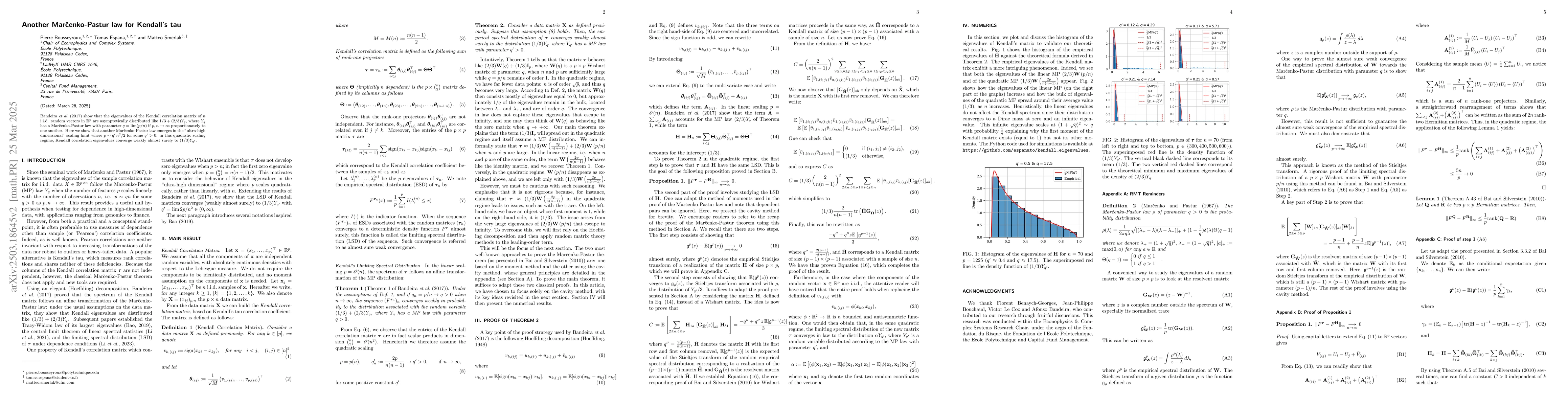

Another Marčenko-Pastur law for Kendall's tau

Bandeira et al. (2017) show that the eigenvalues of the Kendall correlation matrix of $n$ i.i.d. random vectors in $\mathbb{R}^p$ are asymptotically distributed like $1/3 + (2/3)Y_q$, where $Y_q$ has ...

Spectral Properties of Generalized Correlation Matrices

We introduce a family of coefficients that generalize the notion of correlation and explore their properties in the large dimensional multivariate case, showing that in the null case of uncorrelated v...