Authors

Summary

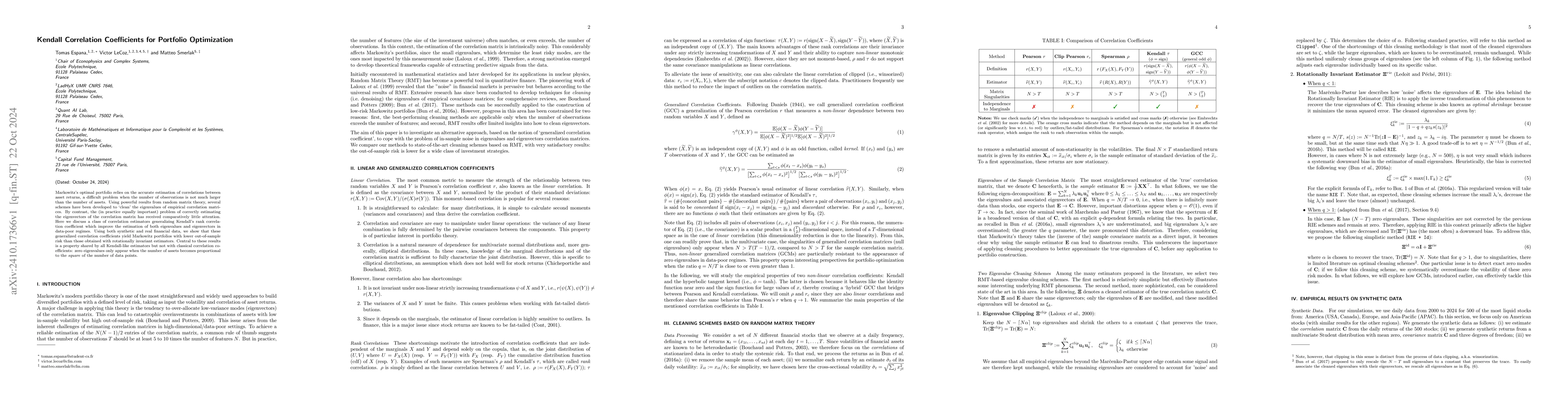

Markowitz's optimal portfolio relies on the accurate estimation of correlations between asset returns, a difficult problem when the number of observations is not much larger than the number of assets. Using powerful results from random matrix theory, several schemes have been developed to "clean" the eigenvalues of empirical correlation matrices. By contrast, the (in practice equally important) problem of correctly estimating the eigenvectors of the correlation matrix has received comparatively little attention. Here we discuss a class of correlation estimators generalizing Kendall's rank correlation coefficient which improve the estimation of both eigenvalues and eigenvectors in data-poor regimes. Using both synthetic and real financial data, we show that these generalized correlation coefficients yield Markowitz portfolios with lower out-of-sample risk than those obtained with rotationally invariant estimators. Central to these results is a property shared by all Kendall-like estimators but not with classical correlation coefficients: zero eigenvalues only appear when the number of assets becomes proportional to the square of the number of data points.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)