Summary

We consider the problem of portfolio optimization with a correlation constraint. The framework is the multiperiod stochastic financial market setting with one tradable stock, stochastic income and a non-tradable index. The correlation constraint is imposed on the portfolio and the non-tradable index at some benchmark time horizon. The goal is to maximize portofolio's expected exponential utility subject to the correlation constraint. Two types of optimal portfolio strategies are considered: the subgame perfect and the precommitment ones. We find analytical expressions for the constrained subgame perfect (CSGP) and the constrained precommitment (CPC) portfolio strategies. Both these portfolio strategies yield significantly lower risk when compared to the unconstrained setting, at the cost of a small utility loss. The performance of the CSGP and CPC portfolio strategies is similar.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

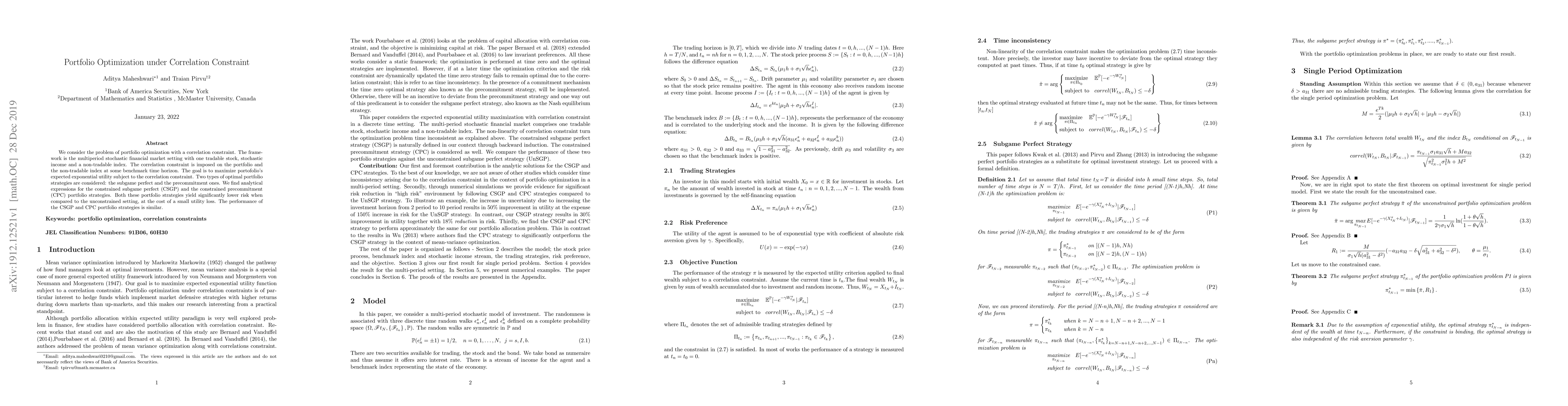

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Portfolio Choice Problem Under Risk Capacity Constraint

Zimu Zhu, Weidong Tian

Sample Average Approximation for Portfolio Optimization under CVaR constraint in an (re)insurance context

Jérôme Lelong, Véronique Maume-Deschamps, William Thevenot

| Title | Authors | Year | Actions |

|---|

Comments (0)