Summary

This paper solves a utility maximization problem under utility-based shortfall risk constraint, by proposing an approach using Lagrange multiplier and convex duality. Under mild conditions on the asymptotic elasticity of the utility function and the loss function, we find an optimal wealth process for the constrained problem and characterize the bi-dual relation between the respective value functions of the constrained problem and its dual. This approach applies to both complete and incomplete markets. Moreover, the extension to more complicated cases is illustrated by solving the problem with a consumption process added. Finally, we give an example of utility and loss functions in the Black-Scholes market where the solutions have explicit forms.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

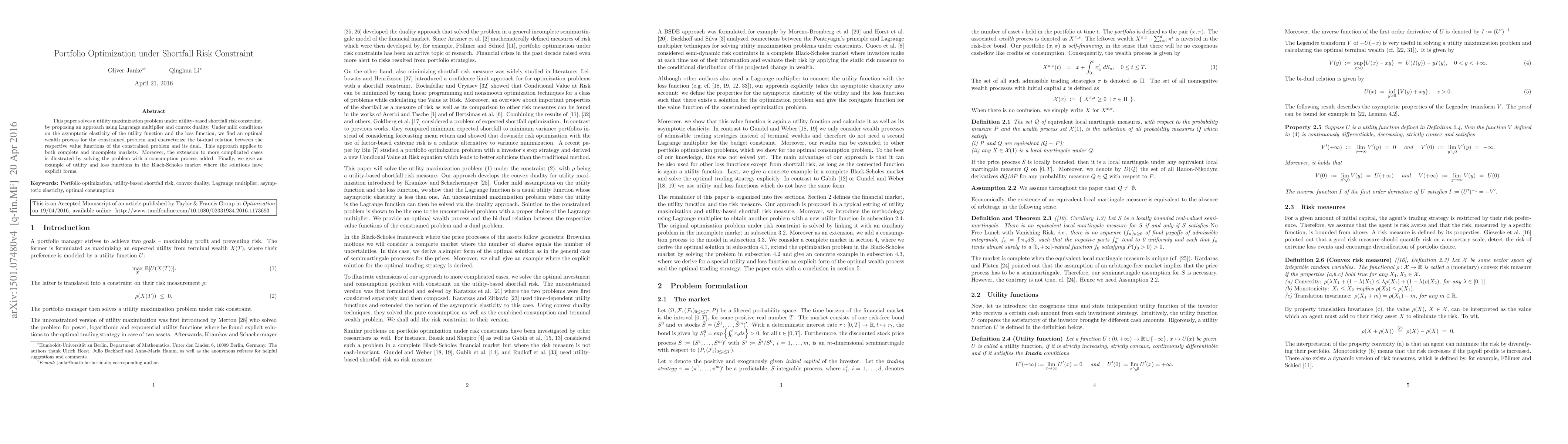

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)