Wenyan Xu

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

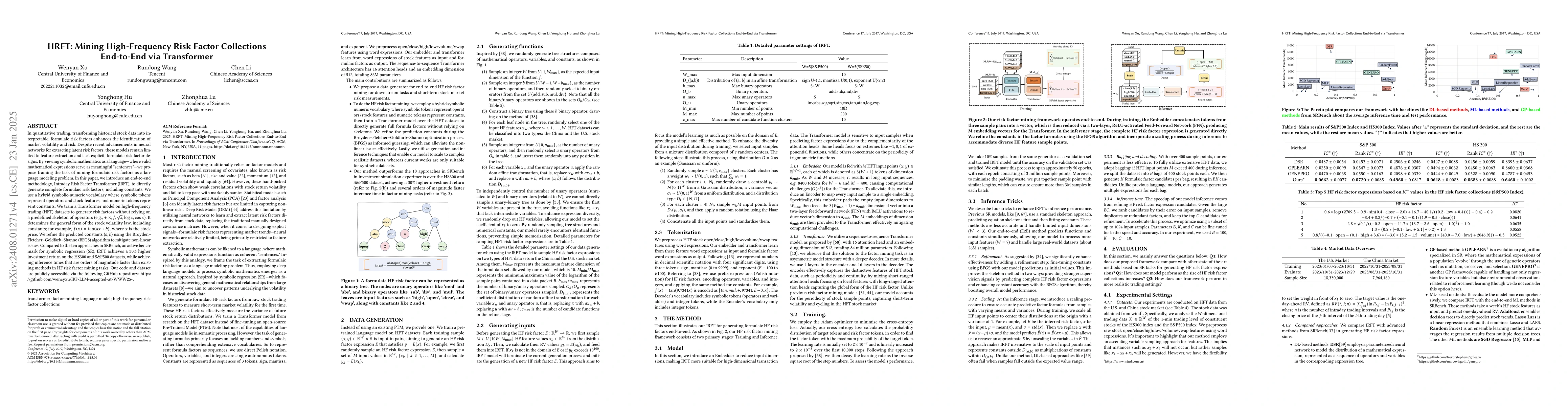

HRFT: Mining High-Frequency Risk Factor Collections End-to-End via Transformer

In quantitative trading, transforming historical stock data into interpretable, formulaic risk factors enhances the identification of market volatility and risk. Despite recent advancements in neural ...

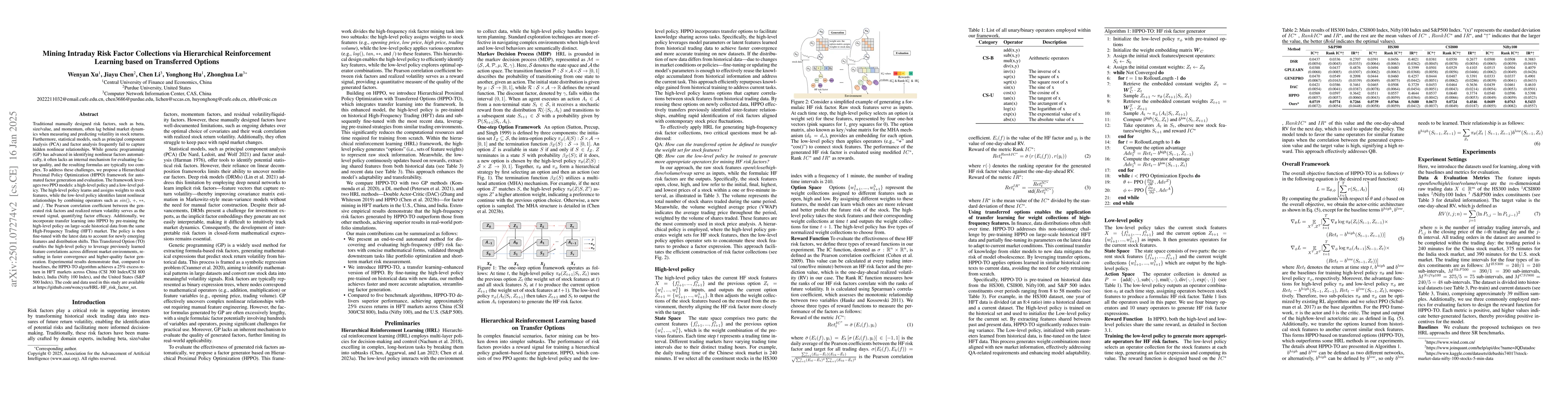

Mining Intraday Risk Factor Collections via Hierarchical Reinforcement Learning based on Transferred Options

Traditional risk factors like beta, size/value, and momentum often lag behind market dynamics in measuring and predicting stock return volatility. Statistical models like PCA and factor analysis fail ...

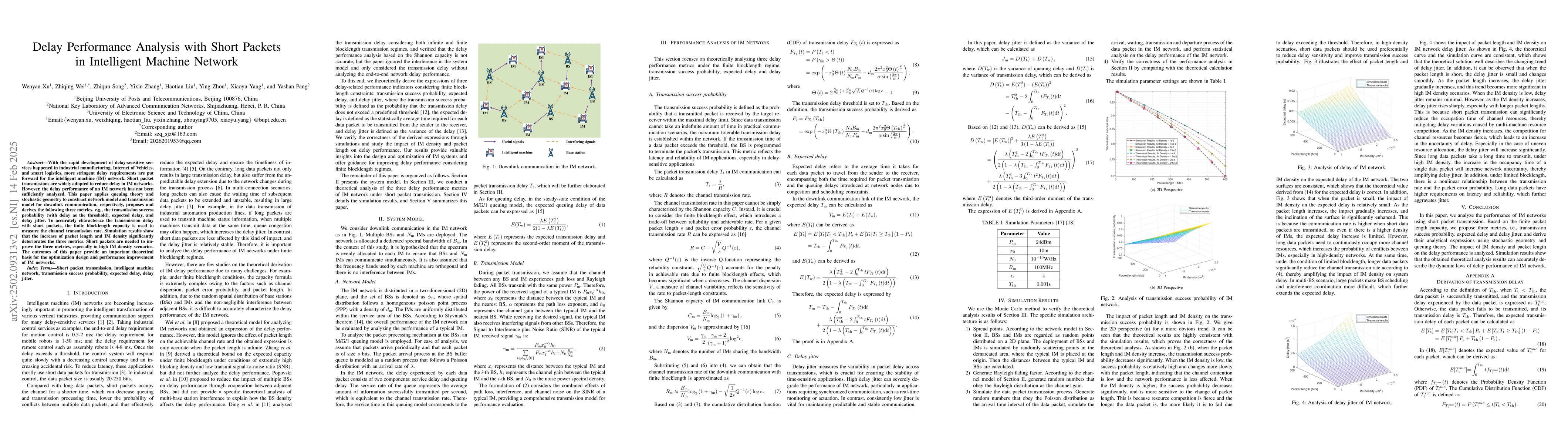

Delay Performance Analysis with Short Packets in Intelligent Machine Network

With the rapid development of delay-sensitive services happened in industrial manufacturing, Internet of Vehicles, and smart logistics, more stringent delay requirements are put forward for the intell...

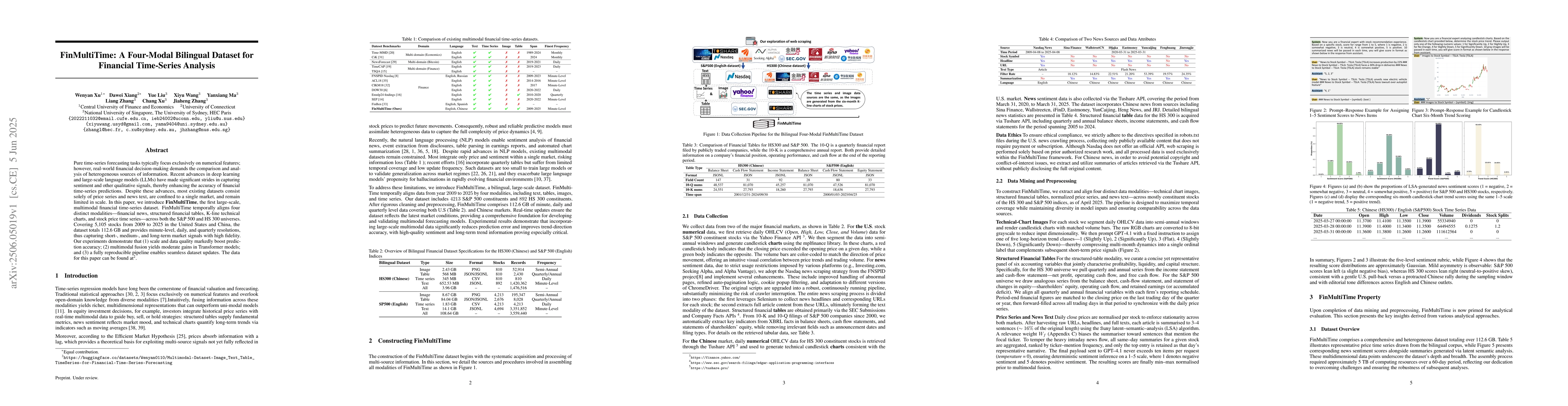

FinMultiTime: A Four-Modal Bilingual Dataset for Financial Time-Series Analysis

Pure time series forecasting tasks typically focus exclusively on numerical features; however, real-world financial decision-making demands the comparison and analysis of heterogeneous sources of info...

Learning Explainable Stock Predictions with Tweets Using Mixture of Experts

Stock price movements are influenced by many factors, and alongside historical price data, tex-tual information is a key source. Public news and social media offer valuable insights into market sentim...

PromptSculptor: Multi-Agent Based Text-to-Image Prompt Optimization

The rapid advancement of generative AI has democratized access to powerful tools such as Text-to-Image models. However, to generate high-quality images, users must still craft detailed prompts specify...

MMM-Fact: A Multimodal, Multi-Domain Fact-Checking Dataset with Multi-Level Retrieval Difficulty

Misinformation and disinformation demand fact checking that goes beyond simple evidence-based reasoning. Existing benchmarks fall short: they are largely single modality (text-only), span short time h...