Summary

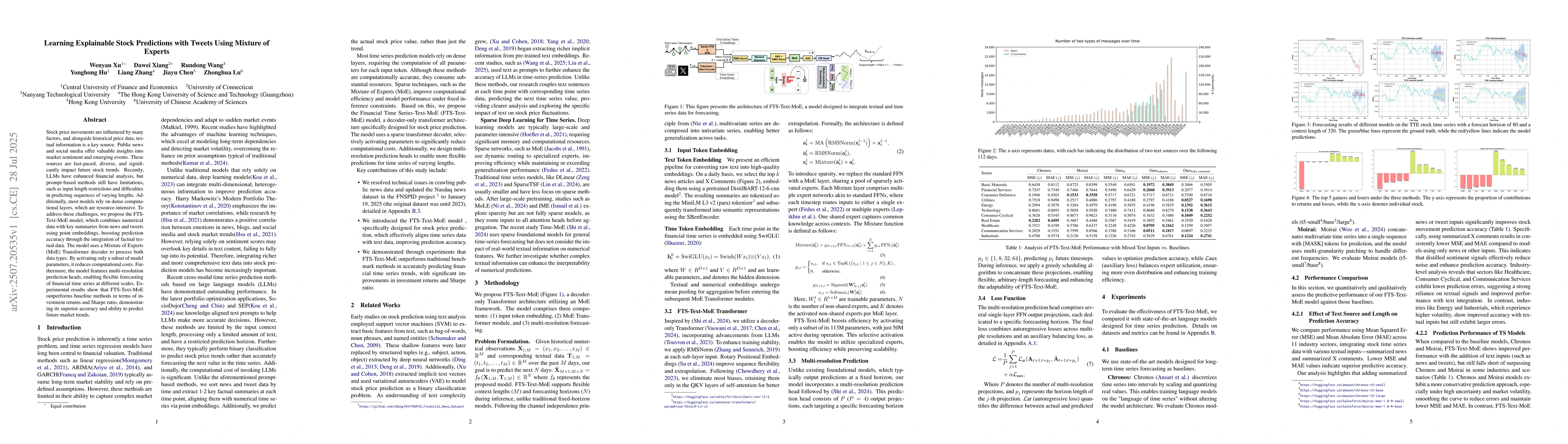

Stock price movements are influenced by many factors, and alongside historical price data, tex-tual information is a key source. Public news and social media offer valuable insights into market sentiment and emerging events. These sources are fast-paced, diverse, and significantly impact future stock trends. Recently, LLMs have enhanced financial analysis, but prompt-based methods still have limitations, such as input length restrictions and difficulties in predicting sequences of varying lengths. Additionally, most models rely on dense computational layers, which are resource-intensive. To address these challenges, we propose the FTS- Text-MoE model, which combines numerical data with key summaries from news and tweets using point embeddings, boosting prediction accuracy through the integration of factual textual data. The model uses a Mixture of Experts (MoE) Transformer decoder to process both data types. By activating only a subset of model parameters, it reduces computational costs. Furthermore, the model features multi-resolution prediction heads, enabling flexible forecasting of financial time series at different scales. Experimental results show that FTS-Text-MoE outperforms baseline methods in terms of investment returns and Sharpe ratio, demonstrating its superior accuracy and ability to predict future market trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMIGA: Mixture-of-Experts with Group Aggregation for Stock Market Prediction

Zhaojian Yu, Yinghao Wu, Genesis Wang et al.

Learning to Generate Explainable Stock Predictions using Self-Reflective Large Language Models

Tat-Seng Chua, Yunshan Ma, Kelvin J. L. Koa et al.

FEAMOE: Fair, Explainable and Adaptive Mixture of Experts

Shubham Sharma, Joydeep Ghosh, Jette Henderson

No citations found for this paper.

Comments (0)