Worapree Maneesoonthorn

9 papers on arXiv

Academic Profile

Statistics

Papers on arXiv

Large Skew-t Copula Models and Asymmetric Dependence in Intraday Equity Returns

Skew-t copula models are attractive for the modeling of financial data because they allow for asymmetric and extreme tail dependence. We show that the copula implicit in the skew-t distribution of Azz...

Optimal probabilistic forecasts for risk management

This paper explores the implications of producing forecast distributions that are optimized according to scoring rules that are relevant to financial risk management. We assess the predictive perfor...

Natural Gradient Hybrid Variational Inference with Application to Deep Mixed Models

Stochastic models with global parameters $\bm{\theta}$ and latent variables $\bm{z}$ are common, and variational inference (VI) is popular for their estimation. This paper uses a variational approxi...

Bayesian Forecasting in Economics and Finance: A Modern Review

The Bayesian statistical paradigm provides a principled and coherent approach to probabilistic forecasting. Uncertainty about all unknowns that characterize any forecasting problem -- model, paramet...

ABC of the Future

Approximate Bayesian computation (ABC) has advanced in two decades from a seminal idea to a practically applicable inference tool for simulator-based statistical models, which are becoming increasin...

Probabilistic Predictions of Option Prices Using Multiple Sources of Data

A new modular approximate Bayesian inferential framework is proposed that enables fast calculation of probabilistic predictions of future option prices. We exploit multiple information sources, includ...

Tractable Unified Skew-t Distribution and Copula for Heterogeneous Asymmetries

Multivariate distributions that allow for asymmetry and heavy tails are important building blocks in many econometric and statistical models. The Unified Skew-t (UST) is a promising choice because it ...

A New Perspective of the Meese-Rogoff Puzzle: Application of Sparse Dynamic Shrinkage

We propose the Markov Switching Dynamic Shrinkage process (MSDSP), nesting the Dynamic Shrinkage Process (DSP) of Kowal et al. (2019). We revisit the Meese-Rogoff puzzle (Meese and Rogoff, 1983a,b, 19...

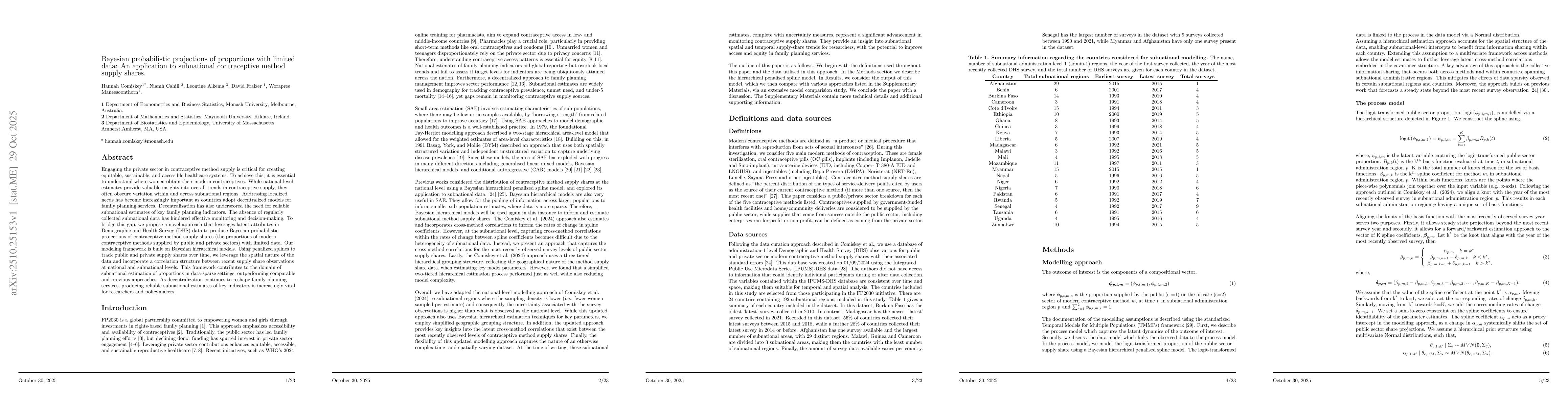

Bayesian probabilistic projections of proportions with limited data: An application to subnational contraceptive method supply shares

Engaging the private sector in contraceptive method supply is critical for creating equitable, sustainable, and accessible healthcare systems. To achieve this, it is essential to understand where wome...