Summary

This paper explores the implications of producing forecast distributions that are optimized according to scoring rules that are relevant to financial risk management. We assess the predictive performance of optimal forecasts from potentially misspecified models for i) value-at-risk and expected shortfall predictions; and ii) prediction of the VIX volatility index for use in hedging strategies involving VIX futures. Our empirical results show that calibrating the predictive distribution using a score that rewards the accurate prediction of extreme returns improves the VaR and ES predictions. Tail-focused predictive distributions are also shown to yield better outcomes in hedging strategies using VIX futures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

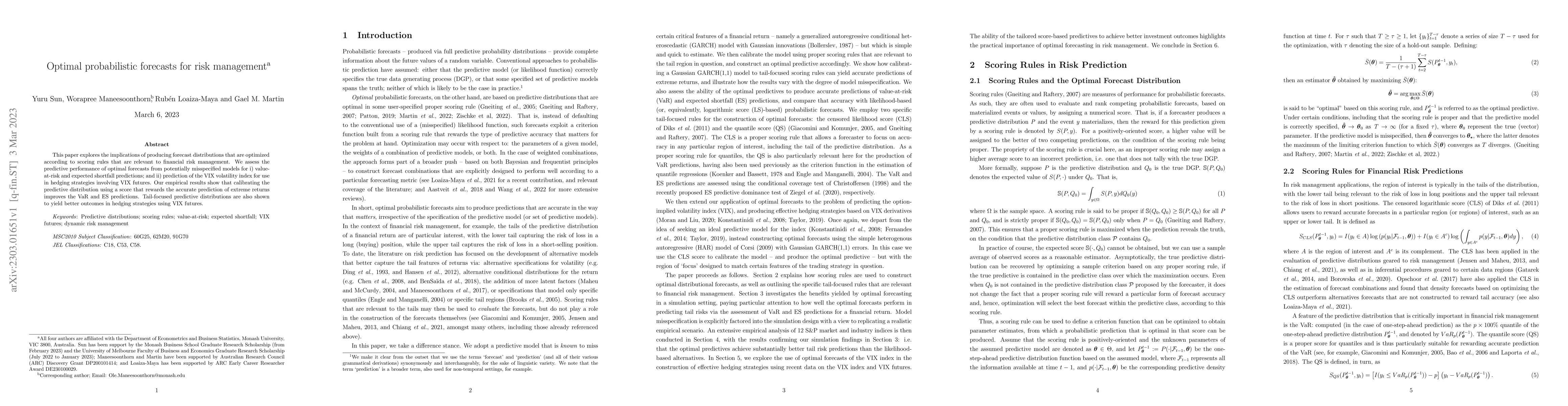

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTail calibration of probabilistic forecasts

Sam Allen, Jonathan Koh, Johan Segers et al.

No citations found for this paper.

Comments (0)