Yizun Lin

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Autonomous Sparse Mean-CVaR Portfolio Optimization

The $\ell_0$-constrained mean-CVaR model poses a significant challenge due to its NP-hard nature, typically tackled through combinatorial methods characterized by high computational demands. From a ...

Globally Optimal Solutions to a Class of Fractional Optimization Problems Based on Proximal Gradient Algorithm

In this paper, we investigate a category of constrained fractional optimization problems that emerge in various practical applications. The objective function for this category is characterized by t...

Convergence Rate Analysis of Accelerated Forward-Backward Algorithm with Generalized Nesterov Momentum Scheme

Nesterov's accelerated forward-backward algorithm (AFBA) is an efficient algorithm for solving a class of two-term convex optimization models consisting of a differentiable function with a Lipschitz...

A Fast Convergent Ordered-Subsets Algorithm with Subiteration-Dependent Preconditioners for PET Image Reconstruction

We investigated the imaging performance of a fast convergent ordered-subsets algorithm with subiteration-dependent preconditioners (SDPs) for positron emission tomography (PET) image reconstruction....

Convergence Rate Analysis for Fixed-Point Iterations of Generalized Averaged Nonexpansive Operators

We estimate convergence rates for fixed-point iterations of a class of nonlinear operators which are partially motivated from solving convex optimization problems. We introduce the notion of the gen...

A Krasnoselskii-Mann Proximity Algorithm for Markowitz Portfolios with Adaptive Expected Return Level

Markowitz's criterion aims to balance expected return and risk when optimizing the portfolio. The expected return level is usually fixed according to the risk appetite of an investor, then the risk is...

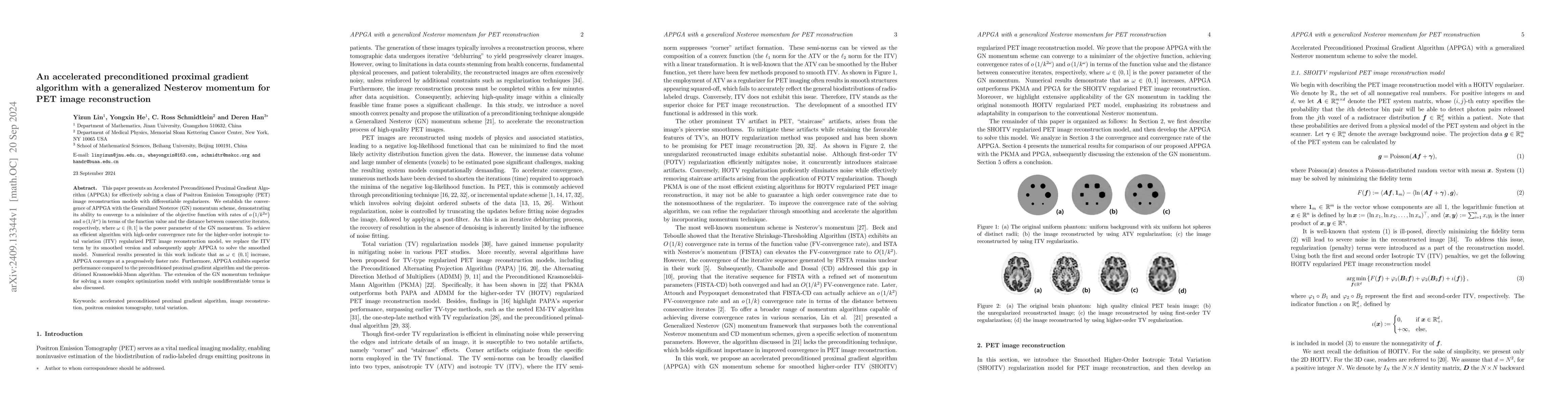

An accelerated preconditioned proximal gradient algorithm with a generalized Nesterov momentum for PET image reconstruction

This paper presents an Accelerated Preconditioned Proximal Gradient Algorithm (APPGA) for effectively solving a class of Positron Emission Tomography (PET) image reconstruction models with differentia...

A Globally Optimal Portfolio for m-Sparse Sharpe Ratio Maximization

The Sharpe ratio is an important and widely-used risk-adjusted return in financial engineering. In modern portfolio management, one may require an m-sparse (no more than m active assets) portfolio to ...