Authors

Summary

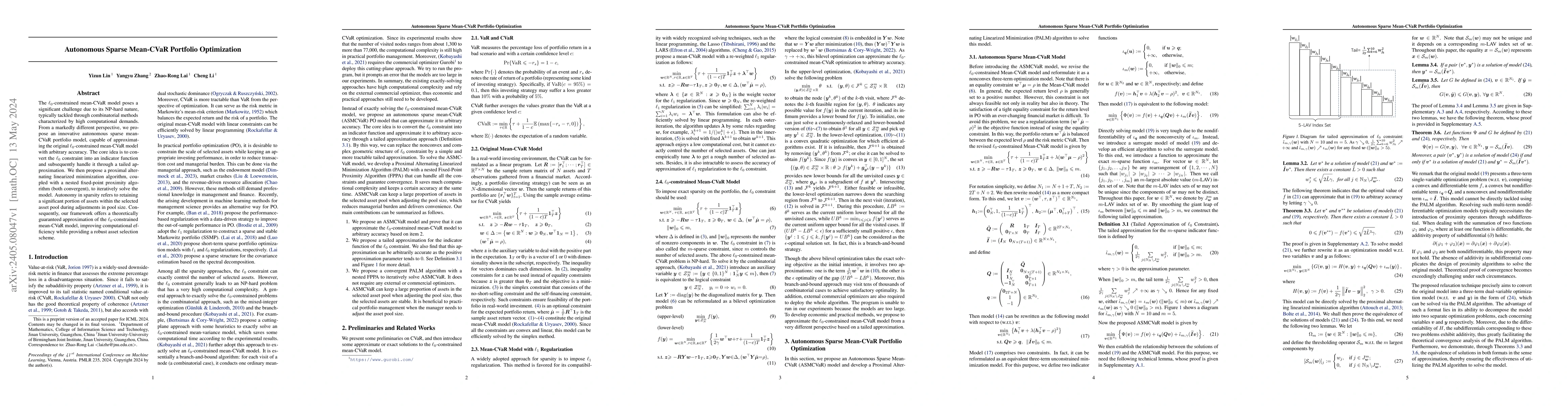

The $\ell_0$-constrained mean-CVaR model poses a significant challenge due to its NP-hard nature, typically tackled through combinatorial methods characterized by high computational demands. From a markedly different perspective, we propose an innovative autonomous sparse mean-CVaR portfolio model, capable of approximating the original $\ell_0$-constrained mean-CVaR model with arbitrary accuracy. The core idea is to convert the $\ell_0$ constraint into an indicator function and subsequently handle it through a tailed approximation. We then propose a proximal alternating linearized minimization algorithm, coupled with a nested fixed-point proximity algorithm (both convergent), to iteratively solve the model. Autonomy in sparsity refers to retaining a significant portion of assets within the selected asset pool during adjustments in pool size. Consequently, our framework offers a theoretically guaranteed approximation of the $\ell_0$-constrained mean-CVaR model, improving computational efficiency while providing a robust asset selection scheme.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio analysis with mean-CVaR and mean-CVaR-skewness criteria based on mean-variance mixture models

Ruoyu Sun, Kai He, Svetlozar T. Rachev et al.

No citations found for this paper.

Comments (0)