Summary

The paper Zhao et al. (2015) shows that mean-CVaR-skewness portfolio optimization problems based on asymetric Laplace (AL) distributions can be transformed into quadratic optimization problems under which closed form solutions can be found. In this note, we show that such result also holds for mean-risk-skewness portfolio optimization problems when the underlying distribution is a larger class of normal mean-variance mixture (NMVM) models than the class of AL distributions. We then study the value at risk (VaR) and conditional value at risk (CVaR) risk measures on portfolios of returns with NMVM distributions. They have closed form expressions for portfolios of normal and more generally elliptically distributed returns as discussed in Rockafellar & Uryasev (2000) and in Landsman & Valdez (2003). When the returns have general NMVM distributions, these risk measures do not give closed form expressions. In this note, we give approximate closed form expressions for VaR and CVaR of portfolios of returns with NMVM distributions. Numerical tests show that our closed form formulas give accurate values for VaR and CVaR and shortens the computational time for portfolio optimization problems associated with VaR and CVaR considerably.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

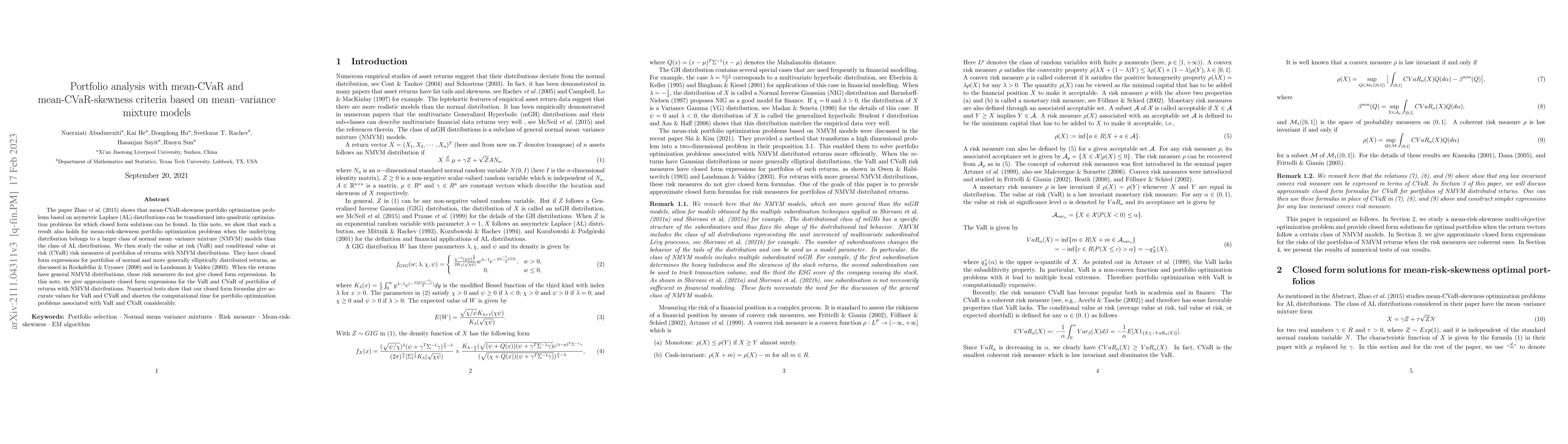

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutonomous Sparse Mean-CVaR Portfolio Optimization

Cheng Li, Zhao-Rong Lai, Yizun Lin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)