Summary

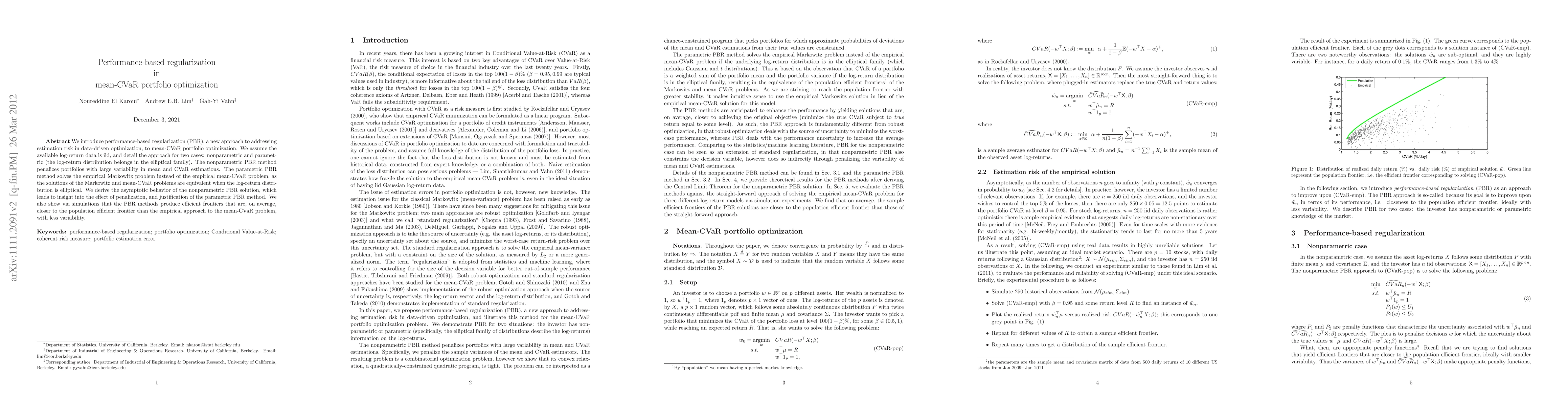

We introduce performance-based regularization (PBR), a new approach to addressing estimation risk in data-driven optimization, to mean-CVaR portfolio optimization. We assume the available log-return data is iid, and detail the approach for two cases: nonparametric and parametric (the log-return distribution belongs in the elliptical family). The nonparametric PBR method penalizes portfolios with large variability in mean and CVaR estimations. The parametric PBR method solves the empirical Markowitz problem instead of the empirical mean-CVaR problem, as the solutions of the Markowitz and mean-CVaR problems are equivalent when the log-return distribution is elliptical. We derive the asymptotic behavior of the nonparametric PBR solution, which leads to insight into the effect of penalization, and justification of the parametric PBR method. We also show via simulations that the PBR methods produce efficient frontiers that are, on average, closer to the population efficient frontier than the empirical approach to the mean-CVaR problem, with less variability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutonomous Sparse Mean-CVaR Portfolio Optimization

Cheng Li, Zhao-Rong Lai, Yizun Lin et al.

Portfolio analysis with mean-CVaR and mean-CVaR-skewness criteria based on mean-variance mixture models

Ruoyu Sun, Kai He, Svetlozar T. Rachev et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)