Yuanjian Xu

3 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

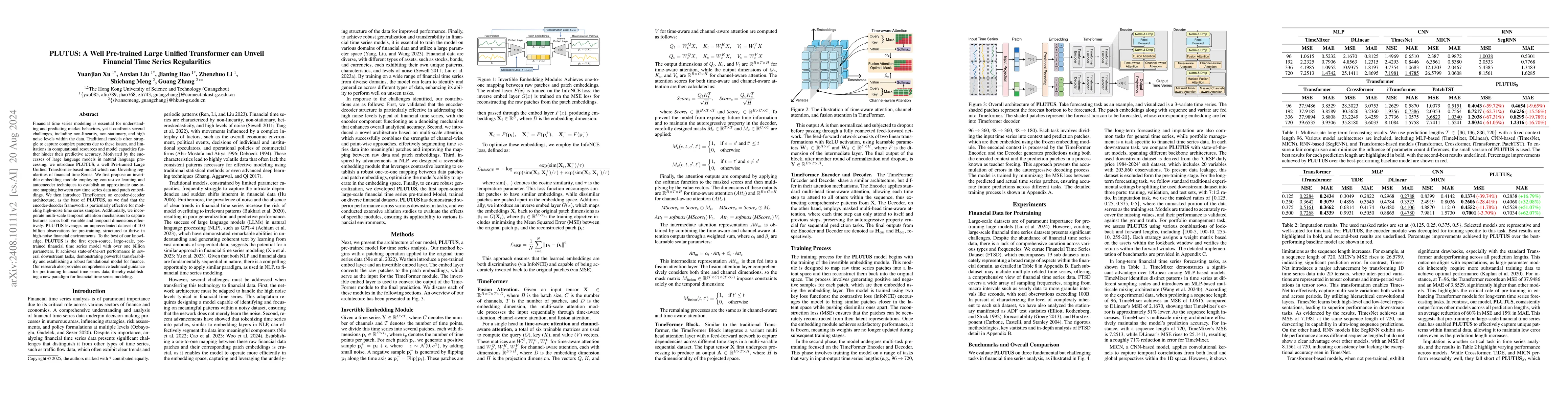

PLUTUS: A Well Pre-trained Large Unified Transformer can Unveil Financial Time Series Regularities

Financial time series modeling is crucial for understanding and predicting market behaviors but faces challenges such as non-linearity, non-stationarity, and high noise levels. Traditional models stru...

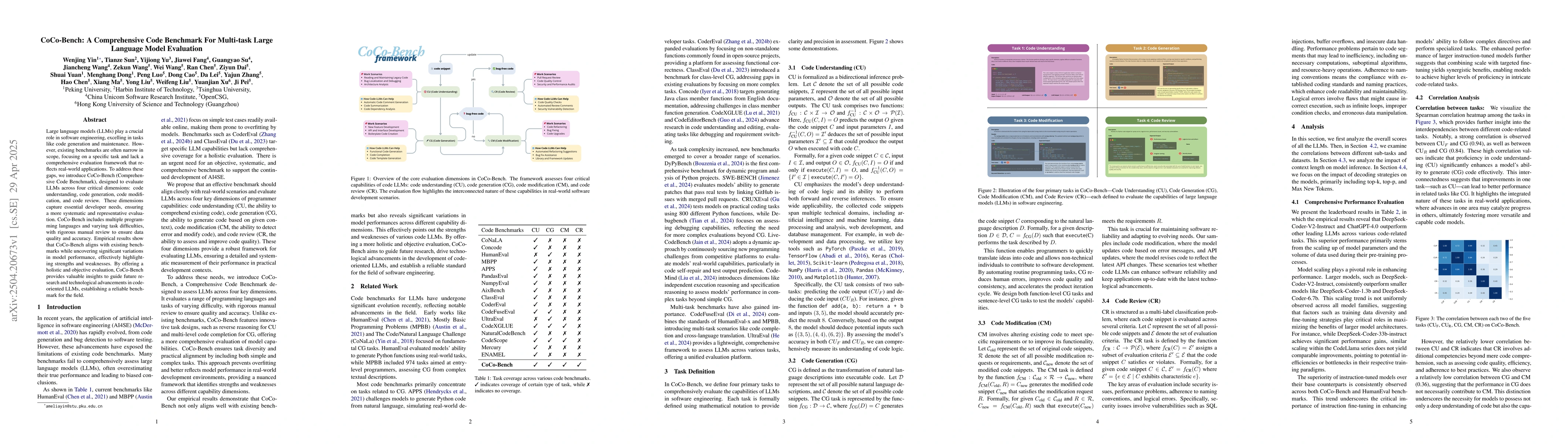

CoCo-Bench: A Comprehensive Code Benchmark For Multi-task Large Language Model Evaluation

Large language models (LLMs) play a crucial role in software engineering, excelling in tasks like code generation and maintenance. However, existing benchmarks are often narrow in scope, focusing on a...

FinRipple: Aligning Large Language Models with Financial Market for Event Ripple Effect Awareness

Financial markets exhibit complex dynamics where localized events trigger ripple effects across entities. Previous event studies, constrained by static single-company analyses and simplistic assumptio...