Summary

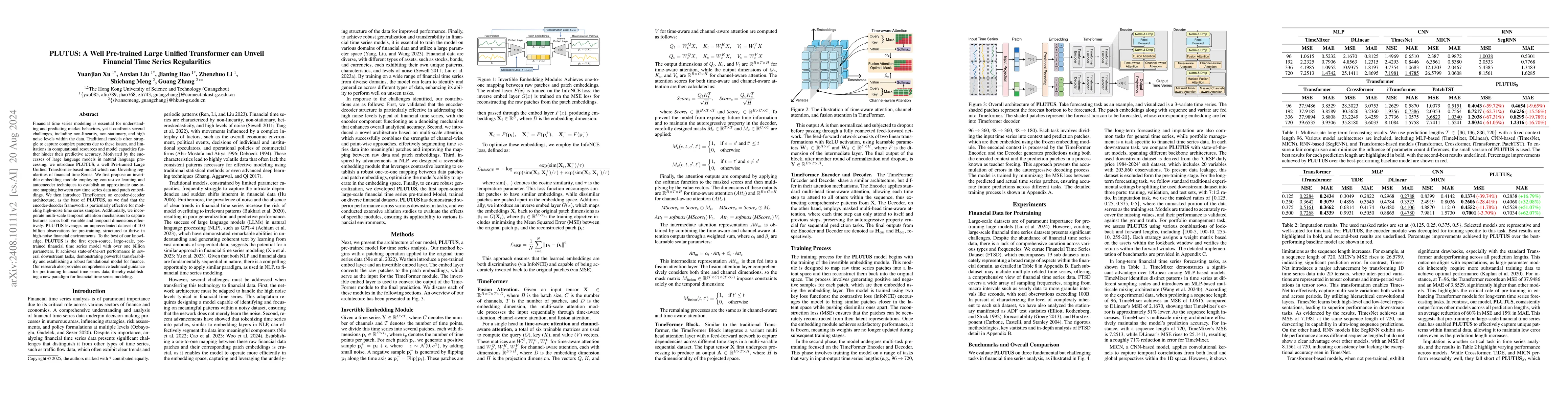

Financial time series modeling is crucial for understanding and predicting market behaviors but faces challenges such as non-linearity, non-stationarity, and high noise levels. Traditional models struggle to capture complex patterns due to these issues, compounded by limitations in computational resources and model capacity. Inspired by the success of large language models in NLP, we introduce $\textbf{PLUTUS}$, a $\textbf{P}$re-trained $\textbf{L}$arge $\textbf{U}$nified $\textbf{T}$ransformer-based model that $\textbf{U}$nveils regularities in financial time $\textbf{S}$eries. PLUTUS uses an invertible embedding module with contrastive learning and autoencoder techniques to create an approximate one-to-one mapping between raw data and patch embeddings. TimeFormer, an attention based architecture, forms the core of PLUTUS, effectively modeling high-noise time series. We incorporate a novel attention mechanisms to capture features across both variable and temporal dimensions. PLUTUS is pre-trained on an unprecedented dataset of 100 billion observations, designed to thrive in noisy financial environments. To our knowledge, PLUTUS is the first open-source, large-scale, pre-trained financial time series model with over one billion parameters. It achieves state-of-the-art performance in various tasks, demonstrating strong transferability and establishing a robust foundational model for finance. Our research provides technical guidance for pre-training financial time series data, setting a new standard in the field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarketGPT: Developing a Pre-trained transformer (GPT) for Modeling Financial Time Series

Aaron Wheeler, Jeffrey D. Varner

DELPHYNE: A Pre-Trained Model for General and Financial Time Series

Achintya Gopal, Xueying Ding, Aakriti Mittal

Timer: Generative Pre-trained Transformers Are Large Time Series Models

Haoran Zhang, Yong Liu, Mingsheng Long et al.

A Survey on Time-Series Pre-Trained Models

Qianli Ma, James T. Kwok, Zhen Liu et al.

No citations found for this paper.

Comments (0)