Anxian Liu

3 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

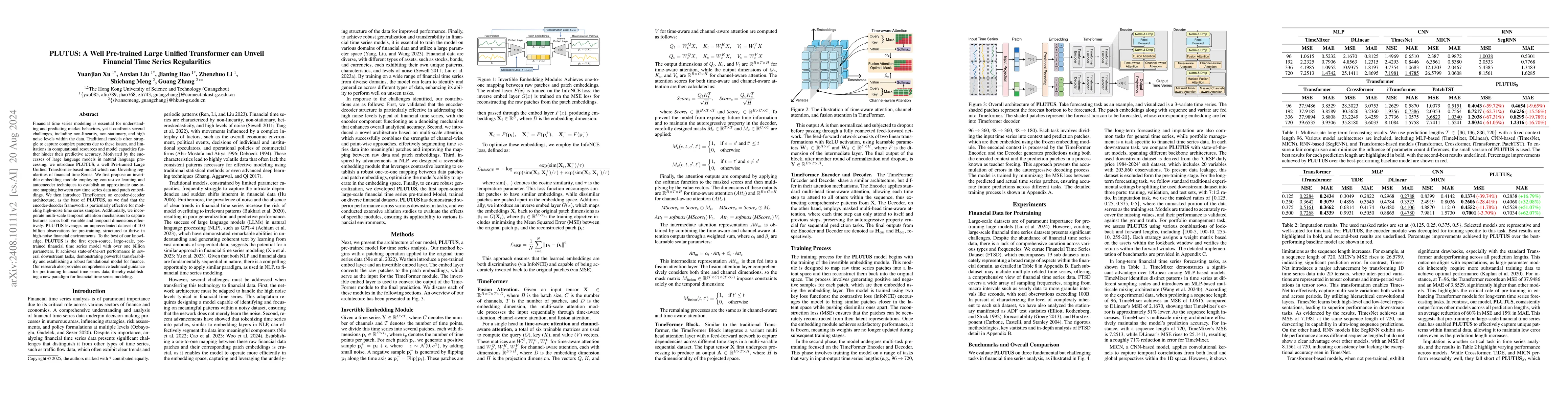

PLUTUS: A Well Pre-trained Large Unified Transformer can Unveil Financial Time Series Regularities

Financial time series modeling is crucial for understanding and predicting market behaviors but faces challenges such as non-linearity, non-stationarity, and high noise levels. Traditional models stru...

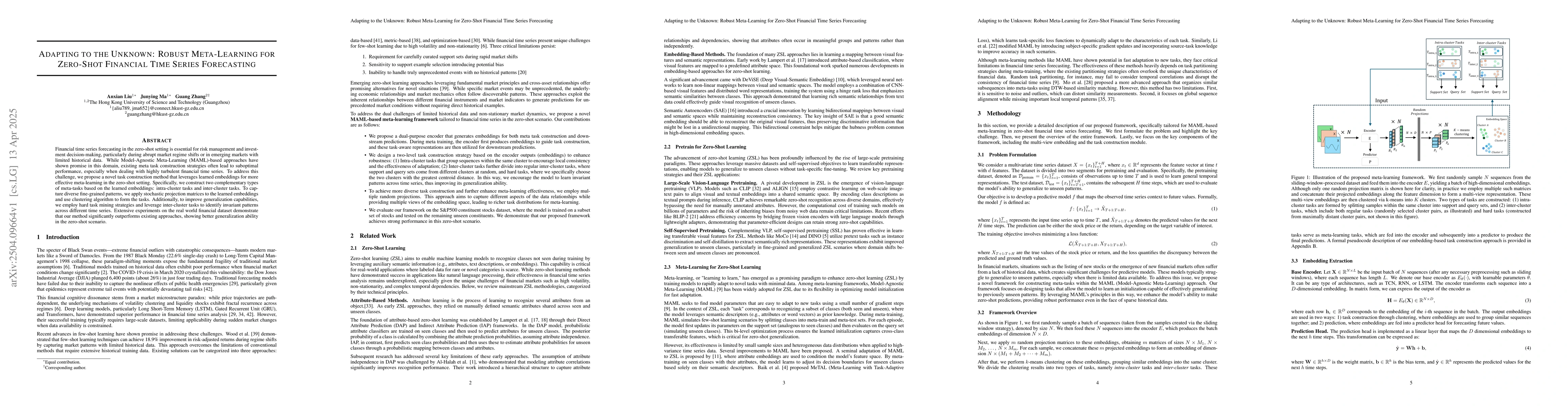

Adapting to the Unknown: Robust Meta-Learning for Zero-Shot Financial Time Series Forecasting

Financial time series forecasting in the zero-shot setting is essential for risk management and investment decision-making, particularly during abrupt market regime shifts or in emerging markets with ...

FinRipple: Aligning Large Language Models with Financial Market for Event Ripple Effect Awareness

Financial markets exhibit complex dynamics where localized events trigger ripple effects across entities. Previous event studies, constrained by static single-company analyses and simplistic assumptio...