Authors

Summary

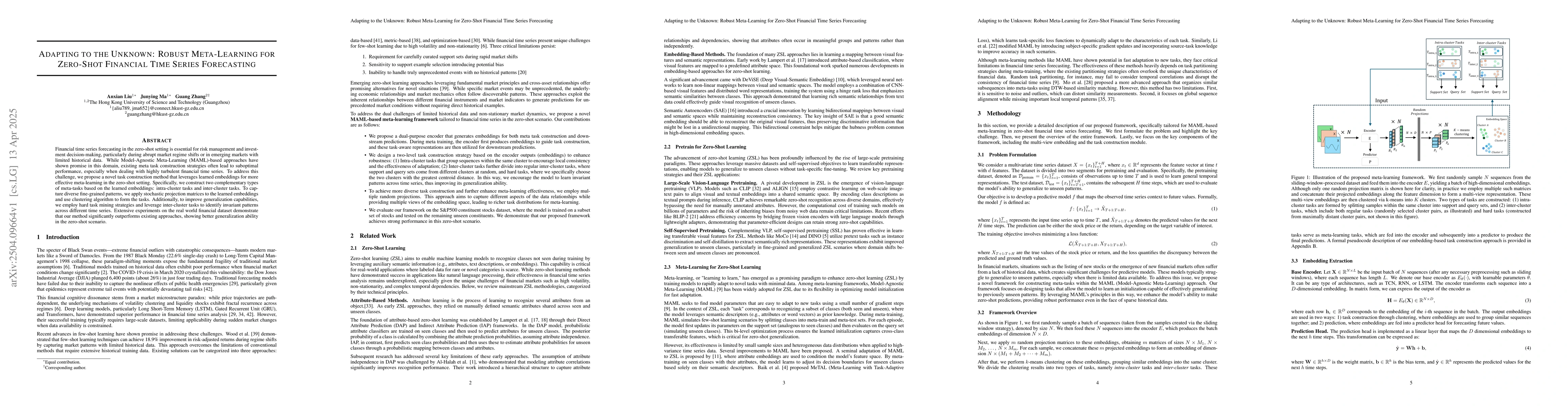

Financial time series forecasting in the zero-shot setting is essential for risk management and investment decision-making, particularly during abrupt market regime shifts or in emerging markets with limited historical data. While Model-Agnostic Meta-Learning (MAML)-based approaches have shown promise in this domain, existing meta task construction strategies often lead to suboptimal performance, especially when dealing with highly turbulent financial time series. To address this challenge, we propose a novel task construction method that leverages learned embeddings for more effective meta-learning in the zero-shot setting. Specifically, we construct two complementary types of meta-tasks based on the learned embeddings: intra-cluster tasks and inter-cluster tasks. To capture diverse fine-grained patterns, we apply stochastic projection matrices to the learned embeddings and use clustering algorithm to form the tasks. Additionally, to improve generalization capabilities, we employ hard task mining strategies and leverage inter-cluster tasks to identify invariant patterns across different time series. Extensive experiments on the real world financial dataset demonstrate that our method significantly outperforms existing approaches, showing better generalization ability in the zero-shot scenario.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research proposes a meta-learning framework for zero-shot time series forecasting in financial markets, utilizing an embedding-based approach with task construction involving intra-cluster and inter-cluster tasks. It employs a standard MAML-based meta-learning procedure over tasks derived from clustering, with a learning objective using Mean Squared Error (MSE).

Key Results

- The proposed method significantly outperforms existing approaches in zero-shot financial time series forecasting, demonstrating superior generalization ability.

- The multi-level task construction strategy effectively captures fine-grained market behaviors and invariant predictive patterns across different market regimes.

- Experimental results validate the necessity of each component in the proposed framework, balancing the needs of both price and return prediction tasks.

- The approach shows robust predictive performance across diverse neural architectures under both standard and data-constrained training conditions, particularly excelling with LSTM and TCN architectures.

Significance

This research is significant for financial risk management and investment decision-making, especially during market regime shifts or in emerging markets with limited historical data. The proposed method enhances the model's potential peak performance by incorporating diverse training tasks.

Technical Contribution

The paper introduces a novel task construction method leveraging learned embeddings for effective meta-learning in the zero-shot setting, combining intra-cluster tasks for local pattern learning and inter-cluster tasks for better generalization.

Novelty

The work distinguishes itself by creating a beneficial feedback loop where better embeddings lead to more meaningful task structures, which in turn help learn better embeddings through meta-optimization. Additionally, the multi-level task construction strategy captures both fine-grained market behaviors and invariant predictive patterns across different market regimes.

Limitations

- The study does not explore the impact of varying sequence lengths on model performance beyond the specified configurations.

- The paper does not delve into the computational complexity and scalability of the proposed method for very large datasets.

Future Work

- Develop an adaptive mechanism to automatically adjust the proportions of inter-cluster tasks and hard tasks based on model performance and data characteristics.

- Investigate more advanced sampling strategies beyond fixed-stride sliding windows to create training samples.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFew-Shot Learning Patterns in Financial Time-Series for Trend-Following Strategies

Stefan Zohren, Kieran Wood, Samuel Kessler et al.

Data Scaling Effect of Deep Learning in Financial Time Series Forecasting

Chen Liu, Chao Wang, Richard Gerlach et al.

No citations found for this paper.

Comments (0)