Summary

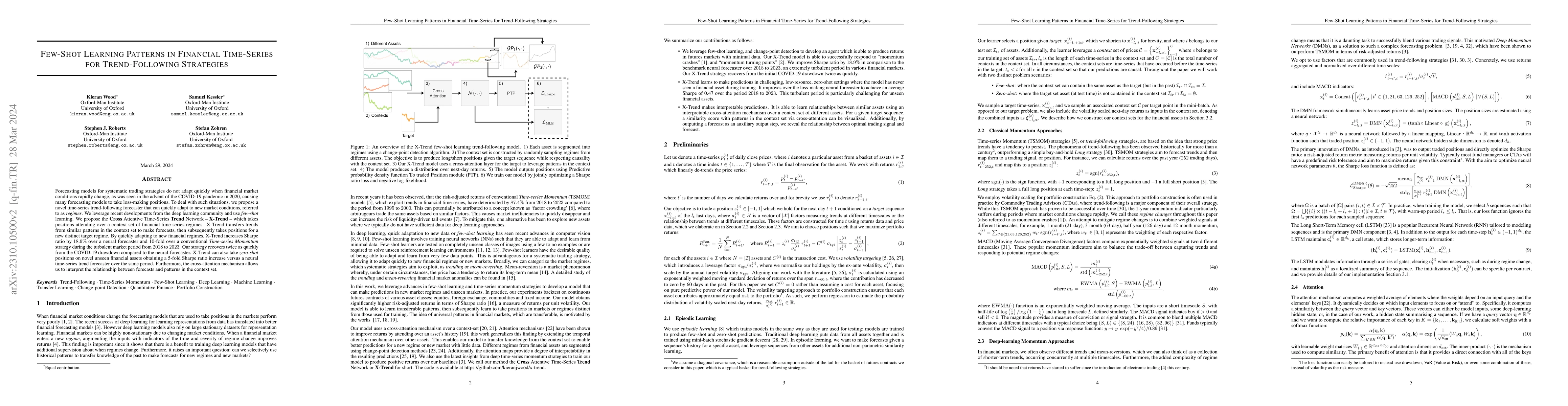

Forecasting models for systematic trading strategies do not adapt quickly when financial market conditions rapidly change, as was seen in the advent of the COVID-19 pandemic in 2020, causing many forecasting models to take loss-making positions. To deal with such situations, we propose a novel time-series trend-following forecaster that can quickly adapt to new market conditions, referred to as regimes. We leverage recent developments from the deep learning community and use few-shot learning. We propose the Cross Attentive Time-Series Trend Network -- X-Trend -- which takes positions attending over a context set of financial time-series regimes. X-Trend transfers trends from similar patterns in the context set to make forecasts, then subsequently takes positions for a new distinct target regime. By quickly adapting to new financial regimes, X-Trend increases Sharpe ratio by 18.9% over a neural forecaster and 10-fold over a conventional Time-series Momentum strategy during the turbulent market period from 2018 to 2023. Our strategy recovers twice as quickly from the COVID-19 drawdown compared to the neural-forecaster. X-Trend can also take zero-shot positions on novel unseen financial assets obtaining a 5-fold Sharpe ratio increase versus a neural time-series trend forecaster over the same period. Furthermore, the cross-attention mechanism allows us to interpret the relationship between forecasts and patterns in the context set.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdapting to the Unknown: Robust Meta-Learning for Zero-Shot Financial Time Series Forecasting

Guang Zhang, Anxian Liu, Junying Ma

Similarity Learning based Few Shot Learning for ECG Time Series Classification

Priyanka Gupta, Manik Gupta, Sathvik Bhaskarpandit

| Title | Authors | Year | Actions |

|---|

Comments (0)