Stefan Zohren

48 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Graphical Structures for Design and Verification of Quantum Error Correction

We introduce a high-level graphical framework for designing and analysing quantum error correcting codes, centred on what we term the coherent parity check (CPC). The graphical formulation is based ...

A Survey of Large Language Models for Financial Applications: Progress, Prospects and Challenges

Recent advances in large language models (LLMs) have unlocked novel opportunities for machine learning applications in the financial domain. These models have demonstrated remarkable capabilities in...

Time Machine GPT

Large language models (LLMs) are often trained on extensive, temporally indiscriminate text corpora, reflecting the lack of datasets with temporal metadata. This approach is not aligned with the evo...

Few-Shot Learning Patterns in Financial Time-Series for Trend-Following Strategies

Forecasting models for systematic trading strategies do not adapt quickly when financial market conditions rapidly change, as was seen in the advent of the COVID-19 pandemic in 2020, causing many fo...

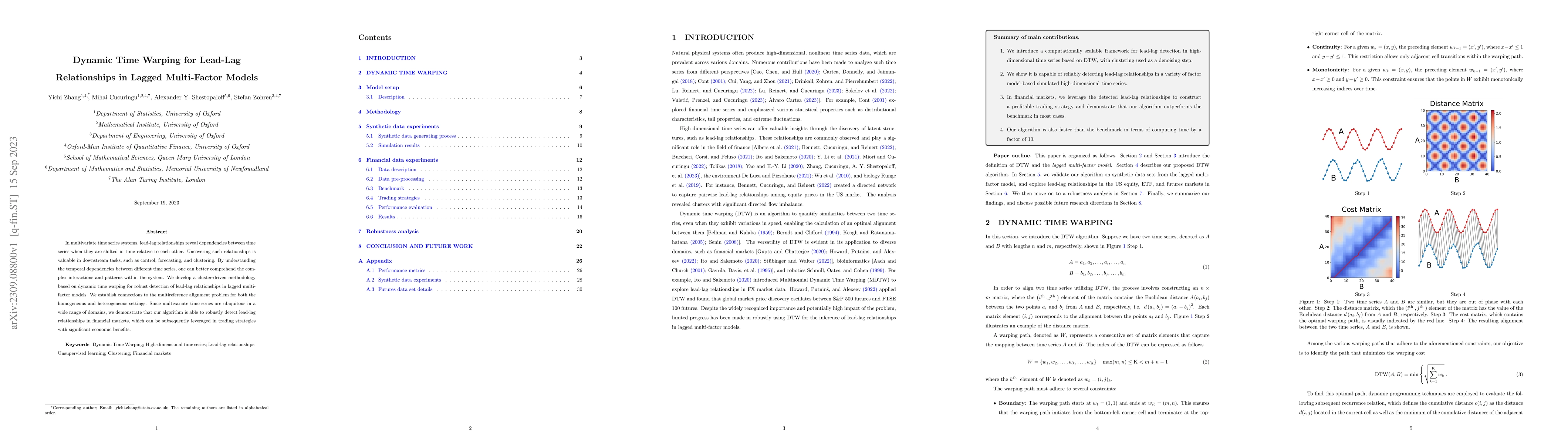

Dynamic Time Warping for Lead-Lag Relationships in Lagged Multi-Factor Models

In multivariate time series systems, lead-lag relationships reveal dependencies between time series when they are shifted in time relative to each other. Uncovering such relationships is valuable in...

On statistical arbitrage under a conditional factor model of equity returns

We consider a conditional factor model for a multivariate portfolio of United States equities in the context of analysing a statistical arbitrage trading strategy. A state space framework underlies ...

Generative AI for End-to-End Limit Order Book Modelling: A Token-Level Autoregressive Generative Model of Message Flow Using a Deep State Space Network

Developing a generative model of realistic order flow in financial markets is a challenging open problem, with numerous applications for market participants. Addressing this, we propose the first en...

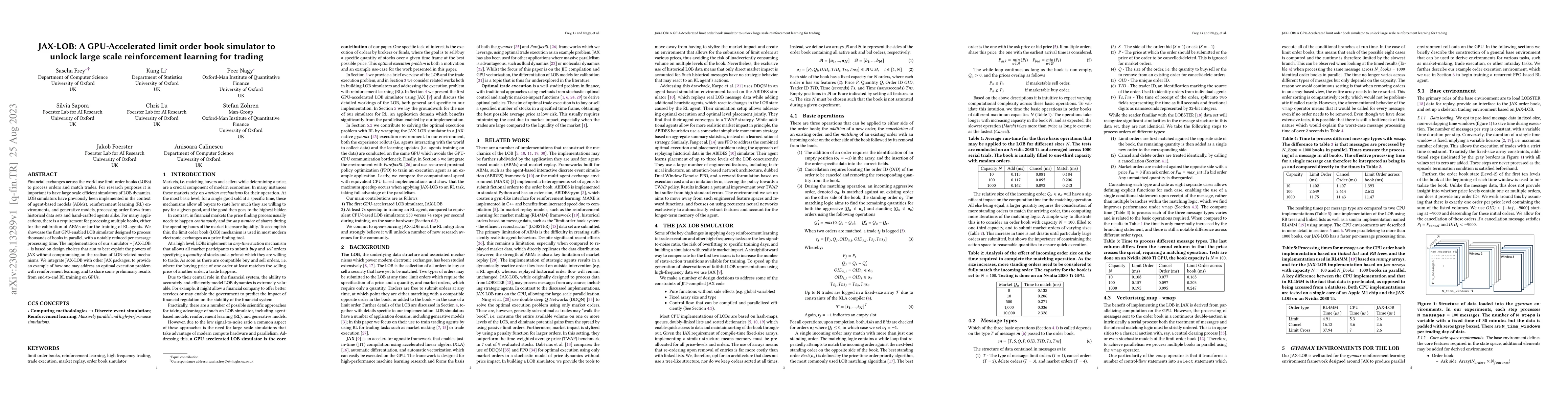

JAX-LOB: A GPU-Accelerated limit order book simulator to unlock large scale reinforcement learning for trading

Financial exchanges across the world use limit order books (LOBs) to process orders and match trades. For research purposes it is important to have large scale efficient simulators of LOB dynamics. ...

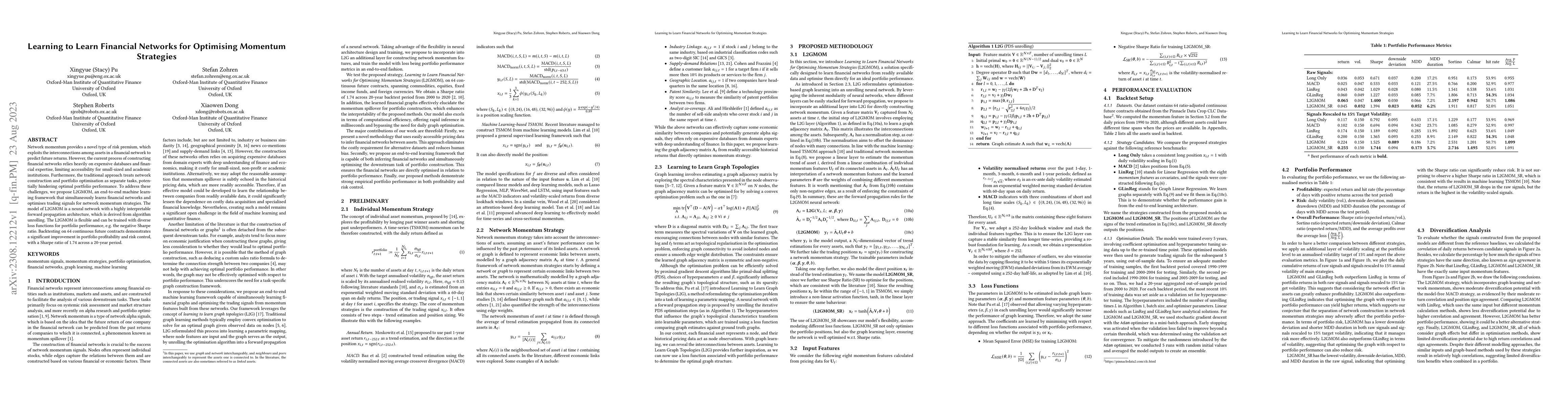

Learning to Learn Financial Networks for Optimising Momentum Strategies

Network momentum provides a novel type of risk premium, which exploits the interconnections among assets in a financial network to predict future returns. However, the current process of constructin...

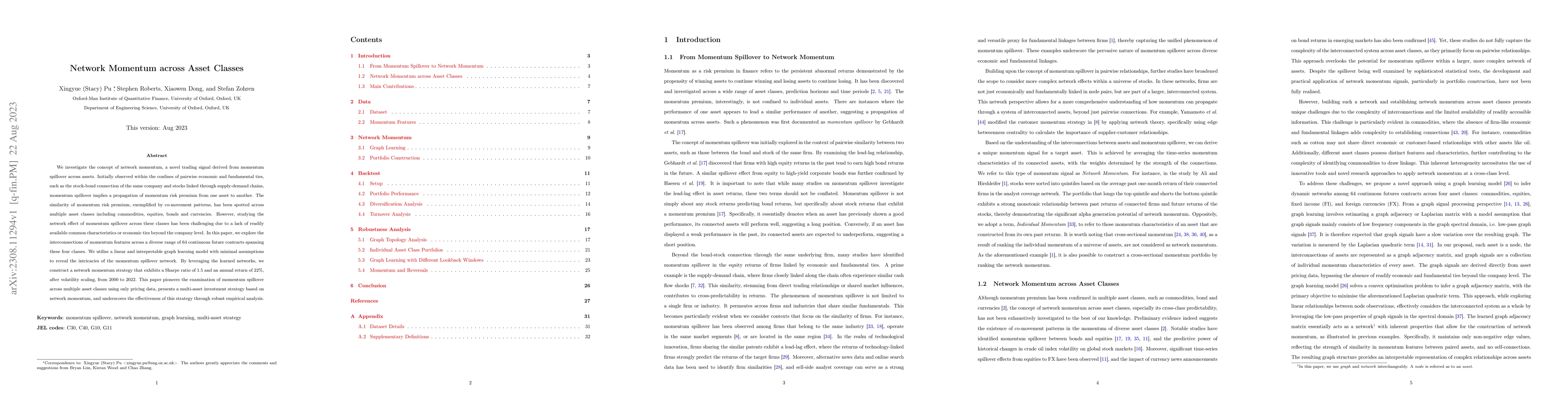

Network Momentum across Asset Classes

We investigate the concept of network momentum, a novel trading signal derived from momentum spillover across assets. Initially observed within the confines of pairwise economic and fundamental ties...

Wisdom of the Crowds or Ignorance of the Masses? A data-driven guide to WSB

A trite yet fundamental question in economics is: What causes large asset price fluctuations? A tenfold rise in the price of GameStop equity, between the 22nd and 28th of January 2021, demonstrated ...

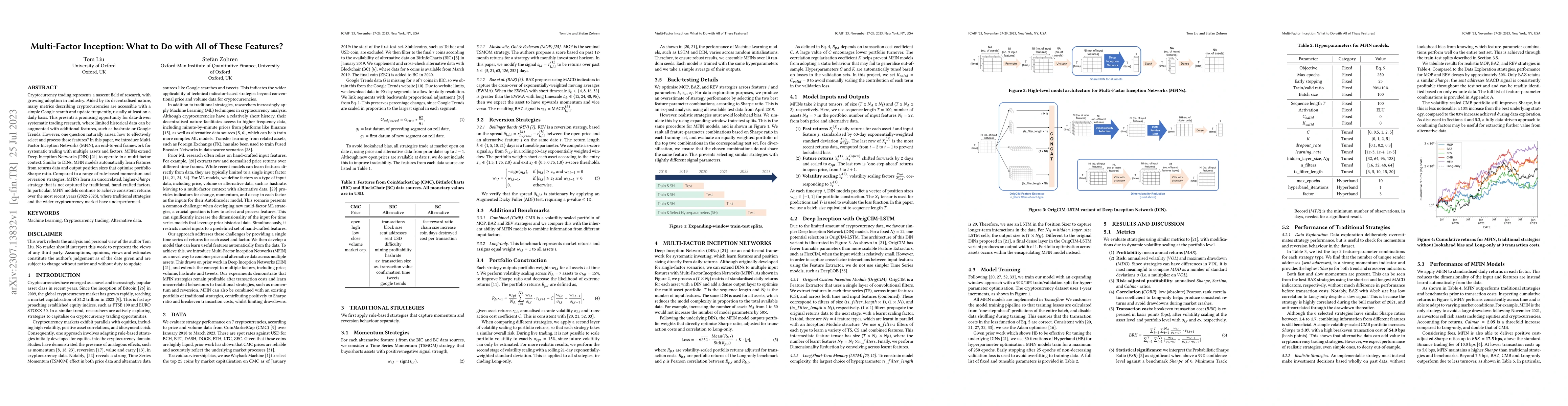

Multi-Factor Inception: What to Do with All of These Features?

Cryptocurrency trading represents a nascent field of research, with growing adoption in industry. Aided by its decentralised nature, many metrics describing cryptocurrencies are accessible with a si...

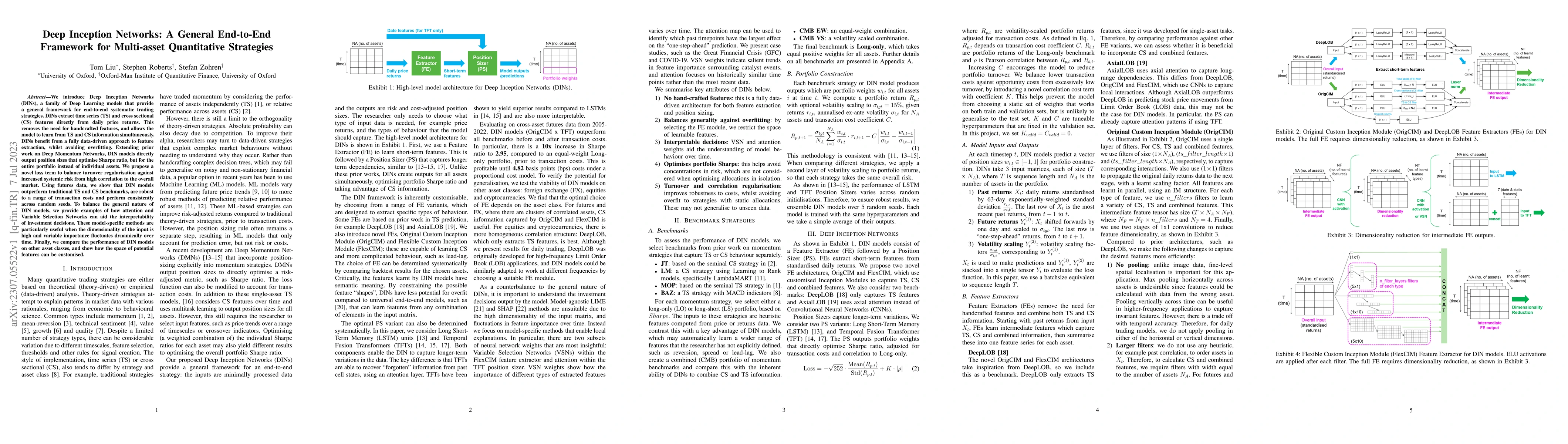

Deep Inception Networks: A General End-to-End Framework for Multi-asset Quantitative Strategies

We introduce Deep Inception Networks (DINs), a family of Deep Learning models that provide a general framework for end-to-end systematic trading strategies. DINs extract time series (TS) and cross s...

Deep Attentive Survival Analysis in Limit Order Books: Estimating Fill Probabilities with Convolutional-Transformers

One of the key decisions in execution strategies is the choice between a passive (liquidity providing) or an aggressive (liquidity taking) order to execute a trade in a limit order book (LOB). Essen...

Robust Detection of Lead-Lag Relationships in Lagged Multi-Factor Models

In multivariate time series systems, key insights can be obtained by discovering lead-lag relationships inherent in the data, which refer to the dependence between two time series shifted in time re...

Spatio-Temporal Momentum: Jointly Learning Time-Series and Cross-Sectional Strategies

We introduce Spatio-Temporal Momentum strategies, a class of models that unify both time-series and cross-sectional momentum strategies by trading assets based on their cross-sectional momentum feat...

View fusion vis-\`a-vis a Bayesian interpretation of Black-Litterman for portfolio allocation

The Black-Litterman model extends the framework of the Markowitz Modern Portfolio Theory to incorporate investor views. We consider a case where multiple view estimates, including uncertainties, are...

Asynchronous Deep Double Duelling Q-Learning for Trading-Signal Execution in Limit Order Book Markets

We employ deep reinforcement learning (RL) to train an agent to successfully translate a high-frequency trading signal into a trading strategy that places individual limit orders. Based on the ABIDE...

On Sequential Bayesian Inference for Continual Learning

Sequential Bayesian inference can be used for continual learning to prevent catastrophic forgetting of past tasks and provide an informative prior when learning new tasks. We revisit sequential Baye...

Understanding stock market instability via graph auto-encoders

Understanding stock market instability is a key question in financial management as practitioners seek to forecast breakdowns in asset co-movements which expose portfolios to rapid and devastating c...

DeepVol: Volatility Forecasting from High-Frequency Data with Dilated Causal Convolutions

Volatility forecasts play a central role among equity risk measures. Besides traditional statistical models, modern forecasting techniques, based on machine learning, can readily be employed when tr...

Transfer Ranking in Finance: Applications to Cross-Sectional Momentum with Data Scarcity

Cross-sectional strategies are a classical and popular trading style, with recent high performing variants incorporating sophisticated neural architectures. While these strategies have been applied ...

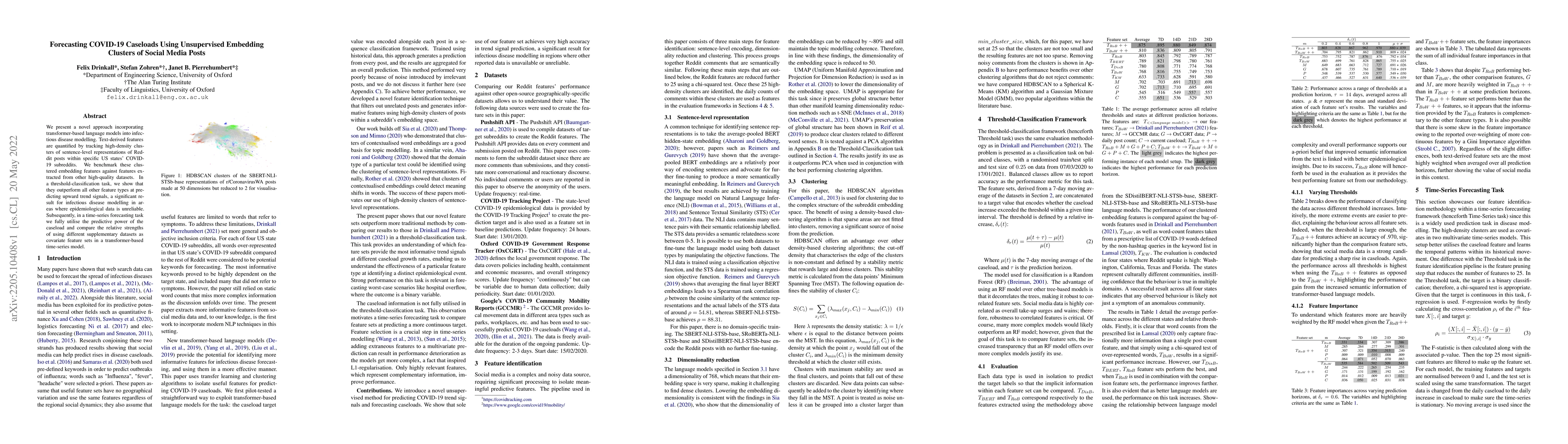

Forecasting COVID-19 Caseloads Using Unsupervised Embedding Clusters of Social Media Posts

We present a novel approach incorporating transformer-based language models into infectious disease modelling. Text-derived features are quantified by tracking high-density clusters of sentence-leve...

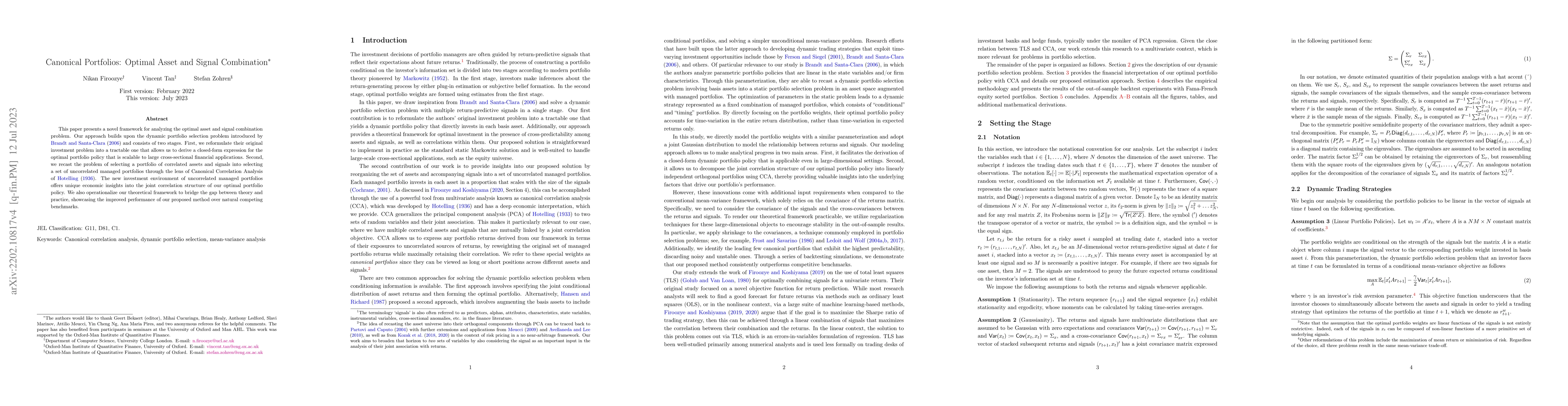

Canonical Portfolios: Optimal Asset and Signal Combination

This paper presents a novel framework for analyzing the optimal asset and signal combination problem. Our approach builds upon the dynamic portfolio selection problem introduced by Brandt and Santa-...

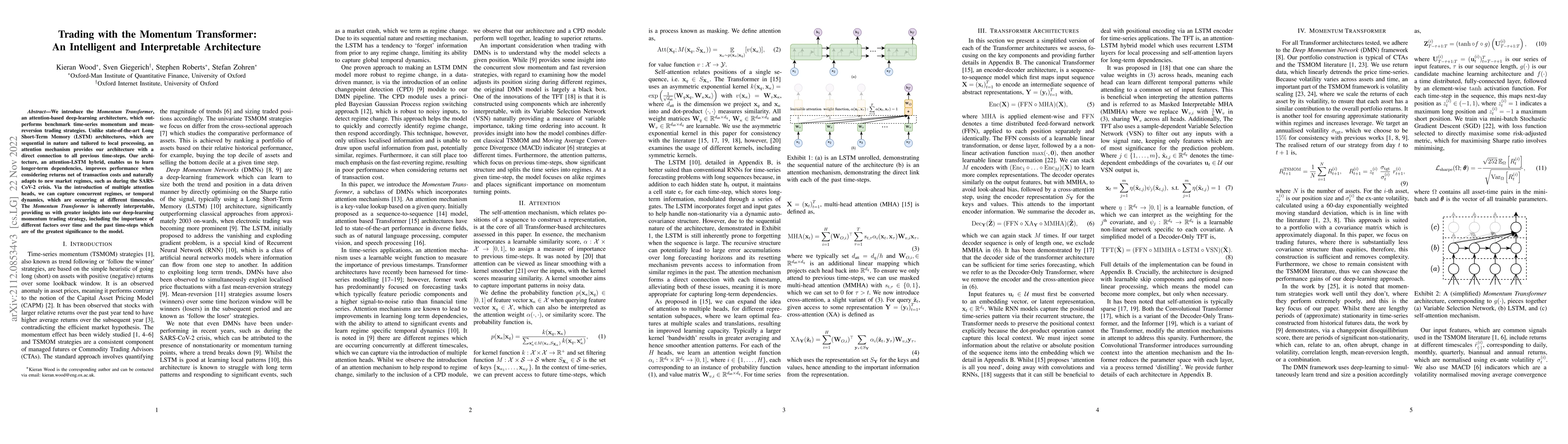

Trading with the Momentum Transformer: An Intelligent and Interpretable Architecture

We introduce the Momentum Transformer, an attention-based deep-learning architecture, which outperforms benchmark time-series momentum and mean-reversion trading strategies. Unlike state-of-the-art ...

A Universal End-to-End Approach to Portfolio Optimization via Deep Learning

We propose a universal end-to-end framework for portfolio optimization where asset distributions are directly obtained. The designed framework circumvents the traditional forecasting step and avoids...

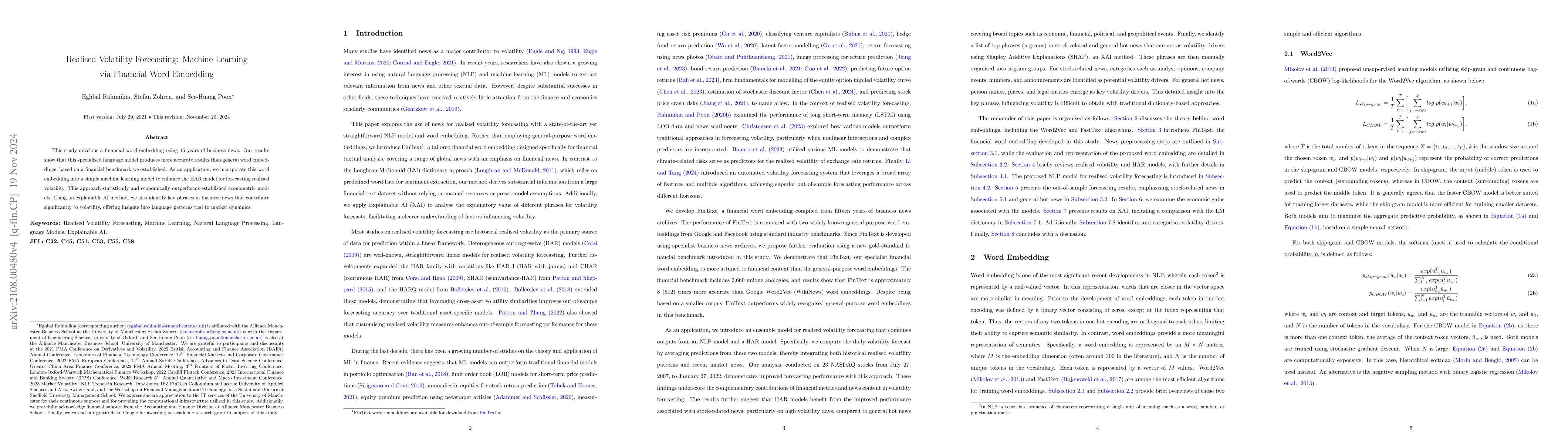

Realised Volatility Forecasting: Machine Learning via Financial Word Embedding

This study develops FinText, a financial word embedding compiled from 15 years of business news archives. The results show that FinText produces substantially more accurate results than general word...

Same State, Different Task: Continual Reinforcement Learning without Interference

Continual Learning (CL) considers the problem of training an agent sequentially on a set of tasks while seeking to retain performance on all previous tasks. A key challenge in CL is catastrophic for...

Slow Momentum with Fast Reversion: A Trading Strategy Using Deep Learning and Changepoint Detection

Momentum strategies are an important part of alternative investments and are at the heart of commodity trading advisors (CTAs). These strategies have, however, been found to have difficulties adjust...

Enhancing Cross-Sectional Currency Strategies by Context-Aware Learning to Rank with Self-Attention

The performance of a cross-sectional currency strategy depends crucially on accurately ranking instruments prior to portfolio construction. While this ranking step is traditionally performed using h...

Estimation of Large Financial Covariances: A Cross-Validation Approach

We introduce a novel covariance estimator for portfolio selection that adapts to the non-stationary or persistent heteroskedastic environments of financial time series by employing exponentially wei...

Fast Agent-Based Simulation Framework with Applications to Reinforcement Learning and the Study of Trading Latency Effects

We introduce a new software toolbox for agent-based simulation. Facilitating rapid prototyping by offering a user-friendly Python API, its core rests on an efficient C++ implementation to support si...

Learning Rates as a Function of Batch Size: A Random Matrix Theory Approach to Neural Network Training

We study the effect of mini-batching on the loss landscape of deep neural networks using spiked, field-dependent random matrix theory. We demonstrate that the magnitude of the extremal values of the...

Deep Learning for Options Trading: An End-To-End Approach

We introduce a novel approach to options trading strategies using a highly scalable and data-driven machine learning algorithm. In contrast to traditional approaches that often require specifications ...

Traditional Methods Outperform Generative LLMs at Forecasting Credit Ratings

Large Language Models (LLMs) have been shown to perform well for many downstream tasks. Transfer learning can enable LLMs to acquire skills that were not targeted during pre-training. In financial con...

Temporal Representation Learning for Stock Similarities and Its Applications in Investment Management

In the era of rapid globalization and digitalization, accurate identification of similar stocks has become increasingly challenging due to the non-stationary nature of financial markets and the ambigu...

Unlocking the Power of LSTM for Long Term Time Series Forecasting

Traditional recurrent neural network architectures, such as long short-term memory neural networks (LSTM), have historically held a prominent role in time series forecasting (TSF) tasks. While the rec...

Extracting Alpha from Financial Analyst Networks

We investigate the effectiveness of a momentum trading signal based on the coverage network of financial analysts. This signal builds on the key information-brokerage role financial sell-side analysts...

LOB-Bench: Benchmarking Generative AI for Finance -- an Application to Limit Order Book Data

While financial data presents one of the most challenging and interesting sequence modelling tasks due to high noise, heavy tails, and strategic interactions, progress in this area has been hindered b...

When Dimensionality Hurts: The Role of LLM Embedding Compression for Noisy Regression Tasks

Large language models (LLMs) have shown remarkable success in language modelling due to scaling laws found in model size and the hidden dimension of the model's text representation. Yet, we demonstrat...

Decision-informed Neural Networks with Large Language Model Integration for Portfolio Optimization

This paper addresses the critical disconnect between prediction and decision quality in portfolio optimization by integrating Large Language Models (LLMs) with decision-focused learning. We demonstrat...

Stories that (are) Move(d by) Markets: A Causal Exploration of Market Shocks and Semantic Shifts across Different Partisan Groups

Macroeconomic fluctuations and the narratives that shape them form a mutually reinforcing cycle: public discourse can spur behavioural changes leading to economic shifts, which then result in changes ...

Time-MQA: Time Series Multi-Task Question Answering with Context Enhancement

Time series data are foundational in finance, healthcare, and energy domains. However, most existing methods and datasets remain focused on a narrow spectrum of tasks, such as forecasting or anomaly d...

ClusterLOB: Enhancing Trading Strategies by Clustering Orders in Limit Order Books

In the rapidly evolving world of financial markets, understanding the dynamics of limit order book (LOB) is crucial for unraveling market microstructure and participant behavior. We introduce ClusterL...

Trainability of Parametrised Linear Combinations of Unitaries

A principal concern in the optimisation of parametrised quantum circuits is the presence of barren plateaus, which present fundamental challenges to the scalability of applications, such as variationa...

Painting the market: generative diffusion models for financial limit order book simulation and forecasting

Simulating limit order books (LOBs) has important applications across forecasting and backtesting for financial market data. However, deep generative models struggle in this context due to the high no...

Signature-Informed Transformer for Asset Allocation

Robust asset allocation is a key challenge in quantitative finance, where deep-learning forecasters often fail due to objective mismatch and error amplification. We introduce the Signature-Informed Tr...

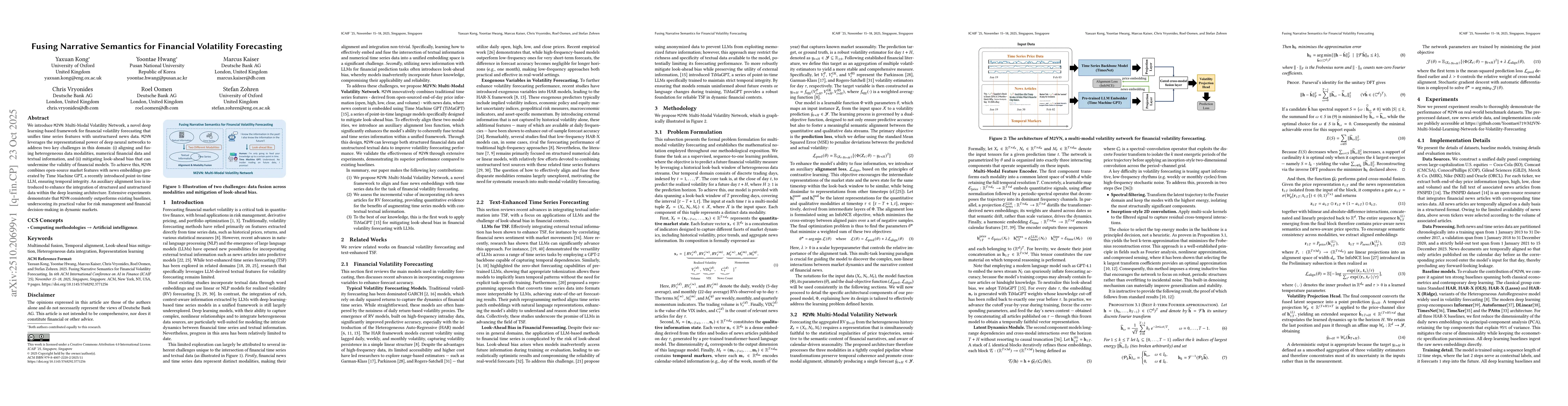

Fusing Narrative Semantics for Financial Volatility Forecasting

We introduce M2VN: Multi-Modal Volatility Network, a novel deep learning-based framework for financial volatility forecasting that unifies time series features with unstructured news data. M2VN levera...