Authors

Summary

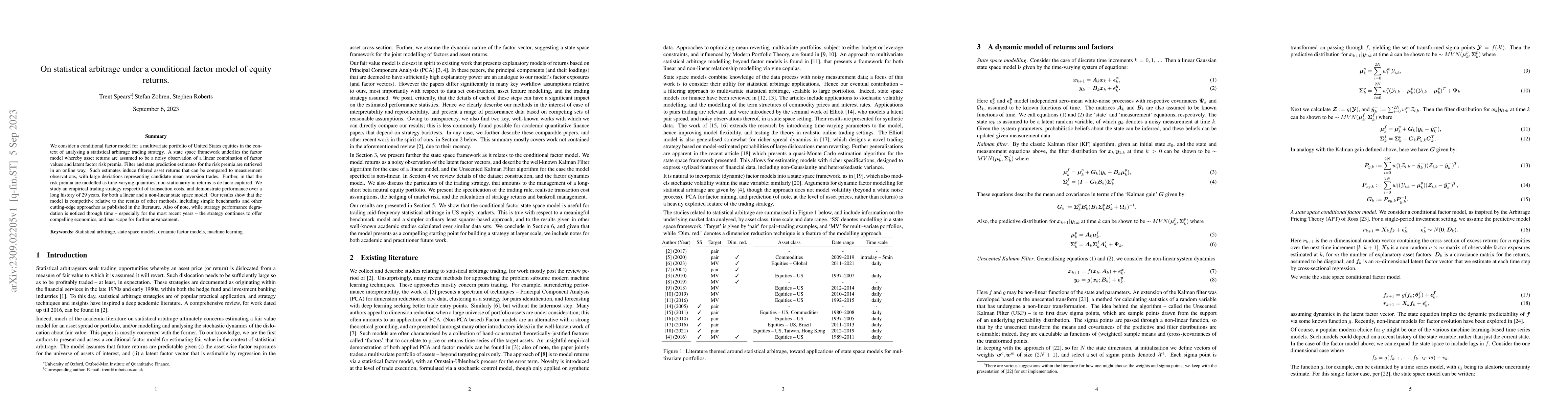

We consider a conditional factor model for a multivariate portfolio of United States equities in the context of analysing a statistical arbitrage trading strategy. A state space framework underlies the factor model whereby asset returns are assumed to be a noisy observation of a linear combination of factor values and latent factor risk premia. Filter and state prediction estimates for the risk premia are retrieved in an online way. Such estimates induce filtered asset returns that can be compared to measurement observations, with large deviations representing candidate mean reversion trades. Further, in that the risk premia are modelled as time-varying quantities, non-stationarity in returns is de facto captured. We study an empirical trading strategy respectful of transaction costs, and demonstrate performance over a long history of 29 years, for both a linear and a non-linear state space model. Our results show that the model is competitive relative to the results of other methods, including simple benchmarks and other cutting-edge approaches as published in the literature. Also of note, while strategy performance degradation is noticed through time -- especially for the most recent years -- the strategy continues to offer compelling economics, and has scope for further advancement.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Statistical Arbitrage

Markus Pelger, Greg Zanotti, Jorge Guijarro-Ordonez

No citations found for this paper.

Comments (0)