Summary

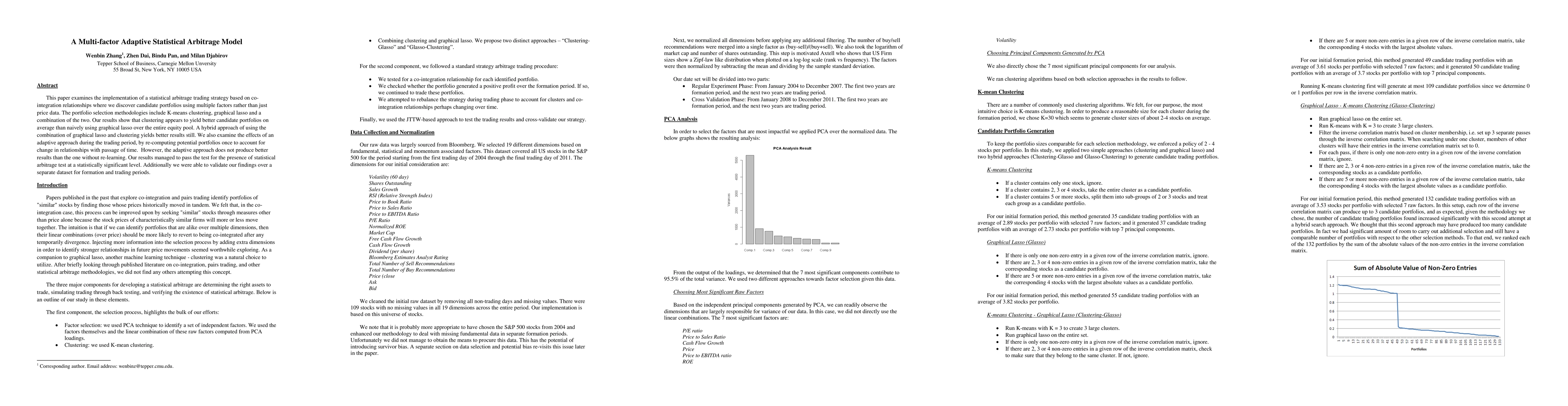

This paper examines the implementation of a statistical arbitrage trading strategy based on co-integration relationships where we discover candidate portfolios using multiple factors rather than just price data. The portfolio selection methodologies include K-means clustering, graphical lasso and a combination of the two. Our results show that clustering appears to yield better candidate portfolios on average than naively using graphical lasso over the entire equity pool. A hybrid approach of using the combination of graphical lasso and clustering yields better results still. We also examine the effects of an adaptive approach during the trading period, by re-computing potential portfolios once to account for change in relationships with passage of time. However, the adaptive approach does not produce better results than the one without re-learning. Our results managed to pass the test for the presence of statistical arbitrage test at a statistically significant level. Additionally we were able to validate our findings over a separate dataset for formation and trading periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn statistical arbitrage under a conditional factor model of equity returns

Stephen Roberts, Stefan Zohren, Trent Spears

| Title | Authors | Year | Actions |

|---|

Comments (0)