Summary

The paper proposes a new algorithm for the high-dimensional financial data -- the Groupwise Interpretable Basis Selection (GIBS) algorithm, to estimate a new Adaptive Multi-Factor (AMF) asset pricing model, implied by the recently developed Generalized Arbitrage Pricing Theory, which relaxes the convention that the number of risk-factors is small. We first obtain an adaptive collection of basis assets and then simultaneously test which basis assets correspond to which securities, using high-dimensional methods. The AMF model, along with the GIBS algorithm, is shown to have a significantly better fitting and prediction power than the Fama-French 5-factor model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

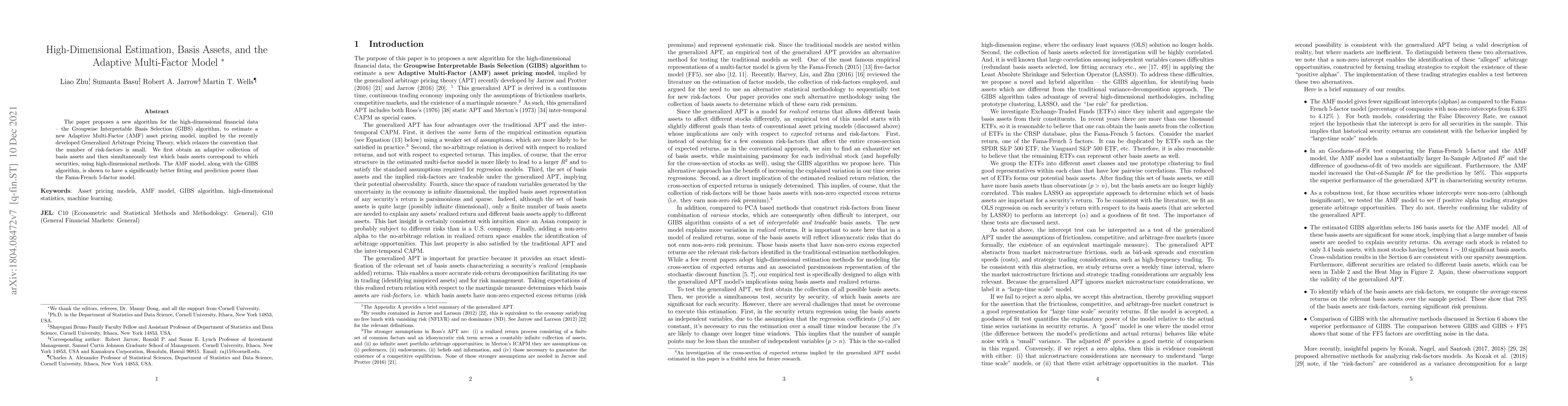

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHigh-Dimensional Multi-Study Multi-Modality Covariate-Augmented Generalized Factor Model

Wei Liu, Qingzhi Zhong

High-Dimensional Covariate-Augmented Overdispersed Multi-Study Poisson Factor Model

Wei Liu, Qingzhi Zhong

| Title | Authors | Year | Actions |

|---|

Comments (0)