Summary

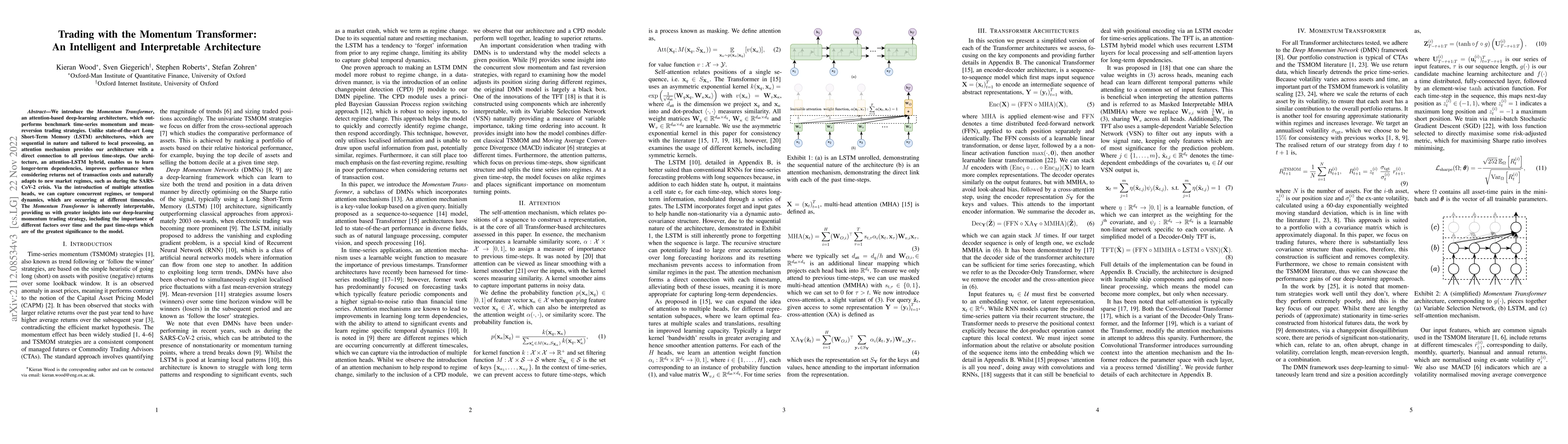

We introduce the Momentum Transformer, an attention-based deep-learning architecture, which outperforms benchmark time-series momentum and mean-reversion trading strategies. Unlike state-of-the-art Long Short-Term Memory (LSTM) architectures, which are sequential in nature and tailored to local processing, an attention mechanism provides our architecture with a direct connection to all previous time-steps. Our architecture, an attention-LSTM hybrid, enables us to learn longer-term dependencies, improves performance when considering returns net of transaction costs and naturally adapts to new market regimes, such as during the SARS-CoV-2 crisis. Via the introduction of multiple attention heads, we can capture concurrent regimes, or temporal dynamics, which are occurring at different timescales. The Momentum Transformer is inherently interpretable, providing us with greater insights into our deep-learning momentum trading strategy, including the importance of different factors over time and the past time-steps which are of the greatest significance to the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhanced Momentum with Momentum Transformers

David Huang, Max Mason, Waasi A Jagirdar et al.

CardioPatternFormer: Pattern-Guided Attention for Interpretable ECG Classification with Transformer Architecture

Ömer Nezih Gerek, Berat Kutay Uğraş, İbrahim Talha Saygı

| Title | Authors | Year | Actions |

|---|

Comments (0)