Authors

Summary

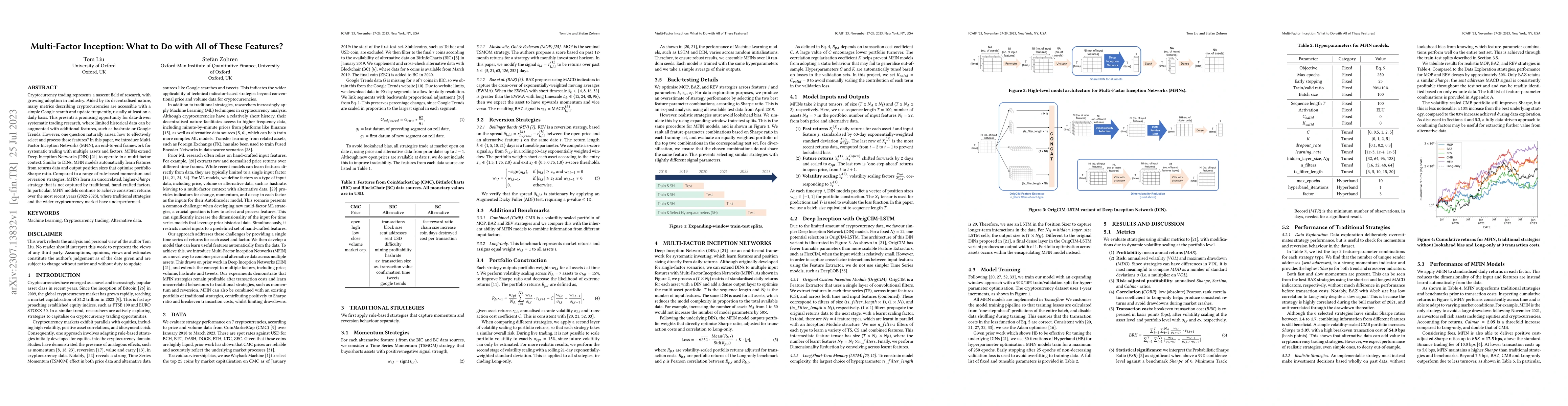

Cryptocurrency trading represents a nascent field of research, with growing adoption in industry. Aided by its decentralised nature, many metrics describing cryptocurrencies are accessible with a simple Google search and update frequently, usually at least on a daily basis. This presents a promising opportunity for data-driven systematic trading research, where limited historical data can be augmented with additional features, such as hashrate or Google Trends. However, one question naturally arises: how to effectively select and process these features? In this paper, we introduce Multi-Factor Inception Networks (MFIN), an end-to-end framework for systematic trading with multiple assets and factors. MFINs extend Deep Inception Networks (DIN) to operate in a multi-factor context. Similar to DINs, MFIN models automatically learn features from returns data and output position sizes that optimise portfolio Sharpe ratio. Compared to a range of rule-based momentum and reversion strategies, MFINs learn an uncorrelated, higher-Sharpe strategy that is not captured by traditional, hand-crafted factors. In particular, MFIN models continue to achieve consistent returns over the most recent years (2022-2023), where traditional strategies and the wider cryptocurrency market have underperformed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnatomy Might Be All You Need: Forecasting What to Do During Surgery

Ender Konukoglu, Gary Sarwin, Alessandro Carretta et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)