Authors

Summary

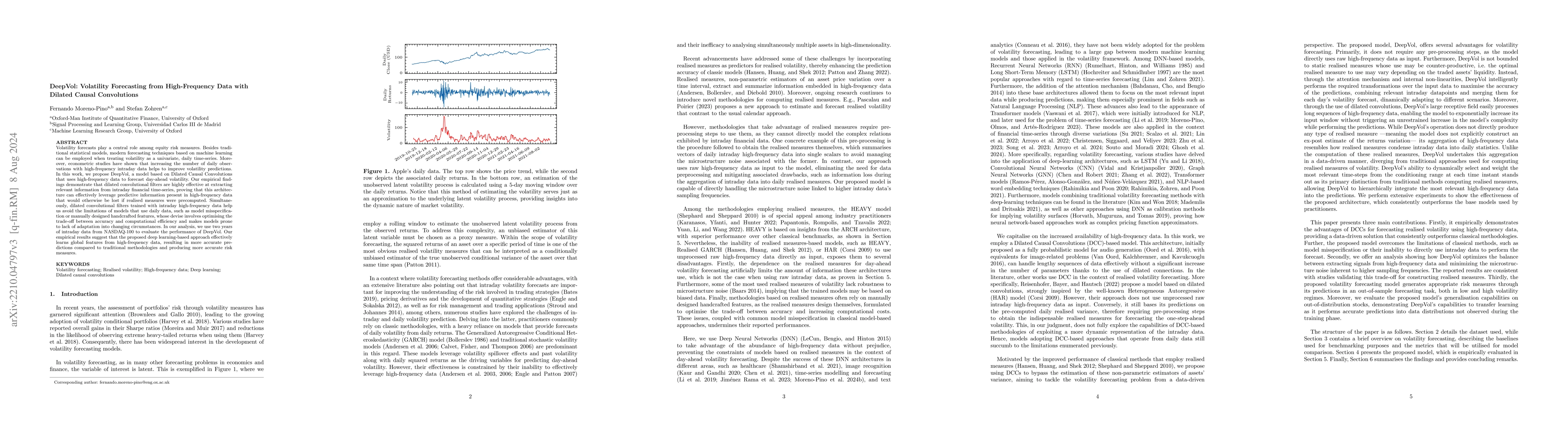

Volatility forecasts play a central role among equity risk measures. Besides traditional statistical models, modern forecasting techniques, based on machine learning, can readily be employed when treating volatility as a univariate, daily time-series. However, econometric studies have shown that increasing the number of daily observations with high-frequency intraday data helps to improve predictions. In this work, we propose DeepVol, a model based on Dilated Causal Convolutions to forecast day-ahead volatility by using high-frequency data. We show that the dilated convolutional filters are ideally suited to extract relevant information from intraday financial data, thereby naturally mimicking (via a data-driven approach) the econometric models which incorporate realised measures of volatility into the forecast. This allows us to take advantage of the abundance of intraday observations, helping us to avoid the limitations of models that use daily data, such as model misspecification or manually designed handcrafted features, whose devise involves optimising the trade-off between accuracy and computational efficiency and makes models prone to lack of adaptation into changing circumstances. In our analysis, we use two years of intraday data from NASDAQ-100 to evaluate DeepVol's performance. The reported empirical results suggest that the proposed deep learning-based approach learns global features from high-frequency data, achieving more accurate predictions than traditional methodologies, yielding to more appropriate risk measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)