Summary

One of the key decisions in execution strategies is the choice between a passive (liquidity providing) or an aggressive (liquidity taking) order to execute a trade in a limit order book (LOB). Essential to this choice is the fill probability of a passive limit order placed in the LOB. This paper proposes a deep learning method to estimate the filltimes of limit orders posted in different levels of the LOB. We develop a novel model for survival analysis that maps time-varying features of the LOB to the distribution of filltimes of limit orders. Our method is based on a convolutional-Transformer encoder and a monotonic neural network decoder. We use proper scoring rules to compare our method with other approaches in survival analysis, and perform an interpretability analysis to understand the informativeness of features used to compute fill probabilities. Our method significantly outperforms those typically used in survival analysis literature. Finally, we carry out a statistical analysis of the fill probability of orders placed in the order book (e.g., within the bid-ask spread) for assets with different queue dynamics and trading activity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

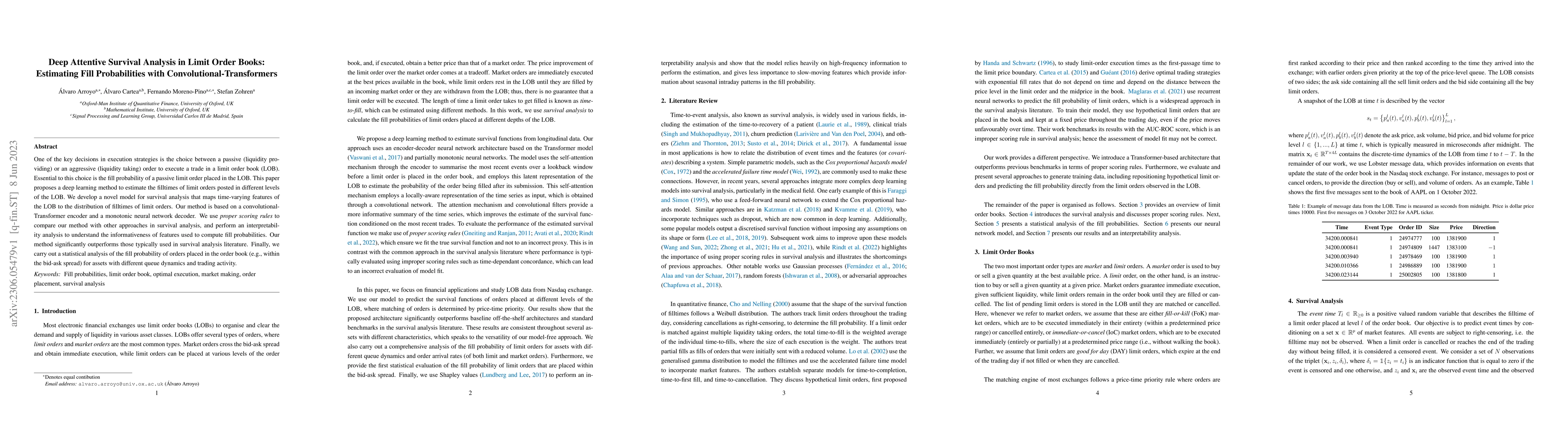

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFill Probabilities in a Limit Order Book with State-Dependent Stochastic Order Flows

Felix Lokin, Fenghui Yu

| Title | Authors | Year | Actions |

|---|

Comments (0)