Summary

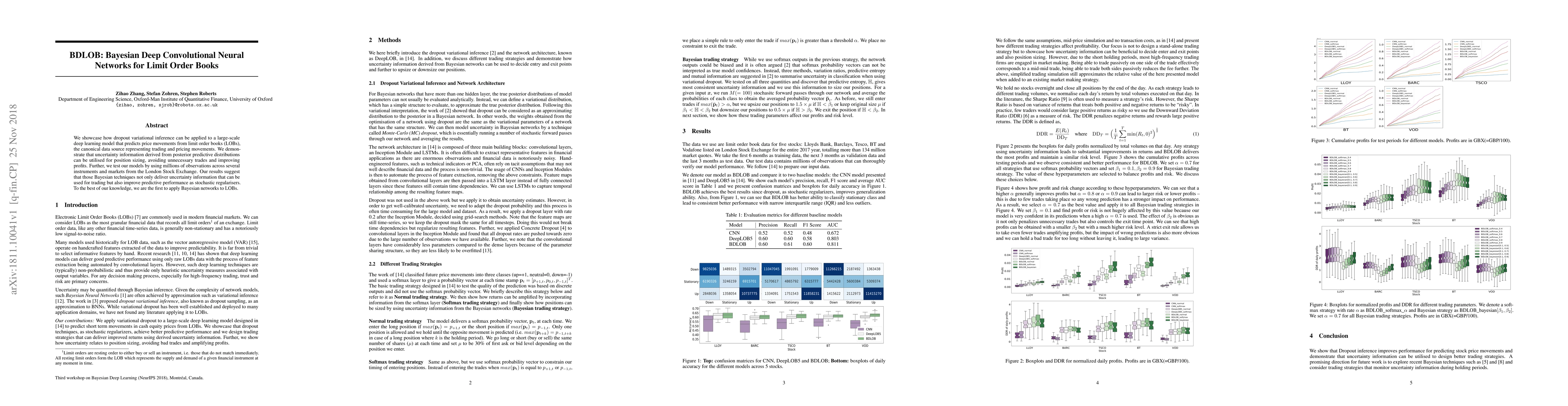

We showcase how dropout variational inference can be applied to a large-scale deep learning model that predicts price movements from limit order books (LOBs), the canonical data source representing trading and pricing movements. We demonstrate that uncertainty information derived from posterior predictive distributions can be utilised for position sizing, avoiding unnecessary trades and improving profits. Further, we test our models by using millions of observations across several instruments and markets from the London Stock Exchange. Our results suggest that those Bayesian techniques not only deliver uncertainty information that can be used for trading but also improve predictive performance as stochastic regularisers. To the best of our knowledge, we are the first to apply Bayesian networks to LOBs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHLOB -- Information Persistence and Structure in Limit Order Books

Antonio Briola, Silvia Bartolucci, Tomaso Aste

| Title | Authors | Year | Actions |

|---|

Comments (0)