Summary

This paper develops a new neural network architecture for modeling spatial distributions (i.e., distributions on R^d) which is computationally efficient and specifically designed to take advantage of the spatial structure of limit order books. The new architecture yields a low-dimensional model of price movements deep into the limit order book, allowing more effective use of information from deep in the limit order book (i.e., many levels beyond the best bid and best ask). This "spatial neural network" models the joint distribution of the state of the limit order book at a future time conditional on the current state of the limit order book. The spatial neural network outperforms other models such as the naive empirical model, logistic regression (with nonlinear features), and a standard neural network architecture. Both neural networks strongly outperform the logistic regression model. Due to its more effective use of information deep in the limit order book, the spatial neural network especially outperforms the standard neural network in the tail of the distribution, which is important for risk management applications. The models are trained and tested on nearly 500 stocks. Techniques from deep learning such as dropout are employed to improve performance. Due to the significant computational challenges associated with the large amount of data, models are trained with a cluster of 50 GPUs.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research develops a new neural network architecture, the spatial neural network, designed to model spatial distributions in limit order books efficiently by leveraging their spatial structure. This architecture outperforms traditional models like the naive empirical model, logistic regression, and a standard neural network, especially in the tail of the distribution, which is crucial for risk management.

Key Results

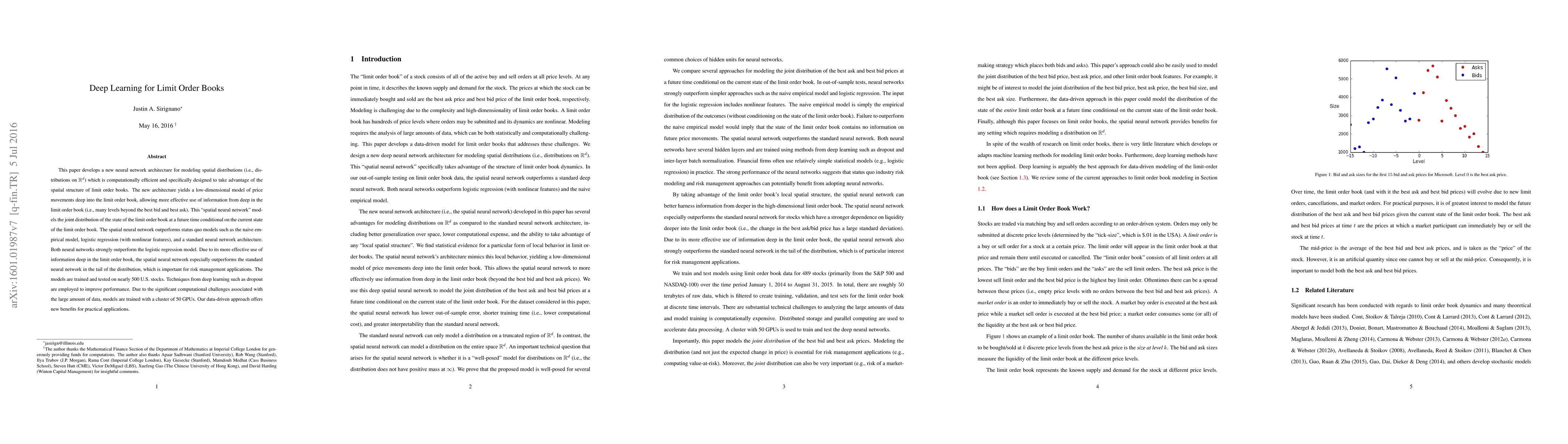

- The spatial neural network yields a low-dimensional model of price movements deep into the limit order book, effectively using information from many levels beyond the best bid and ask.

- Both neural networks (standard and spatial) strongly outperform logistic regression.

- The spatial neural network especially excels in the tail of the distribution, which is important for risk management applications.

- Models are trained and tested on nearly 500 stocks using techniques from deep learning such as dropout and a cluster of 50 GPUs to handle computational challenges.

- The spatial neural network's computational cost grows linearly with dimension due to dimension splitting, making it feasible to model the distribution of the entire limit order book.

Significance

This research is significant as it introduces a computationally efficient neural network architecture that models limit order book dynamics more accurately, particularly in the tails of the distribution, which are vital for risk management applications. It offers a method to better utilize information from deep in the order book, enhancing predictive capabilities in financial markets.

Technical Contribution

The paper presents a novel spatial neural network architecture that models the joint distribution of the limit order book's state at a future time conditional on the current state, effectively capturing spatial dependencies and outperforming traditional models, especially in the distribution tails.

Novelty

The novelty of this work lies in its tailored neural network architecture for limit order books, which efficiently models spatial distributions and leverages deep book information, surpassing existing methods in both accuracy and computational efficiency.

Limitations

- The study is limited to nearly 500 stocks, and the models' performance on a broader range of assets remains untested.

- The method relies heavily on computational resources, specifically a cluster of 50 GPUs, which may limit accessibility for some researchers or institutions.

- While the spatial neural network outperforms other models, it does not explore or compare against all possible alternative architectures or methods.

Future Work

- Investigate the performance of the spatial neural network on a larger and more diverse set of stocks to validate its generalizability.

- Explore methods to reduce computational requirements, making the approach more accessible to researchers with limited GPU resources.

- Examine the applicability of this architecture to other financial instruments and markets beyond equities.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)