Summary

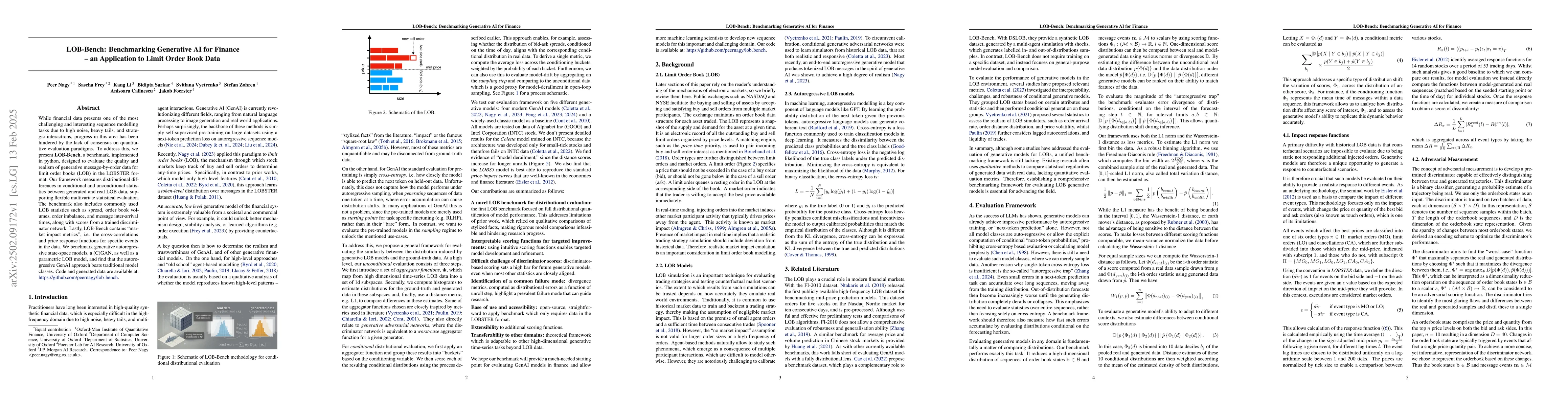

While financial data presents one of the most challenging and interesting sequence modelling tasks due to high noise, heavy tails, and strategic interactions, progress in this area has been hindered by the lack of consensus on quantitative evaluation paradigms. To address this, we present LOB-Bench, a benchmark, implemented in python, designed to evaluate the quality and realism of generative message-by-order data for limit order books (LOB) in the LOBSTER format. Our framework measures distributional differences in conditional and unconditional statistics between generated and real LOB data, supporting flexible multivariate statistical evaluation. The benchmark also includes features commonly used LOB statistics such as spread, order book volumes, order imbalance, and message inter-arrival times, along with scores from a trained discriminator network. Lastly, LOB-Bench contains "market impact metrics", i.e. the cross-correlations and price response functions for specific events in the data. We benchmark generative autoregressive state-space models, a (C)GAN, as well as a parametric LOB model and find that the autoregressive GenAI approach beats traditional model classes.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces LOB-Bench, a benchmark framework in Python for evaluating generative models of limit order book (LOB) data, measuring distributional differences using conditional and unconditional statistics, and including common LOB statistics and discriminator scores. It benchmarks autoregressive state-space models, GANs, and parametric LOB models, finding that autoregressive generative AI outperforms traditional models.

Key Results

- LOB-Bench effectively evaluates generative models for LOB data by measuring distributional differences and including common LOB statistics and discriminator scores.

- Autoregressive generative AI models surpass traditional model classes, such as GANs and parametric LOB models, in capturing limit order book dynamics.

Significance

This research is significant as it addresses the lack of consensus on quantitative evaluation paradigms for financial sequence modeling tasks, providing a benchmark to measure the quality and realism of generated LOB data.

Technical Contribution

LOB-Bench, a benchmark framework for evaluating generative models of limit order book data, providing multivariate statistical evaluation and market impact metrics.

Novelty

The research presents a novel benchmarking approach specifically designed for generative models of limit order book data, addressing the gap in quantitative evaluation paradigms for financial sequence modeling tasks.

Limitations

- The study is limited to evaluating generative models and does not explore discriminative models for LOB data analysis.

- The benchmark's performance may depend on the quality and diversity of the training data used for generative models.

Future Work

- Investigate the application of LOB-Bench to other financial data types and sequence modeling tasks.

- Explore the use of LOB-Bench for evaluating discriminative models in finance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJAX-LOB: A GPU-Accelerated limit order book simulator to unlock large scale reinforcement learning for trading

Stefan Zohren, Chris Lu, Anisoara Calinescu et al.

Generative AI for End-to-End Limit Order Book Modelling: A Token-Level Autoregressive Generative Model of Message Flow Using a Deep State Space Network

Stefan Zohren, Anisoara Calinescu, Jakob Foerster et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)