Summary

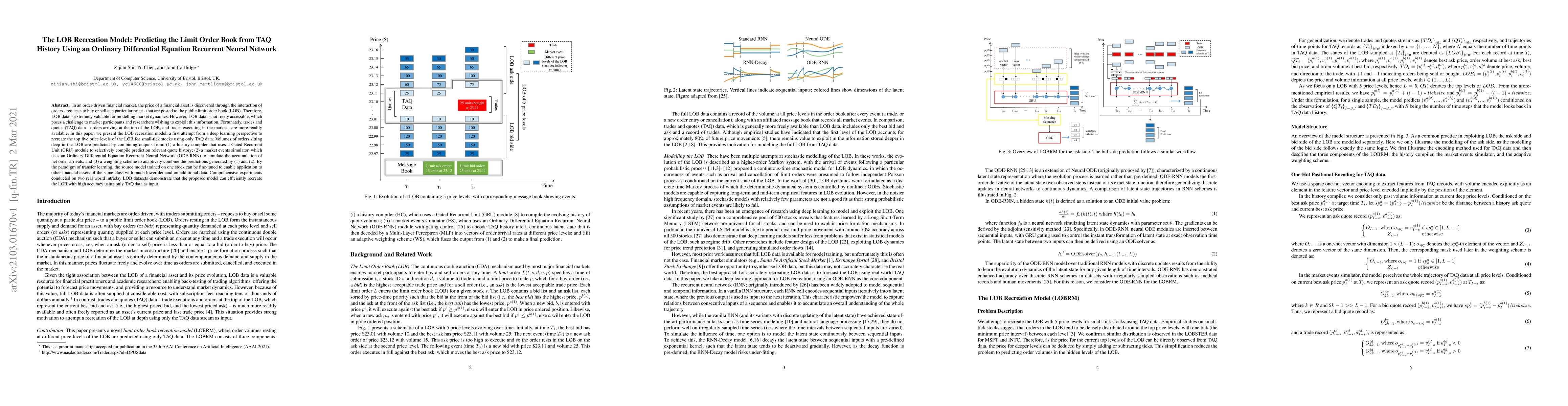

In an order-driven financial market, the price of a financial asset is discovered through the interaction of orders - requests to buy or sell at a particular price - that are posted to the public limit order book (LOB). Therefore, LOB data is extremely valuable for modelling market dynamics. However, LOB data is not freely accessible, which poses a challenge to market participants and researchers wishing to exploit this information. Fortunately, trades and quotes (TAQ) data - orders arriving at the top of the LOB, and trades executing in the market - are more readily available. In this paper, we present the LOB recreation model, a first attempt from a deep learning perspective to recreate the top five price levels of the LOB for small-tick stocks using only TAQ data. Volumes of orders sitting deep in the LOB are predicted by combining outputs from: (1) a history compiler that uses a Gated Recurrent Unit (GRU) module to selectively compile prediction relevant quote history; (2) a market events simulator, which uses an Ordinary Differential Equation Recurrent Neural Network (ODE-RNN) to simulate the accumulation of net order arrivals; and (3) a weighting scheme to adaptively combine the predictions generated by (1) and (2). By the paradigm of transfer learning, the source model trained on one stock can be fine-tuned to enable application to other financial assets of the same class with much lower demand on additional data. Comprehensive experiments conducted on two real world intraday LOB datasets demonstrate that the proposed model can efficiently recreate the LOB with high accuracy using only TAQ data as input.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLOB-Bench: Benchmarking Generative AI for Finance -- an Application to Limit Order Book Data

Stefan Zohren, Jakob Foerster, Kang Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)