Summary

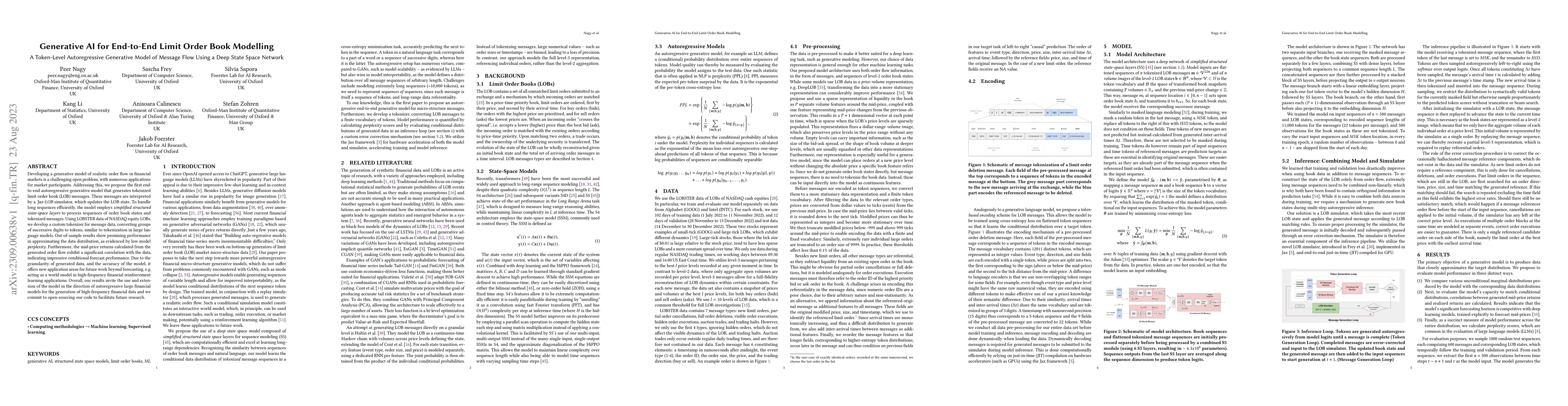

Developing a generative model of realistic order flow in financial markets is a challenging open problem, with numerous applications for market participants. Addressing this, we propose the first end-to-end autoregressive generative model that generates tokenized limit order book (LOB) messages. These messages are interpreted by a Jax-LOB simulator, which updates the LOB state. To handle long sequences efficiently, the model employs simplified structured state-space layers to process sequences of order book states and tokenized messages. Using LOBSTER data of NASDAQ equity LOBs, we develop a custom tokenizer for message data, converting groups of successive digits to tokens, similar to tokenization in large language models. Out-of-sample results show promising performance in approximating the data distribution, as evidenced by low model perplexity. Furthermore, the mid-price returns calculated from the generated order flow exhibit a significant correlation with the data, indicating impressive conditional forecast performance. Due to the granularity of generated data, and the accuracy of the model, it offers new application areas for future work beyond forecasting, e.g. acting as a world model in high-frequency financial reinforcement learning applications. Overall, our results invite the use and extension of the model in the direction of autoregressive large financial models for the generation of high-frequency financial data and we commit to open-sourcing our code to facilitate future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLOB-Bench: Benchmarking Generative AI for Finance -- an Application to Limit Order Book Data

Stefan Zohren, Jakob Foerster, Kang Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)