Svitlana Vyetrenko

37 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A Language Model-Guided Framework for Mining Time Series with Distributional Shifts

Effective utilization of time series data is often constrained by the scarcity of data quantity that reflects complex dynamics, especially under the condition of distributional shifts. Existing data...

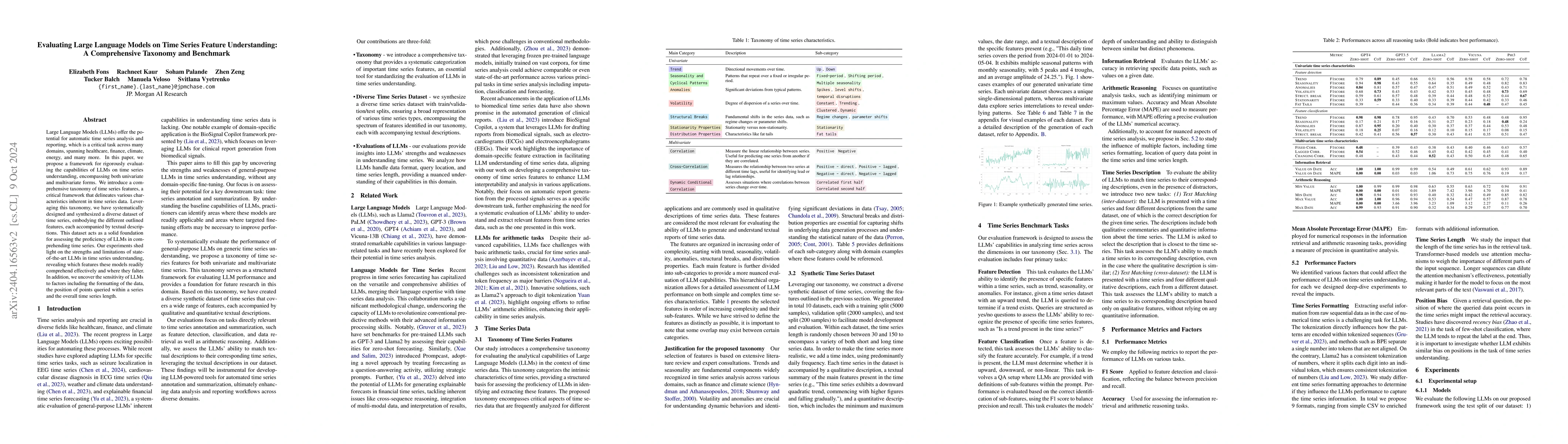

Evaluating Large Language Models on Time Series Feature Understanding: A Comprehensive Taxonomy and Benchmark

Large Language Models (LLMs) offer the potential for automatic time series analysis and reporting, which is a critical task across many domains, spanning healthcare, finance, climate, energy, and ma...

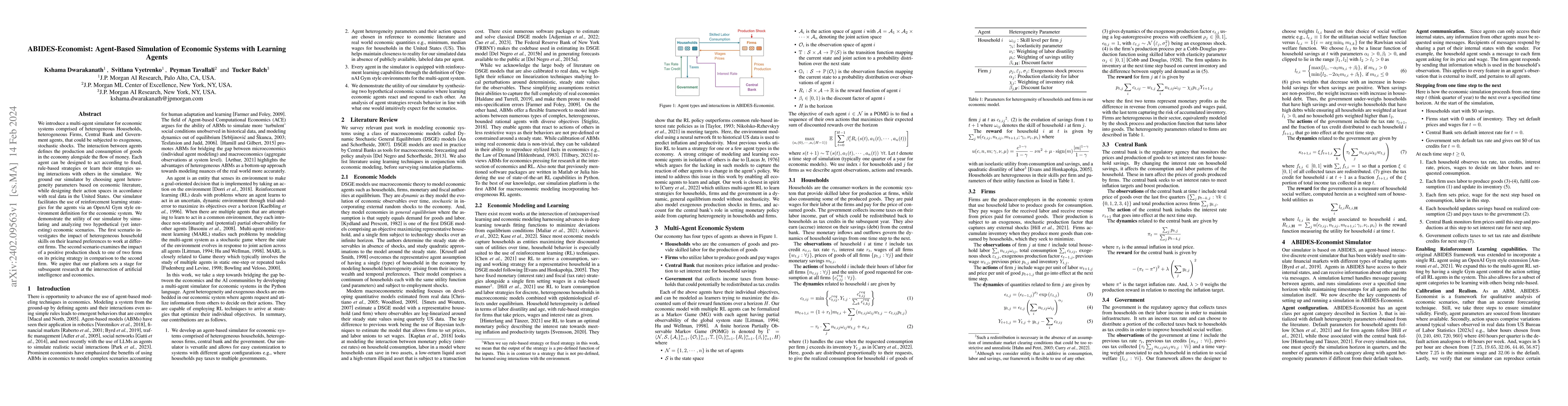

ABIDES-Economist: Agent-Based Simulation of Economic Systems with Learning Agents

We introduce a multi-agent simulator for economic systems comprised of heterogeneous Households, heterogeneous Firms, Central Bank and Government agents, that could be subjected to exogenous, stocha...

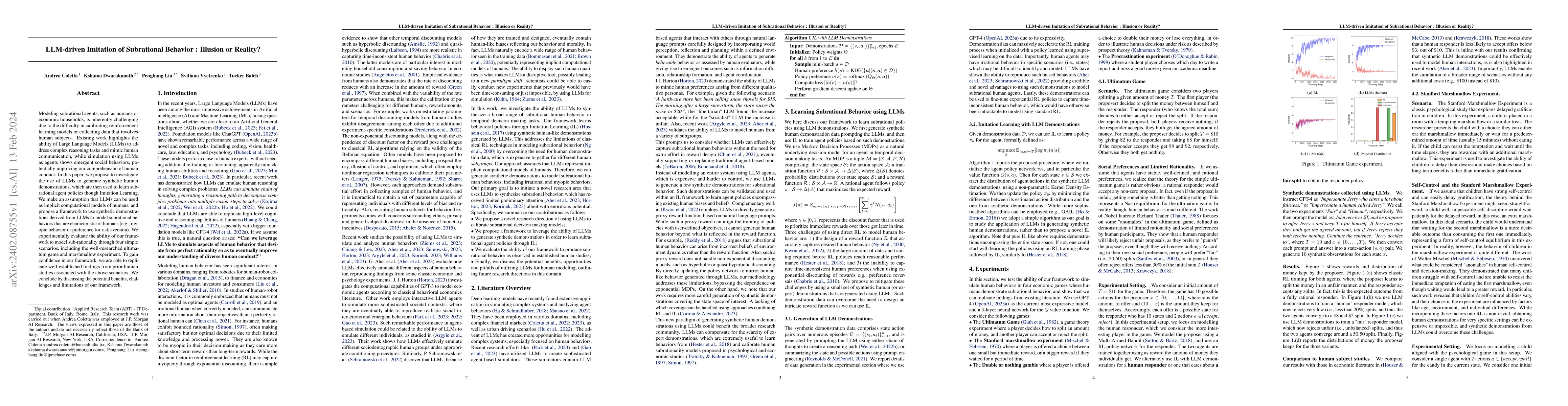

LLM-driven Imitation of Subrational Behavior : Illusion or Reality?

Modeling subrational agents, such as humans or economic households, is inherently challenging due to the difficulty in calibrating reinforcement learning models or collecting data that involves huma...

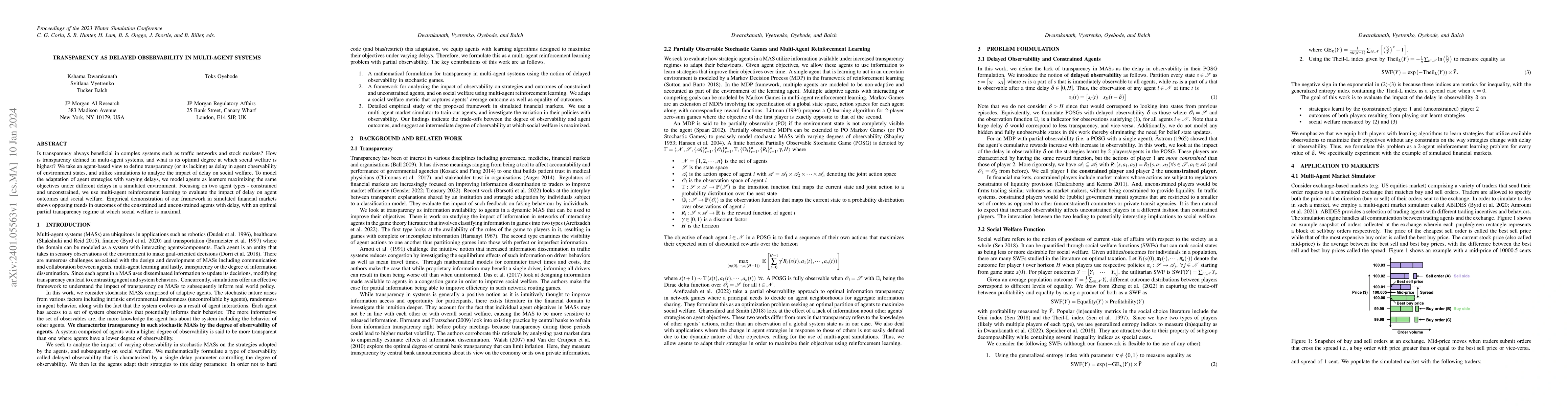

Transparency as Delayed Observability in Multi-Agent Systems

Is transparency always beneficial in complex systems such as traffic networks and stock markets? How is transparency defined in multi-agent systems, and what is its optimal degree at which social we...

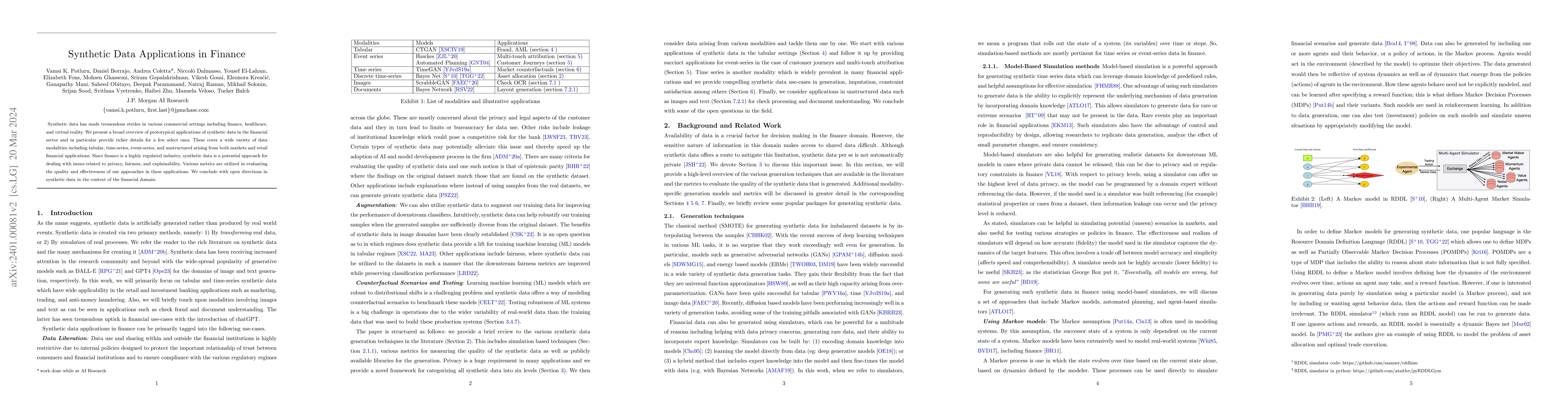

Synthetic Data Applications in Finance

Synthetic data has made tremendous strides in various commercial settings including finance, healthcare, and virtual reality. We present a broad overview of prototypical applications of synthetic da...

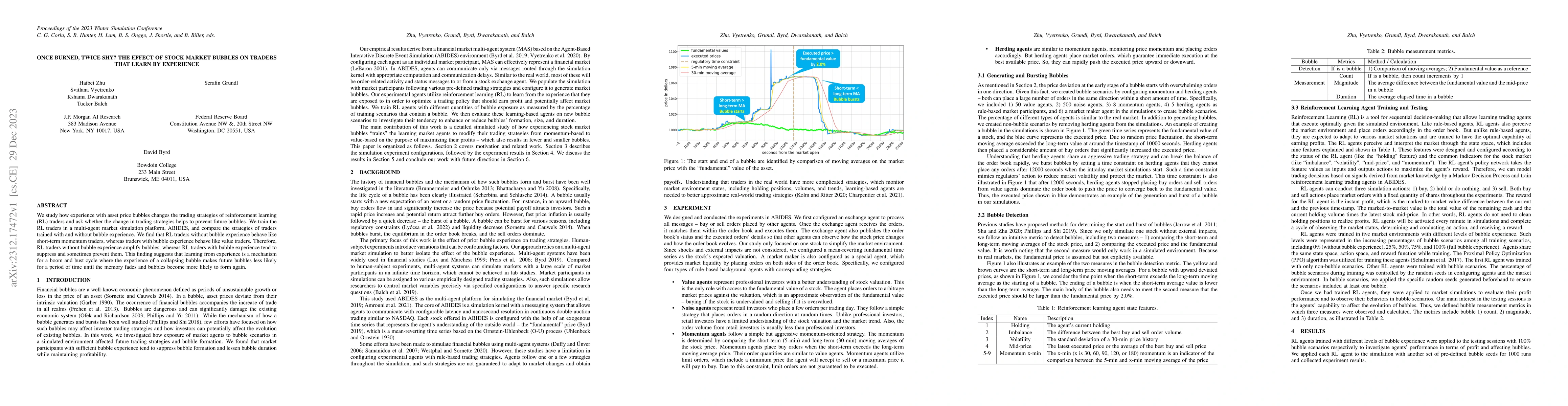

Once Burned, Twice Shy? The Effect of Stock Market Bubbles on Traders that Learn by Experience

We study how experience with asset price bubbles changes the trading strategies of reinforcement learning (RL) traders and ask whether the change in trading strategies helps to prevent future bubble...

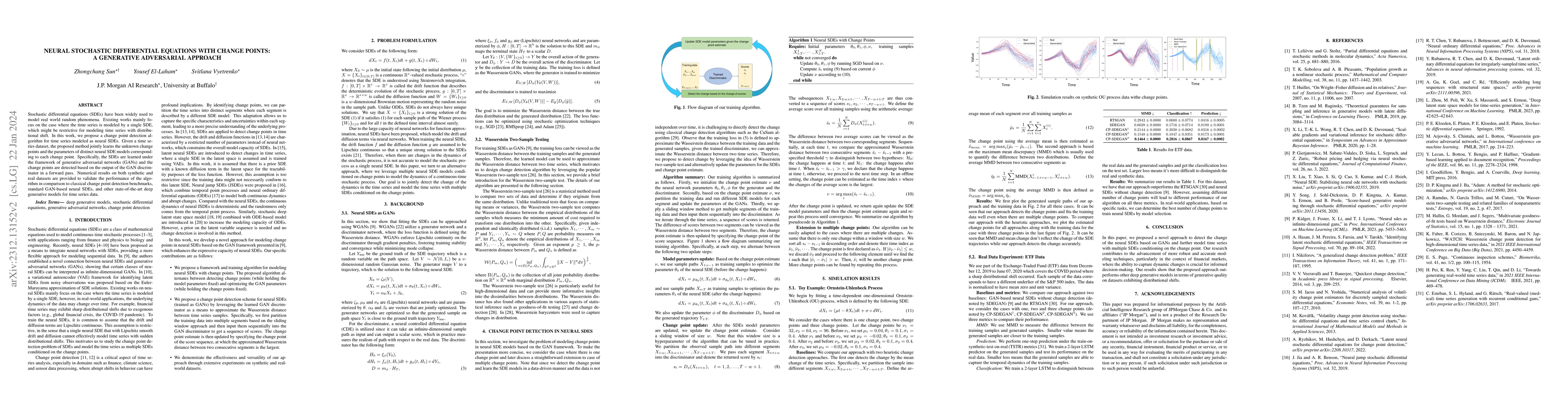

Neural Stochastic Differential Equations with Change Points: A Generative Adversarial Approach

Stochastic differential equations (SDEs) have been widely used to model real world random phenomena. Existing works mainly focus on the case where the time series is modeled by a single SDE, which m...

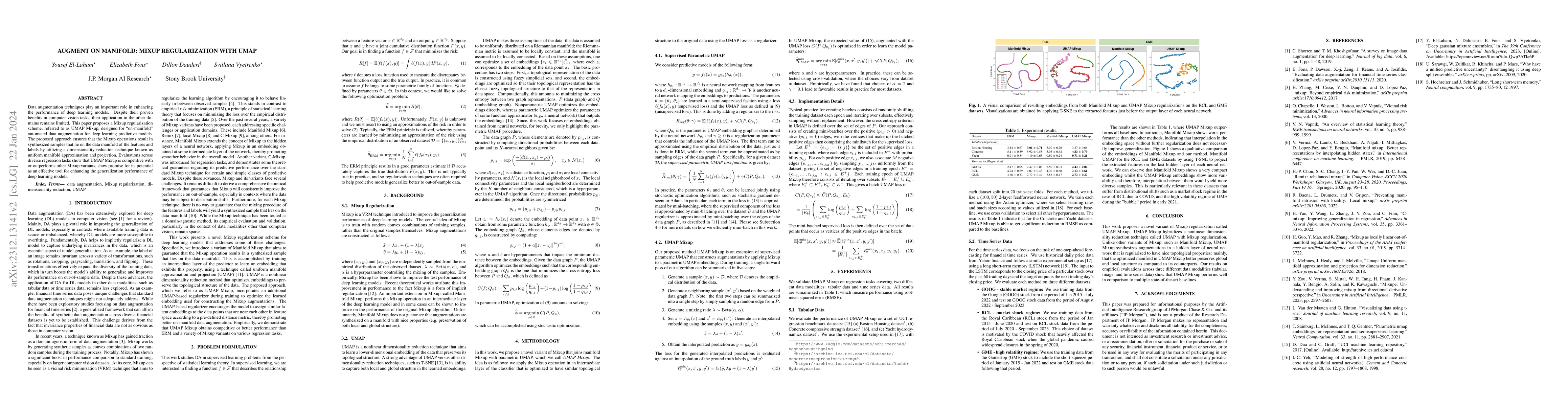

Augment on Manifold: Mixup Regularization with UMAP

Data augmentation techniques play an important role in enhancing the performance of deep learning models. Despite their proven benefits in computer vision tasks, their application in the other domai...

Analyzing the Impact of Tax Credits on Households in Simulated Economic Systems with Learning Agents

In economic modeling, there has been an increasing investigation into multi-agent simulators. Nevertheless, state-of-the-art studies establish the model based on reinforcement learning (RL) exclusiv...

A Model-Based Synthetic Stock Price Time Series Generation Framework

The Ornstein-Uhlenbeck (OU) process, a mean-reverting stochastic process, has been widely applied as a time series model in various domains. This paper describes the design and implementation of a m...

Multi-Modal Financial Time-Series Retrieval Through Latent Space Projections

Financial firms commonly process and store billions of time-series data, generated continuously and at a high frequency. To support efficient data storage and retrieval, specialized time-series data...

INTAGS: Interactive Agent-Guided Simulation

In many applications involving multi-agent system (MAS), it is imperative to test an experimental (Exp) autonomous agent in a high-fidelity simulator prior to its deployment to production, to avoid ...

LOB-Based Deep Learning Models for Stock Price Trend Prediction: A Benchmark Study

The recent advancements in Deep Learning (DL) research have notably influenced the finance sector. We examine the robustness and generalizability of fifteen state-of-the-art DL models focusing on St...

On the Constrained Time-Series Generation Problem

Synthetic time series are often used in practical applications to augment the historical time series dataset for better performance of machine learning algorithms, amplify the occurrence of rare eve...

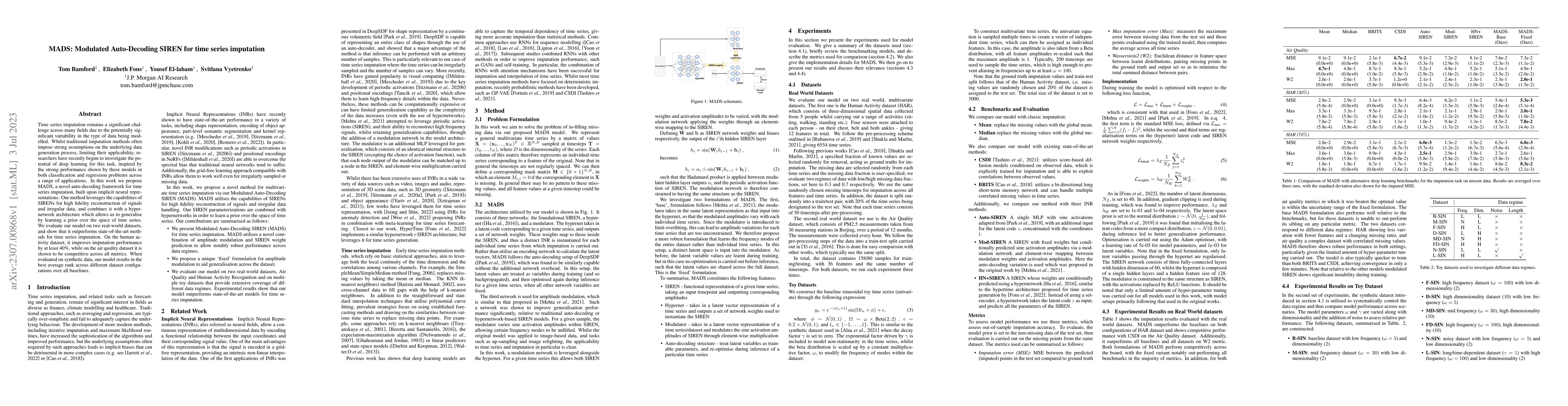

MADS: Modulated Auto-Decoding SIREN for time series imputation

Time series imputation remains a significant challenge across many fields due to the potentially significant variability in the type of data being modelled. Whilst traditional imputation methods oft...

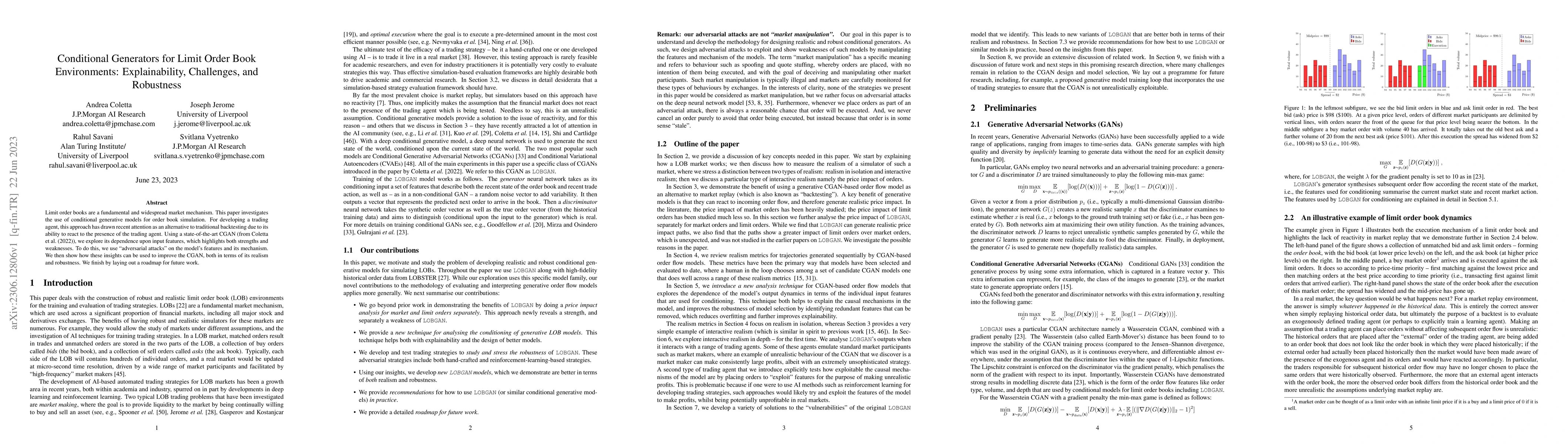

Conditional Generators for Limit Order Book Environments: Explainability, Challenges, and Robustness

Limit order books are a fundamental and widespread market mechanism. This paper investigates the use of conditional generative models for order book simulation. For developing a trading agent, this ...

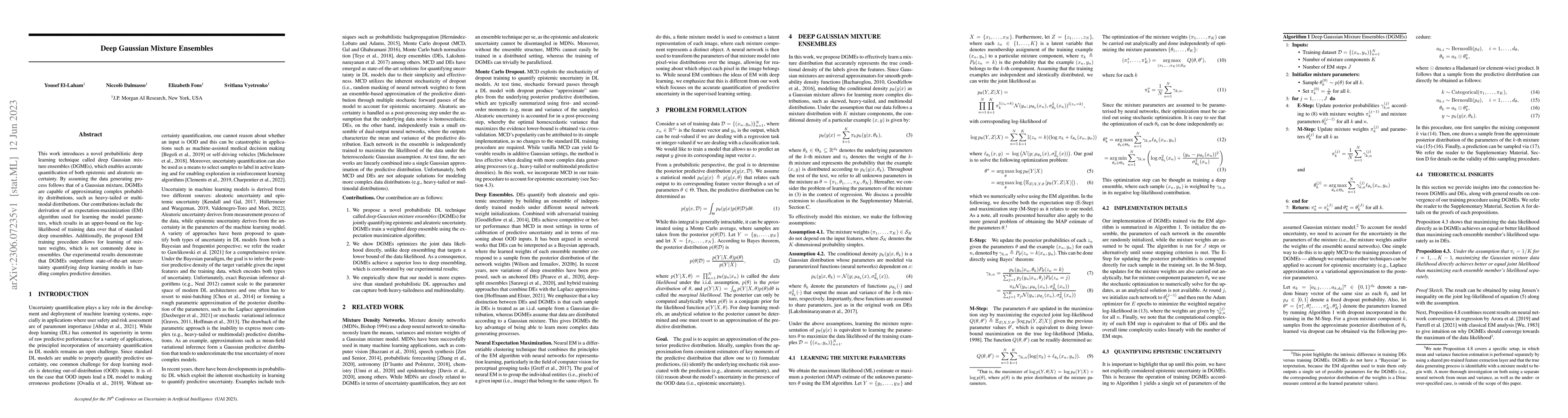

Deep Gaussian Mixture Ensembles

This work introduces a novel probabilistic deep learning technique called deep Gaussian mixture ensembles (DGMEs), which enables accurate quantification of both epistemic and aleatoric uncertainty. ...

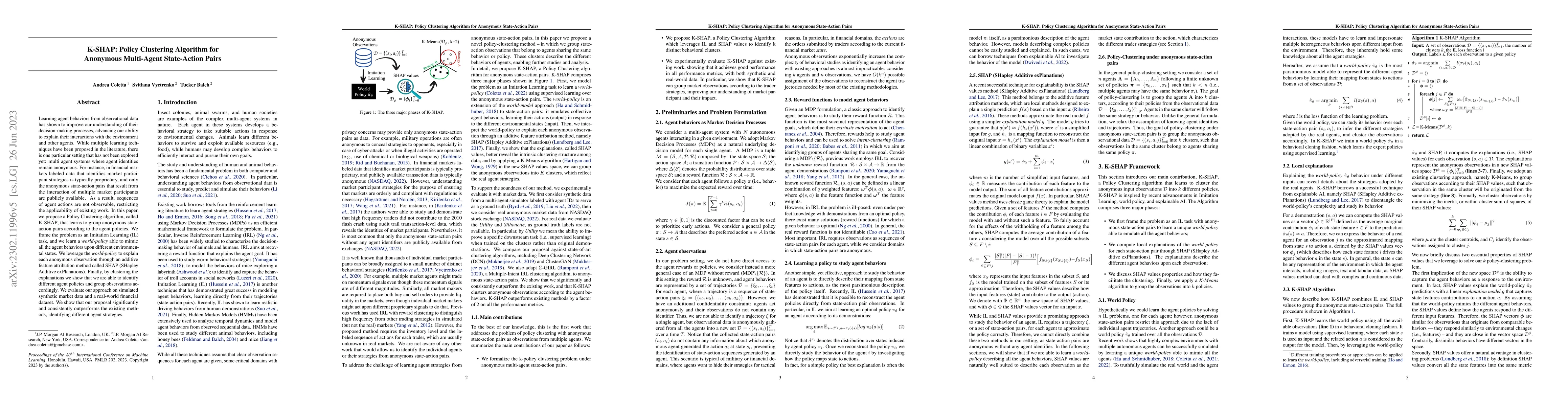

K-SHAP: Policy Clustering Algorithm for Anonymous Multi-Agent State-Action Pairs

Learning agent behaviors from observational data has shown to improve our understanding of their decision-making processes, advancing our ability to explain their interactions with the environment a...

DSLOB: A Synthetic Limit Order Book Dataset for Benchmarking Forecasting Algorithms under Distributional Shift

In electronic trading markets, limit order books (LOBs) provide information about pending buy/sell orders at various price levels for a given security. Recently, there has been a growing interest in...

Learning to simulate realistic limit order book markets from data as a World Agent

Multi-agent market simulators usually require careful calibration to emulate real markets, which includes the number and the type of agents. Poorly calibrated simulators can lead to misleading concl...

StyleTime: Style Transfer for Synthetic Time Series Generation

Neural style transfer is a powerful computer vision technique that can incorporate the artistic "style" of one image to the "content" of another. The underlying theory behind the approach relies on ...

HyperTime: Implicit Neural Representation for Time Series

Implicit neural representations (INRs) have recently emerged as a powerful tool that provides an accurate and resolution-independent encoding of data. Their robustness as general approximators has b...

Efficient Calibration of Multi-Agent Simulation Models from Output Series with Bayesian Optimization

Multi-agent simulation is commonly used across multiple disciplines, specifically in artificial intelligence in recent years, which creates an environment for downstream machine learning or reinforc...

ABIDES-Gym: Gym Environments for Multi-Agent Discrete Event Simulation and Application to Financial Markets

Model-free Reinforcement Learning (RL) requires the ability to sample trajectories by taking actions in the original problem environment or a simulated version of it. Breakthroughs in the field of R...

Towards Realistic Market Simulations: a Generative Adversarial Networks Approach

Simulated environments are increasingly used by trading firms and investment banks to evaluate trading strategies before approaching real markets. Backtesting, a widely used approach, consists of si...

Variational Neural Stochastic Differential Equations with Change Points

In this work, we explore modeling change points in time-series data using neural stochastic differential equations (neural SDEs). We propose a novel model formulation and training procedure based on t...

Tax Credits and Household Behavior: The Roles of Myopic Decision-Making and Liquidity in a Simulated Economy

There has been a growing interest in multi-agent simulators in the domain of economic modeling. However, contemporary research often involves developing reinforcement learning (RL) based models that f...

Empirical Equilibria in Agent-based Economic systems with Learning agents

We present an agent-based simulator for economic systems with heterogeneous households, firms, central bank, and government agents. These agents interact to define production, consumption, and monetar...

LOB-Bench: Benchmarking Generative AI for Finance -- an Application to Limit Order Book Data

While financial data presents one of the most challenging and interesting sequence modelling tasks due to high noise, heavy tails, and strategic interactions, progress in this area has been hindered b...

Mixup Regularization: A Probabilistic Perspective

In recent years, mixup regularization has gained popularity as an effective way to improve the generalization performance of deep learning models by training on convex combinations of training data. W...

TADACap: Time-series Adaptive Domain-Aware Captioning

While image captioning has gained significant attention, the potential of captioning time-series images, prevalent in areas like finance and healthcare, remains largely untapped. Existing time-series ...

LSCD: Lomb-Scargle Conditioned Diffusion for Time series Imputation

Time series with missing or irregularly sampled data are a persistent challenge in machine learning. Many methods operate on the frequency-domain, relying on the Fast Fourier Transform (FFT) which ass...

Towards Interpretable Time Series Foundation Models

In this paper, we investigate the distillation of time series reasoning capabilities into small, instruction-tuned language models as a step toward building interpretable time series foundation models...

AI Analyst: Framework and Comprehensive Evaluation of Large Language Models for Financial Time Series Report Generation

This paper explores the potential of large language models (LLMs) to generate financial reports from time series data. We propose a framework encompassing prompt engineering, model selection, and eval...

Time-RA: Towards Time Series Reasoning for Anomaly with LLM Feedback

Time series anomaly detection is critical across various domains, yet current approaches often limit analysis to mere binary anomaly classification without detailed categorization or further explanato...

TS-Agent: A Time Series Reasoning Agent with Iterative Statistical Insight Gathering

Large language models (LLMs) have shown strong abilities in reasoning and problem solving, but recent studies reveal that they still struggle with time series reasoning tasks, where outputs are often ...