Summary

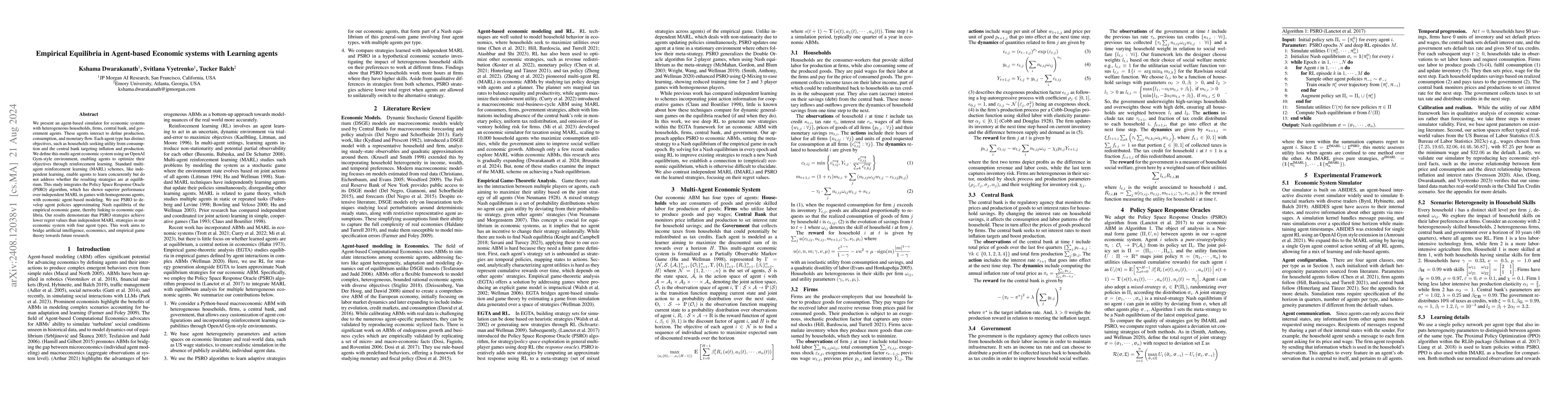

We present an agent-based simulator for economic systems with heterogeneous households, firms, central bank, and government agents. These agents interact to define production, consumption, and monetary flow. Each agent type has distinct objectives, such as households seeking utility from consumption and the central bank targeting inflation and production. We define this multi-agent economic system using an OpenAI Gym-style environment, enabling agents to optimize their objectives through reinforcement learning. Standard multi-agent reinforcement learning (MARL) schemes, like independent learning, enable agents to learn concurrently but do not address whether the resulting strategies are at equilibrium. This study integrates the Policy Space Response Oracle (PSRO) algorithm, which has shown superior performance over independent MARL in games with homogeneous agents, with economic agent-based modeling. We use PSRO to develop agent policies approximating Nash equilibria of the empirical economic game, thereby linking to economic equilibria. Our results demonstrate that PSRO strategies achieve lower regret values than independent MARL strategies in our economic system with four agent types. This work aims to bridge artificial intelligence, economics, and empirical game theory towards future research.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersABIDES-Economist: Agent-Based Simulation of Economic Systems with Learning Agents

Tucker Balch, Svitlana Vyetrenko, Kshama Dwarakanath et al.

No citations found for this paper.

Comments (0)