Tucker Balch

53 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

LETS-C: Leveraging Language Embedding for Time Series Classification

Recent advancements in language modeling have shown promising results when applied to time series data. In particular, fine-tuning pre-trained large language models (LLMs) for time series classificati...

HiddenTables & PyQTax: A Cooperative Game and Dataset For TableQA to Ensure Scale and Data Privacy Across a Myriad of Taxonomies

A myriad of different Large Language Models (LLMs) face a common challenge in contextually analyzing table question-answering tasks. These challenges are engendered from (1) finite context windows f...

Evaluating Large Language Models on Time Series Feature Understanding: A Comprehensive Taxonomy and Benchmark

Large Language Models (LLMs) offer the potential for automatic time series analysis and reporting, which is a critical task across many domains, spanning healthcare, finance, climate, energy, and ma...

FlowMind: Automatic Workflow Generation with LLMs

The rapidly evolving field of Robotic Process Automation (RPA) has made significant strides in automating repetitive processes, yet its effectiveness diminishes in scenarios requiring spontaneous or...

Atlas-X Equity Financing: Unlocking New Methods to Securely Obfuscate Axe Inventory Data Based on Differential Privacy

Banks publish daily a list of available securities/assets (axe list) to selected clients to help them effectively locate Long (buy) or Short (sell) trades at reduced financing rates. This reduces co...

Six Levels of Privacy: A Framework for Financial Synthetic Data

Synthetic Data is increasingly important in financial applications. In addition to the benefits it provides, such as improved financial modeling and better testing procedures, it poses privacy risks...

From Pixels to Predictions: Spectrogram and Vision Transformer for Better Time Series Forecasting

Time series forecasting plays a crucial role in decision-making across various domains, but it presents significant challenges. Recent studies have explored image-driven approaches using computer vi...

ABIDES-Economist: Agent-Based Simulation of Economic Systems with Learning Agents

We introduce a multi-agent simulator for economic systems comprised of heterogeneous Households, heterogeneous Firms, Central Bank and Government agents, that could be subjected to exogenous, stocha...

LLM-driven Imitation of Subrational Behavior : Illusion or Reality?

Modeling subrational agents, such as humans or economic households, is inherently challenging due to the difficulty in calibrating reinforcement learning models or collecting data that involves huma...

Transparency as Delayed Observability in Multi-Agent Systems

Is transparency always beneficial in complex systems such as traffic networks and stock markets? How is transparency defined in multi-agent systems, and what is its optimal degree at which social we...

Downstream Task-Oriented Generative Model Selections on Synthetic Data Training for Fraud Detection Models

Devising procedures for downstream task-oriented generative model selections is an unresolved problem of practical importance. Existing studies focused on the utility of a single family of generativ...

Synthetic Data Applications in Finance

Synthetic data has made tremendous strides in various commercial settings including finance, healthcare, and virtual reality. We present a broad overview of prototypical applications of synthetic da...

Once Burned, Twice Shy? The Effect of Stock Market Bubbles on Traders that Learn by Experience

We study how experience with asset price bubbles changes the trading strategies of reinforcement learning (RL) traders and ask whether the change in trading strategies helps to prevent future bubble...

Fair Wasserstein Coresets

Data distillation and coresets have emerged as popular approaches to generate a smaller representative set of samples for downstream learning tasks to handle large-scale datasets. At the same time, ...

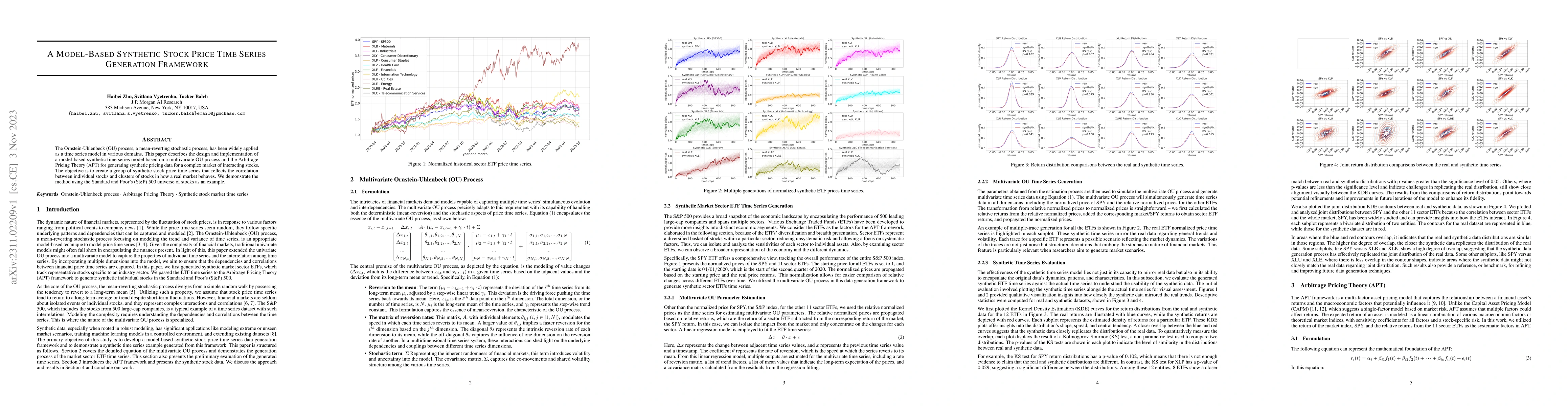

A Model-Based Synthetic Stock Price Time Series Generation Framework

The Ornstein-Uhlenbeck (OU) process, a mean-reverting stochastic process, has been widely applied as a time series model in various domains. This paper describes the design and implementation of a m...

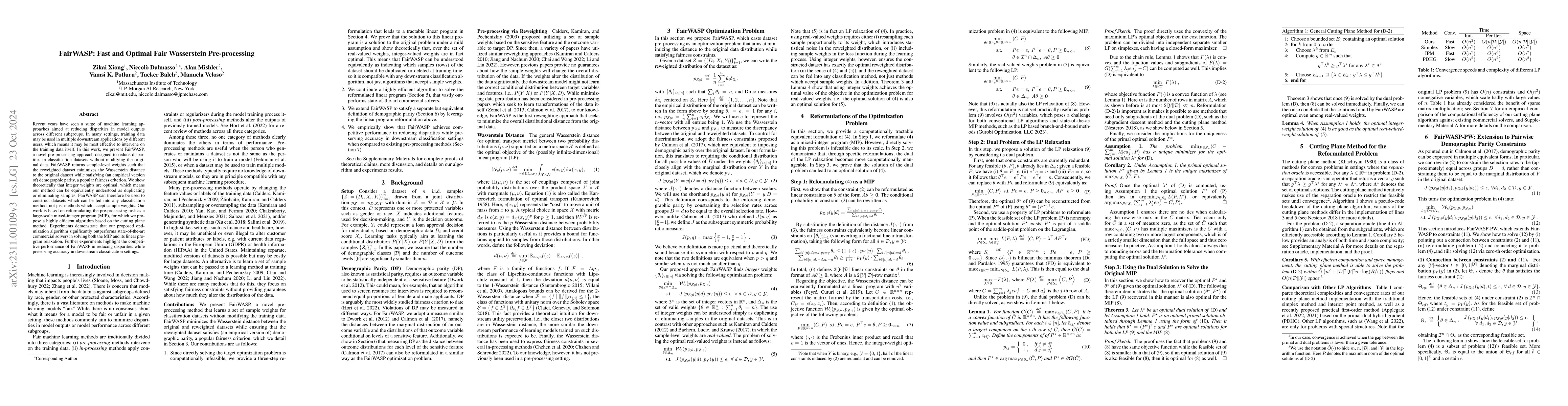

FairWASP: Fast and Optimal Fair Wasserstein Pre-processing

Recent years have seen a surge of machine learning approaches aimed at reducing disparities in model outputs across different subgroups. In many settings, training data may be used in multiple downs...

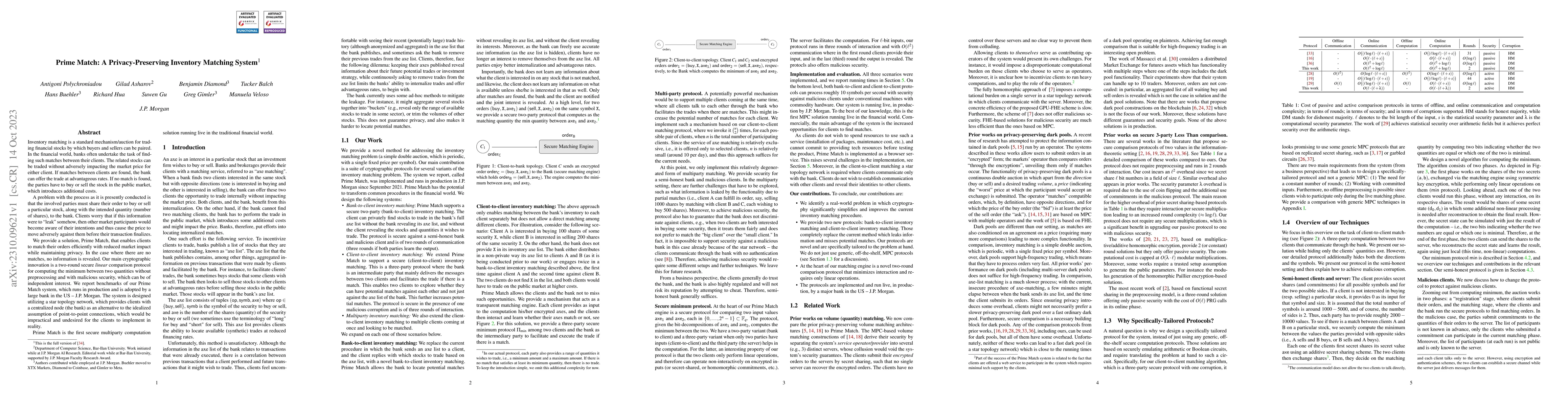

Prime Match: A Privacy-Preserving Inventory Matching System

Inventory matching is a standard mechanism/auction for trading financial stocks by which buyers and sellers can be paired. In the financial world, banks often undertake the task of finding such matc...

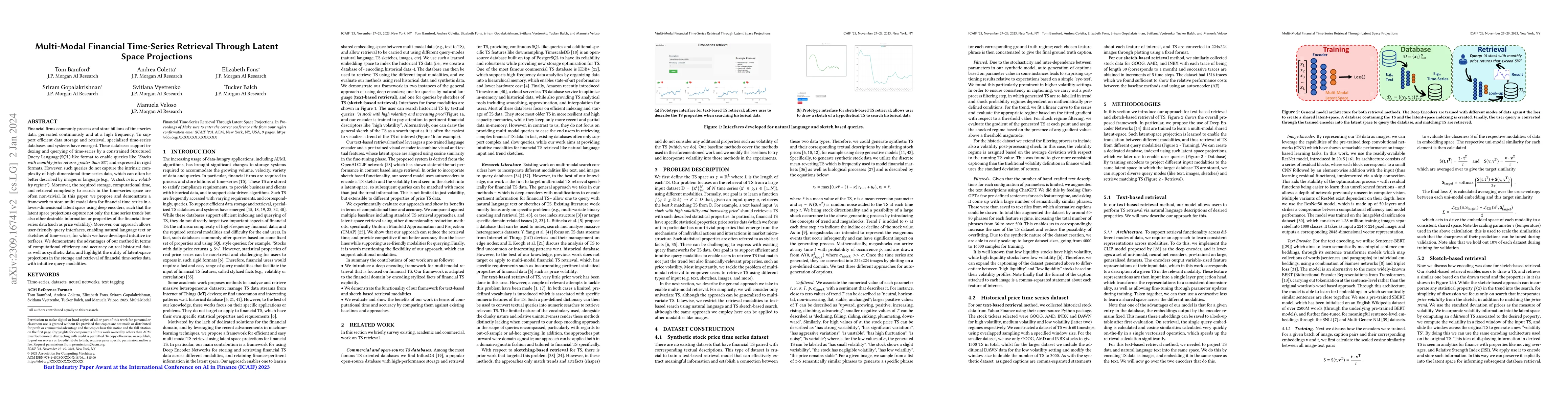

Multi-Modal Financial Time-Series Retrieval Through Latent Space Projections

Financial firms commonly process and store billions of time-series data, generated continuously and at a high frequency. To support efficient data storage and retrieval, specialized time-series data...

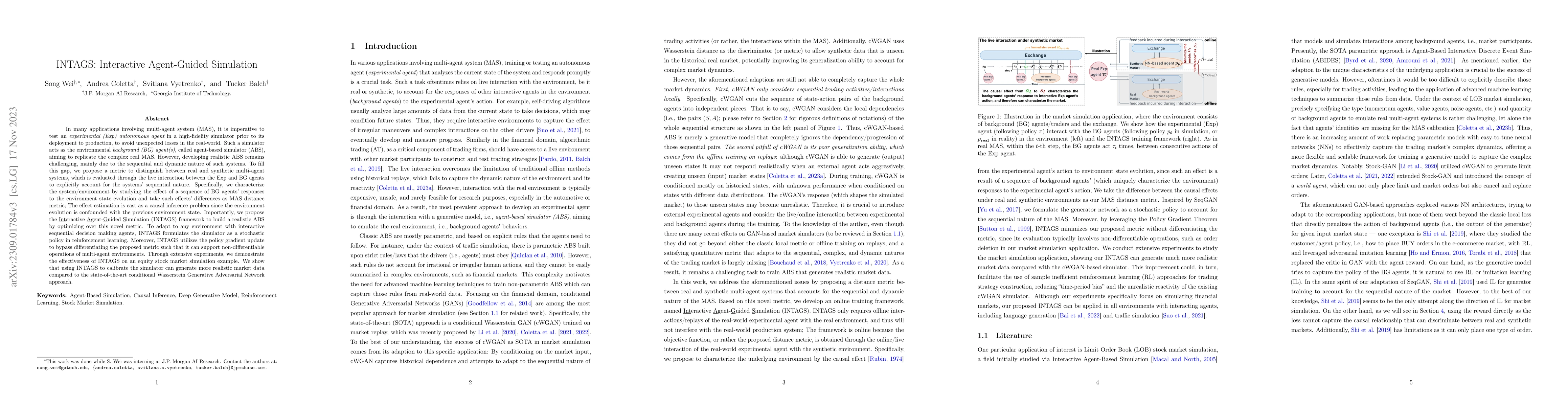

INTAGS: Interactive Agent-Guided Simulation

In many applications involving multi-agent system (MAS), it is imperative to test an experimental (Exp) autonomous agent in a high-fidelity simulator prior to its deployment to production, to avoid ...

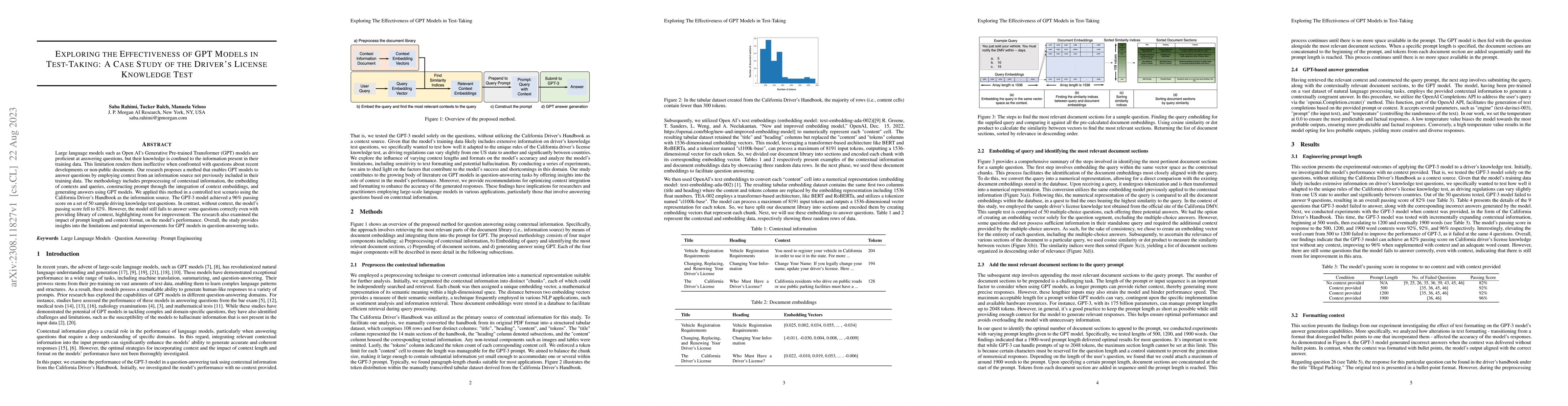

Exploring the Effectiveness of GPT Models in Test-Taking: A Case Study of the Driver's License Knowledge Test

Large language models such as Open AI's Generative Pre-trained Transformer (GPT) models are proficient at answering questions, but their knowledge is confined to the information present in their tra...

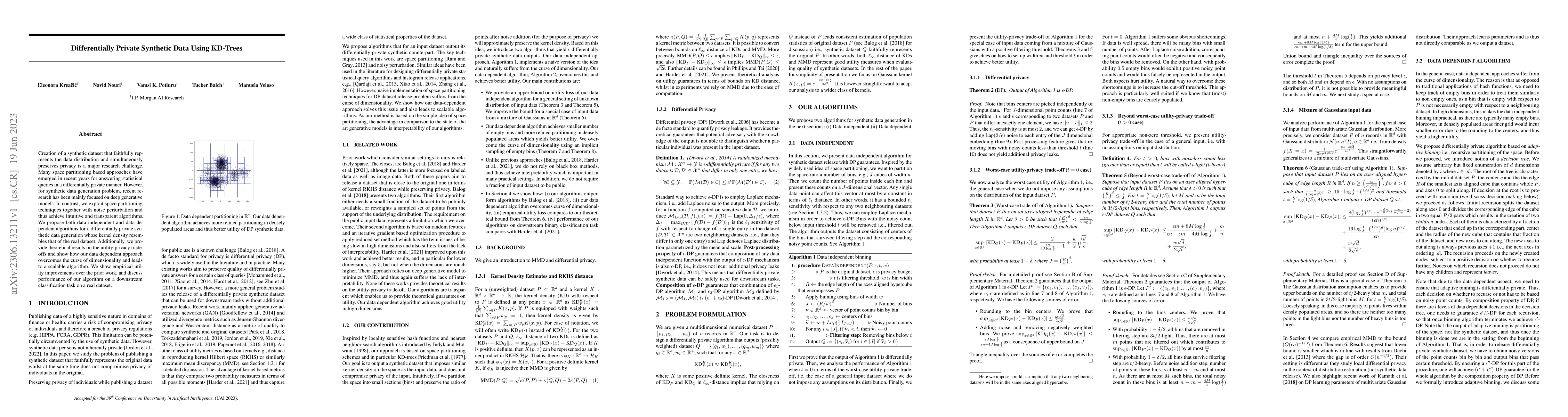

Differentially Private Synthetic Data Using KD-Trees

Creation of a synthetic dataset that faithfully represents the data distribution and simultaneously preserves privacy is a major research challenge. Many space partitioning based approaches have eme...

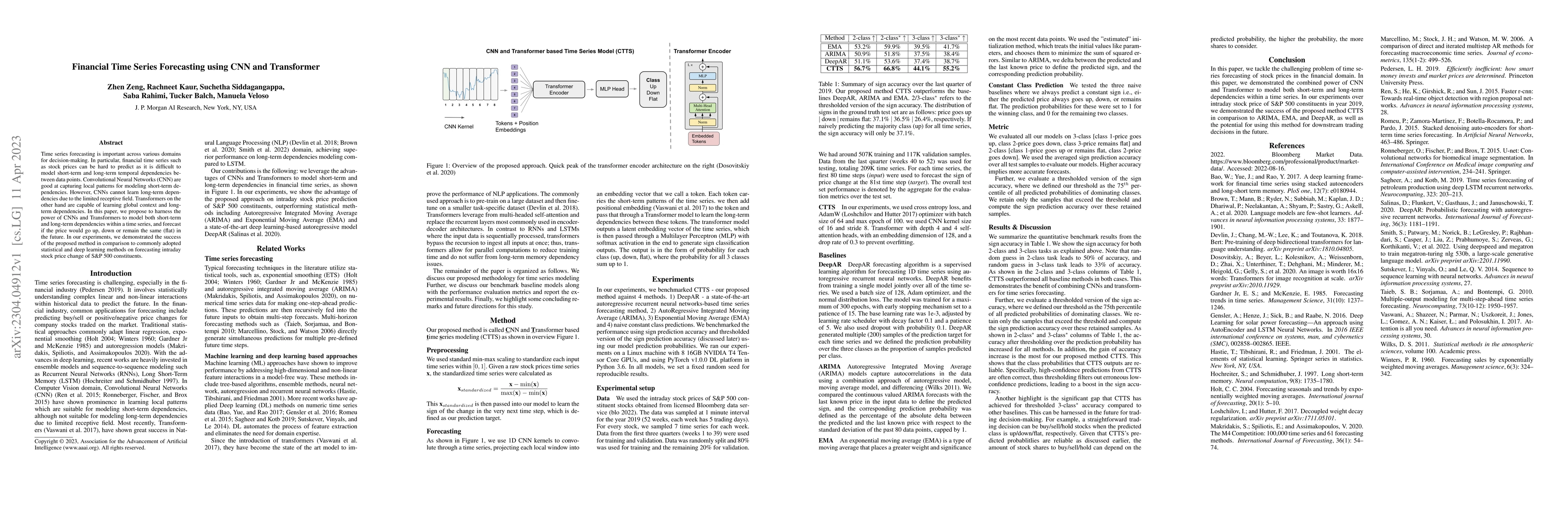

Financial Time Series Forecasting using CNN and Transformer

Time series forecasting is important across various domains for decision-making. In particular, financial time series such as stock prices can be hard to predict as it is difficult to model short-te...

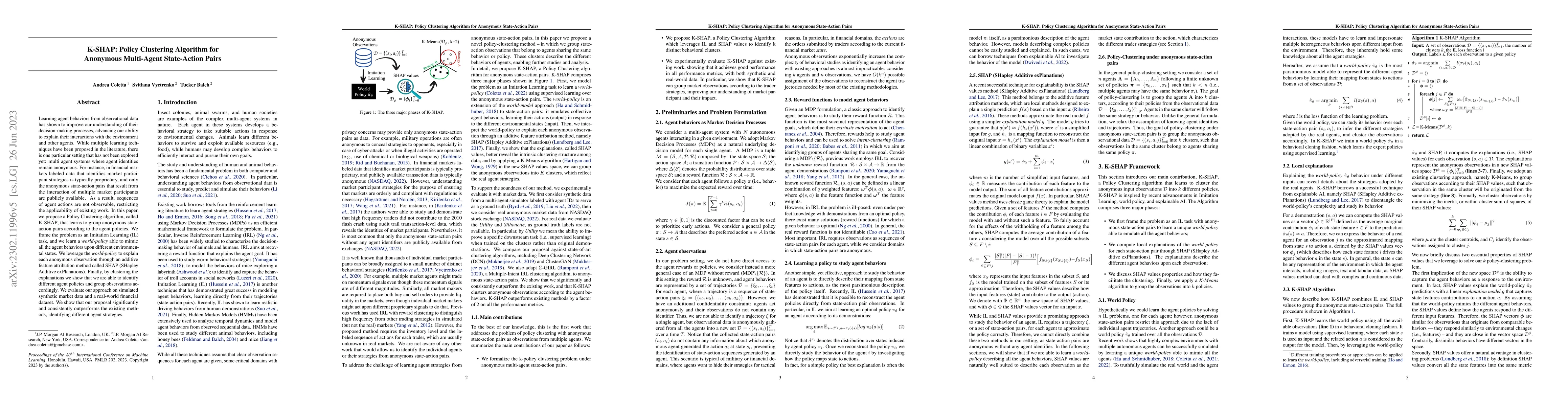

K-SHAP: Policy Clustering Algorithm for Anonymous Multi-Agent State-Action Pairs

Learning agent behaviors from observational data has shown to improve our understanding of their decision-making processes, advancing our ability to explain their interactions with the environment a...

Fast Learning of Multidimensional Hawkes Processes via Frank-Wolfe

Hawkes processes have recently risen to the forefront of tools when it comes to modeling and generating sequential events data. Multidimensional Hawkes processes model both the self and cross-excita...

Learning to simulate realistic limit order book markets from data as a World Agent

Multi-agent market simulators usually require careful calibration to emulate real markets, which includes the number and the type of agents. Poorly calibrated simulators can lead to misleading concl...

Limited or Biased: Modeling Sub-Rational Human Investors in Financial Markets

Human decision-making in real-life deviates significantly from the optimal decisions made by fully rational agents, primarily due to computational limitations or psychological biases. While existing...

Towards Multi-Agent Reinforcement Learning driven Over-The-Counter Market Simulations

We study a game between liquidity provider and liquidity taker agents interacting in an over-the-counter market, for which the typical example is foreign exchange. We show how a suitable design of p...

Equitable Marketplace Mechanism Design

We consider a trading marketplace that is populated by traders with diverse trading strategies and objectives. The marketplace allows the suppliers to list their goods and facilitates matching betwe...

Optimal Stopping with Gaussian Processes

We propose a novel group of Gaussian Process based algorithms for fast approximate optimal stopping of time series with specific applications to financial markets. We show that structural properties...

Online Learning for Mixture of Multivariate Hawkes Processes

Online learning of Hawkes processes has received increasing attention in the last couple of years especially for modeling a network of actors. However, these works typically either model the rich in...

Differentially Private Learning of Hawkes Processes

Hawkes processes have recently gained increasing attention from the machine learning community for their versatility in modeling event sequence data. While they have a rich history going back decade...

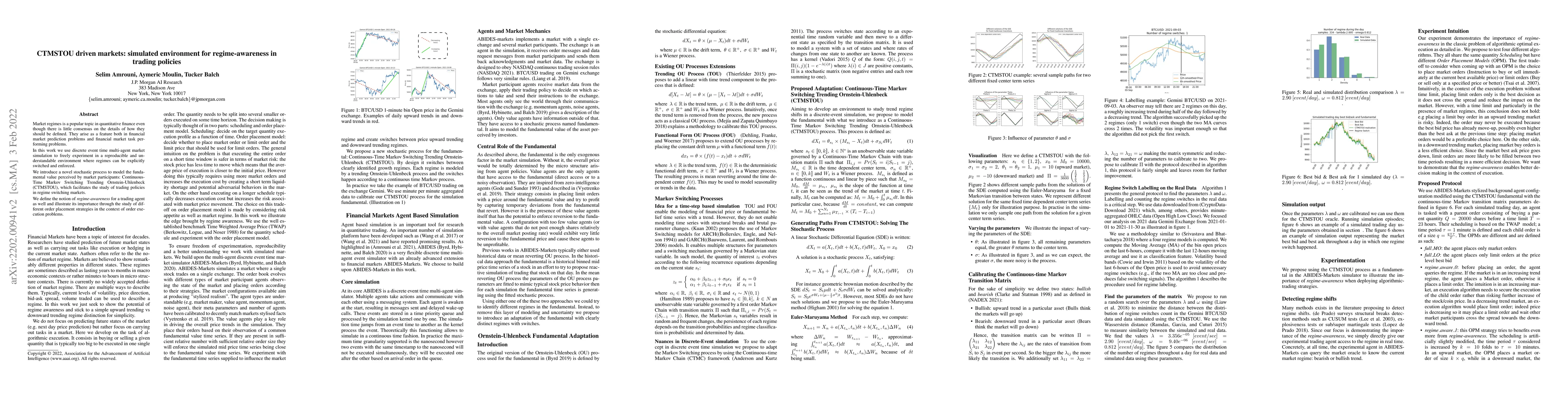

CTMSTOU driven markets: simulated environment for regime-awareness in trading policies

Market regimes is a popular topic in quantitative finance even though there is little consensus on the details of how they should be defined. They arise as a feature both in financial market predict...

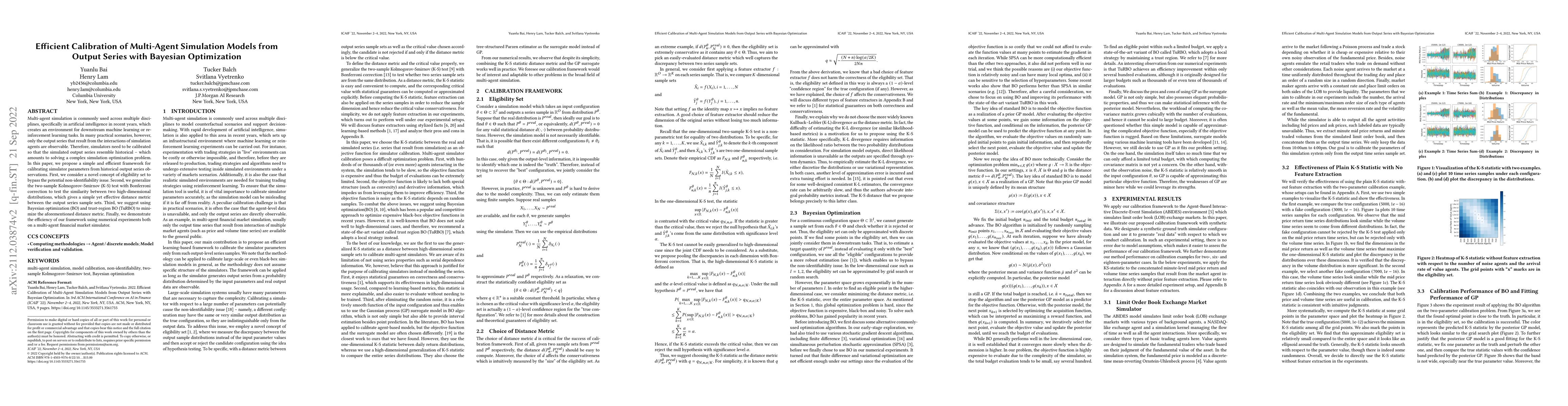

Efficient Calibration of Multi-Agent Simulation Models from Output Series with Bayesian Optimization

Multi-agent simulation is commonly used across multiple disciplines, specifically in artificial intelligence in recent years, which creates an environment for downstream machine learning or reinforc...

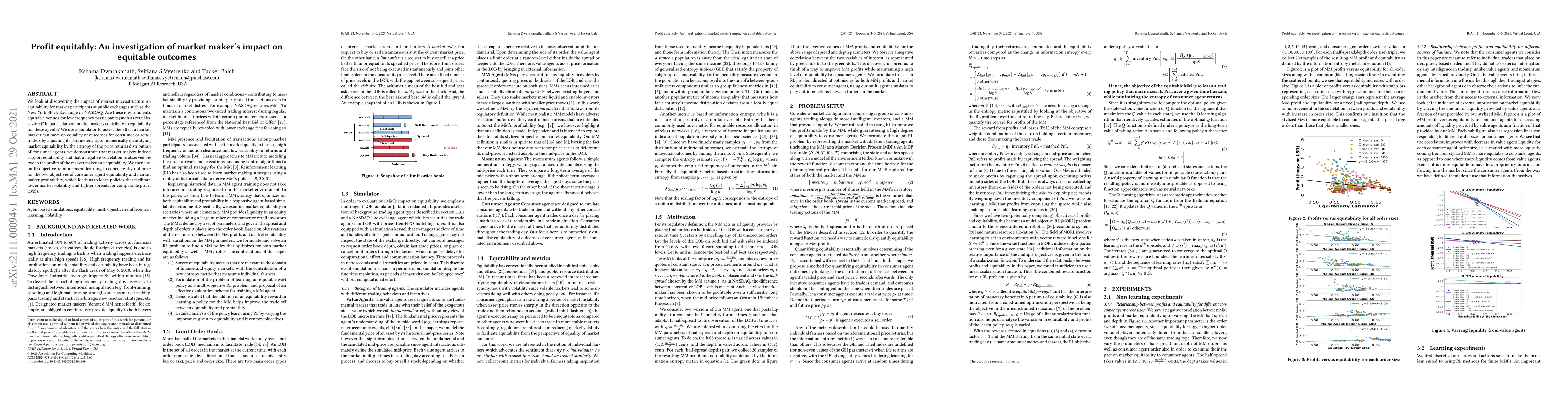

Profit equitably: An investigation of market maker's impact on equitable outcomes

We look at discovering the impact of market microstructure on equitability for market participants at public exchanges such as the New York Stock Exchange or NASDAQ. Are these environments equitable...

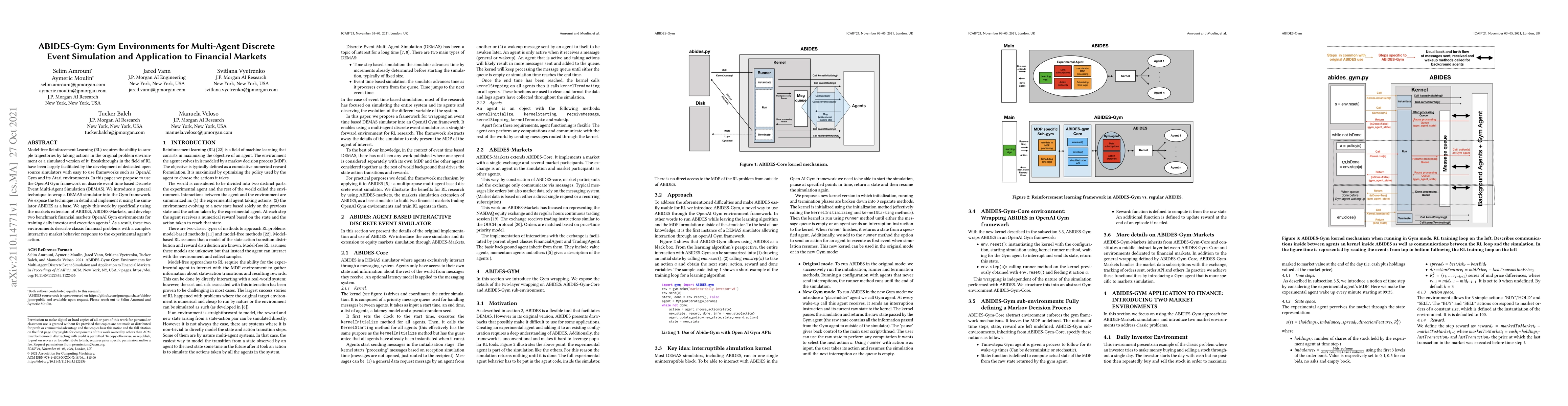

ABIDES-Gym: Gym Environments for Multi-Agent Discrete Event Simulation and Application to Financial Markets

Model-free Reinforcement Learning (RL) requires the ability to sample trajectories by taking actions in the original problem environment or a simulated version of it. Breakthroughs in the field of R...

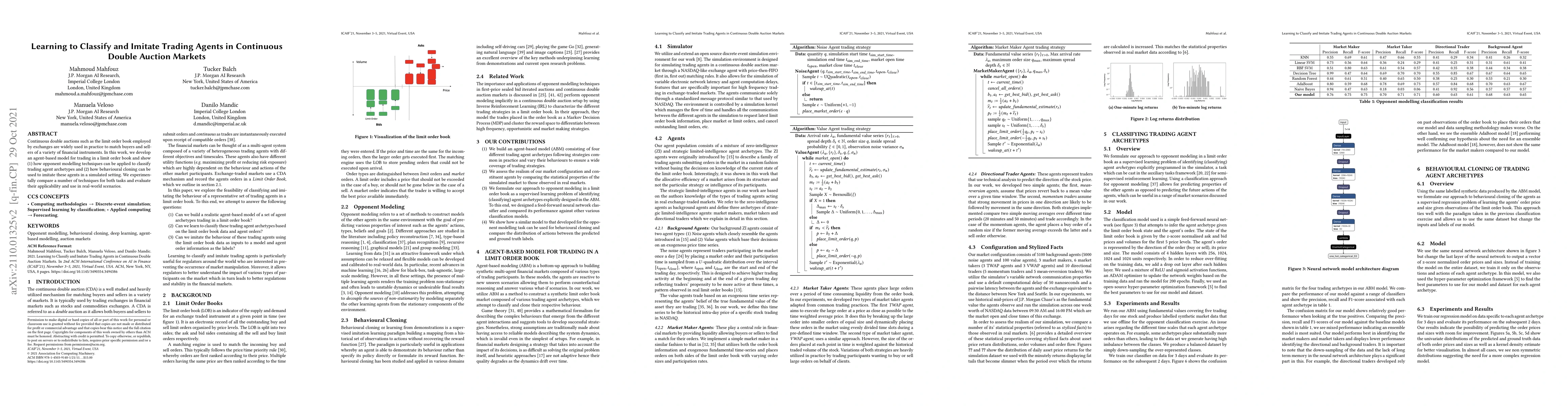

Towards Realistic Market Simulations: a Generative Adversarial Networks Approach

Simulated environments are increasingly used by trading firms and investment banks to evaluate trading strategies before approaching real markets. Backtesting, a widely used approach, consists of si...

Learning to Classify and Imitate Trading Agents in Continuous Double Auction Markets

Continuous double auctions such as the limit order book employed by exchanges are widely used in practice to match buyers and sellers of a variety of financial instruments. In this work, we develop ...

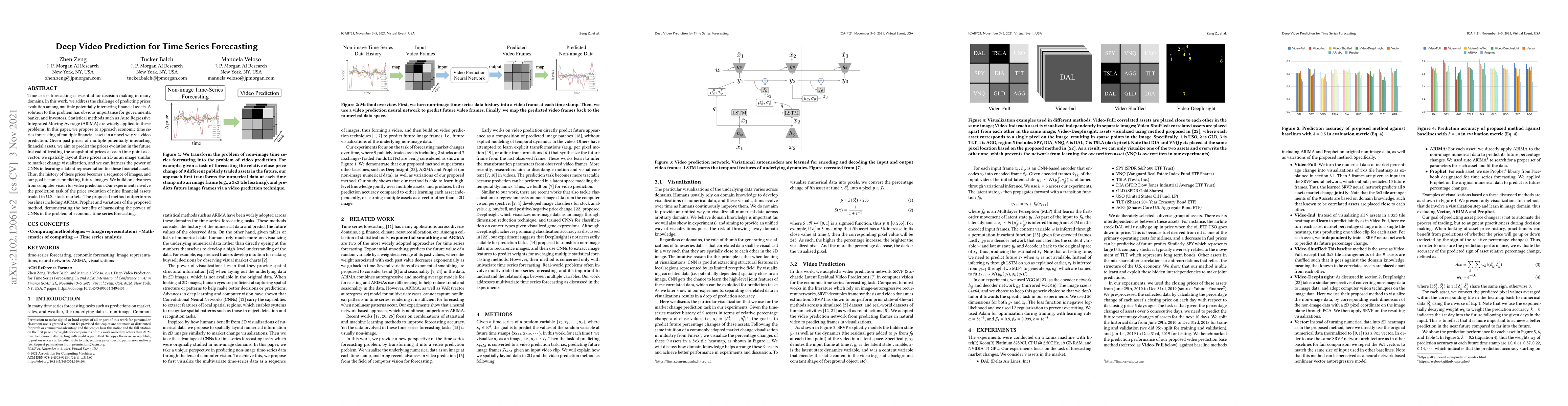

Visual Time Series Forecasting: An Image-driven Approach

In this work, we address time-series forecasting as a computer vision task. We capture input data as an image and train a model to produce the subsequent image. This approach results in predicting d...

Deep Video Prediction for Time Series Forecasting

Time series forecasting is essential for decision making in many domains. In this work, we address the challenge of predicting prices evolution among multiple potentially interacting financial asset...

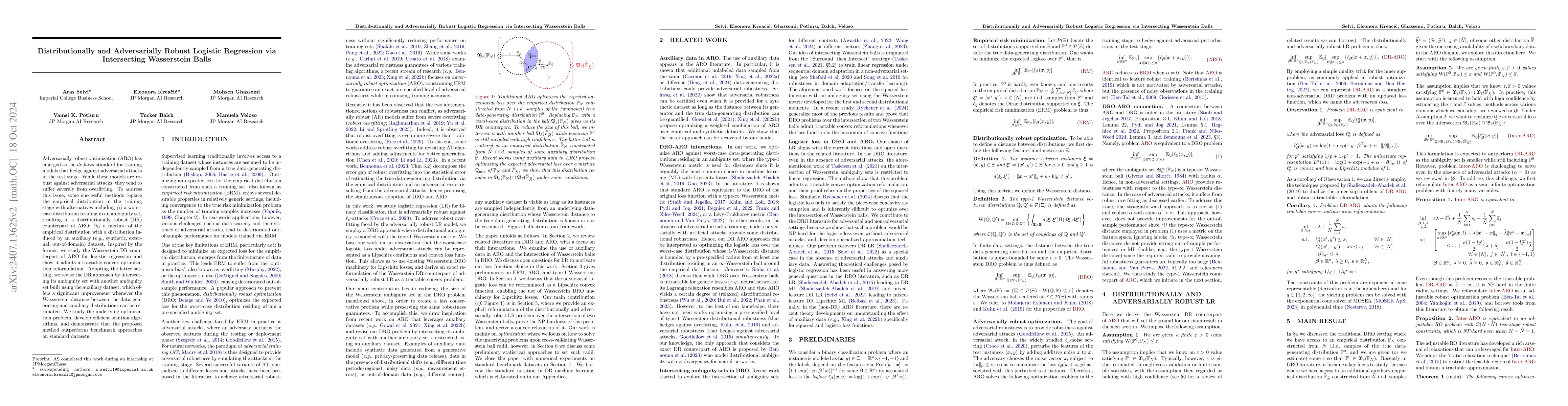

Distributionally and Adversarially Robust Logistic Regression via Intersecting Wasserstein Balls

Empirical risk minimization often fails to provide robustness against adversarial attacks in test data, causing poor out-of-sample performance. Adversarially robust optimization (ARO) has thus emerged...

Ensemble Methods for Sequence Classification with Hidden Markov Models

We present a lightweight approach to sequence classification using Ensemble Methods for Hidden Markov Models (HMMs). HMMs offer significant advantages in scenarios with imbalanced or smaller datasets ...

AI versus AI in Financial Crimes and Detection: GenAI Crime Waves to Co-Evolutionary AI

Adoption of AI by criminal entities across traditional and emerging financial crime paradigms has been a disturbing recent trend. Particularly concerning is the proliferation of generative AI, which h...

Auditing and Enforcing Conditional Fairness via Optimal Transport

Conditional demographic parity (CDP) is a measure of the demographic parity of a predictive model or decision process when conditioning on an additional feature or set of features. Many algorithmic fa...

Shining a Light on Hurricane Damage Estimation via Nighttime Light Data: Pre-processing Matters

Amidst escalating climate change, hurricanes are inflicting severe socioeconomic impacts, marked by heightened economic losses and increased displacement. Previous research utilized nighttime light da...

Behavioral Sequence Modeling with Ensemble Learning

We investigate the use of sequence analysis for behavior modeling, emphasizing that sequential context often outweighs the value of aggregate features in understanding human behavior. We discuss frami...

Variational Neural Stochastic Differential Equations with Change Points

In this work, we explore modeling change points in time-series data using neural stochastic differential equations (neural SDEs). We propose a novel model formulation and training procedure based on t...

AI in Investment Analysis: LLMs for Equity Stock Ratings

Investment Analysis is a cornerstone of the Financial Services industry. The rapid integration of advanced machine learning techniques, particularly Large Language Models (LLMs), offers opportunities ...

AdaptAgent: Adapting Multimodal Web Agents with Few-Shot Learning from Human Demonstrations

State-of-the-art multimodal web agents, powered by Multimodal Large Language Models (MLLMs), can autonomously execute many web tasks by processing user instructions and interacting with graphical user...

Empirical Equilibria in Agent-based Economic systems with Learning agents

We present an agent-based simulator for economic systems with heterogeneous households, firms, central bank, and government agents. These agents interact to define production, consumption, and monetar...

Visual Time Series Forecasting: An Image-driven Approach

Time series forecasting is essential for agents to make decisions. Traditional approaches rely on statistical methods to forecast given past numeric values. In practice, end-users often rely on visual...

LAW: Legal Agentic Workflows for Custody and Fund Services Contracts

Legal contracts in the custody and fund services domain govern critical aspects such as key provider responsibilities, fee schedules, and indemnification rights. However, it is challenging for an off-...

TADACap: Time-series Adaptive Domain-Aware Captioning

While image captioning has gained significant attention, the potential of captioning time-series images, prevalent in areas like finance and healthcare, remains largely untapped. Existing time-series ...

Is All the Information in the Price? LLM Embeddings versus the EMH in Stock Clustering

This paper investigates whether artificial intelligence can enhance stock clustering compared to traditional methods. We consider this in the context of the semi-strong Efficient Markets Hypothesis (E...