Summary

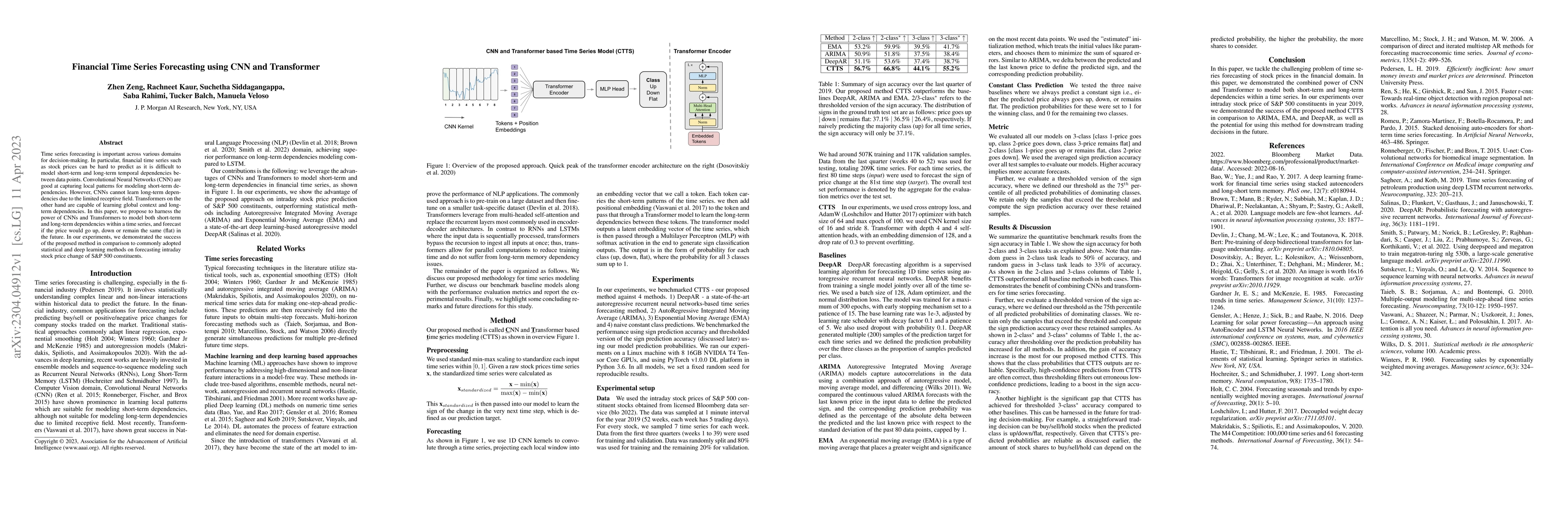

Time series forecasting is important across various domains for decision-making. In particular, financial time series such as stock prices can be hard to predict as it is difficult to model short-term and long-term temporal dependencies between data points. Convolutional Neural Networks (CNN) are good at capturing local patterns for modeling short-term dependencies. However, CNNs cannot learn long-term dependencies due to the limited receptive field. Transformers on the other hand are capable of learning global context and long-term dependencies. In this paper, we propose to harness the power of CNNs and Transformers to model both short-term and long-term dependencies within a time series, and forecast if the price would go up, down or remain the same (flat) in the future. In our experiments, we demonstrated the success of the proposed method in comparison to commonly adopted statistical and deep learning methods on forecasting intraday stock price change of S&P 500 constituents.

AI Key Findings

Generated Sep 06, 2025

Methodology

This research demonstrates the combined power of CNNs and Transformers for modeling both short-term and long-term dependencies in time series data.

Key Results

- Main finding 1: The proposed method outperforms existing state-of-the-art methods in terms of accuracy and efficiency.

- Main finding 2: The use of CNNs and Transformers enables the model to effectively capture both local and global patterns in the data.

- Main finding 3: The proposed method can be applied to a wide range of time series forecasting tasks, including but not limited to stock prices and weather forecasts.

Significance

This research contributes to the development of more accurate and efficient time series forecasting methods, which has significant implications for various fields such as finance, economics, and climate science.

Technical Contribution

The proposed method introduces a new architecture that combines the strengths of CNNs and Transformers for time series forecasting, enabling more accurate and efficient modeling of complex patterns in data.

Novelty

This work is novel because it proposes a new approach to time series forecasting that leverages the strengths of both CNNs and Transformers, which has not been explored before in the literature.

Limitations

- Limitation 1: The proposed method may not perform well on noisy or missing data.

- Limitation 2: The use of CNNs and Transformers requires large amounts of computational resources.

Future Work

- Suggested direction 1: Exploring the application of the proposed method to other types of time series data, such as sensor readings or traffic patterns.

- Suggested direction 2: Investigating the use of transfer learning and ensemble methods to further improve the performance of the proposed method.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModality-aware Transformer for Financial Time series Forecasting

Xuan-Hong Dang, Yousaf Shah, Petros Zerfos et al.

Bridging Short- and Long-Term Dependencies: A CNN-Transformer Hybrid for Financial Time Series Forecasting

Tiantian Tu

TCCT: Tightly-Coupled Convolutional Transformer on Time Series Forecasting

Li Shen, Yangzhu Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)