Summary

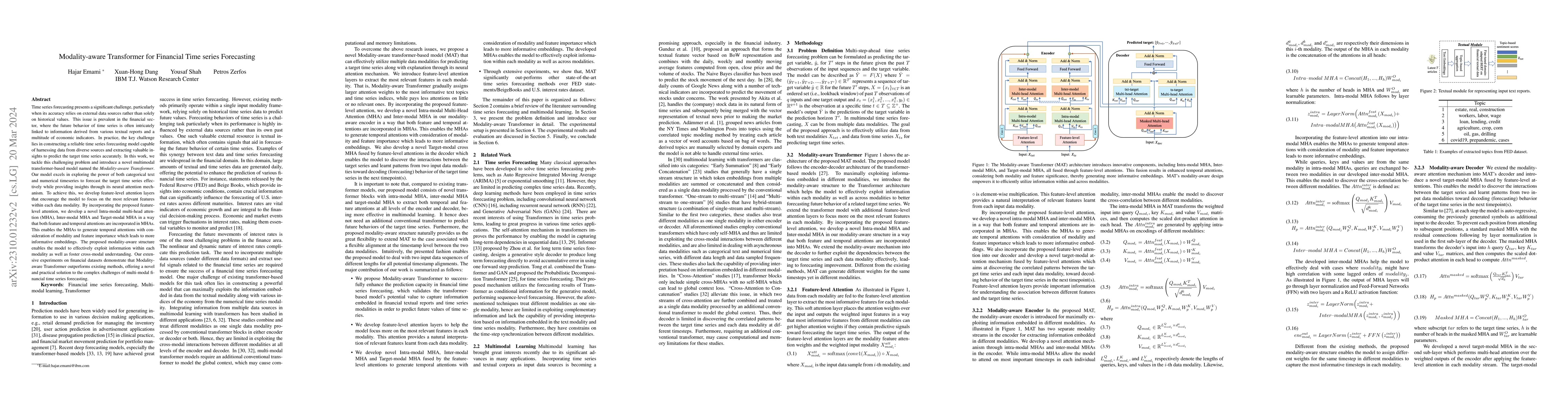

Time series forecasting presents a significant challenge, particularly when its accuracy relies on external data sources rather than solely on historical values. This issue is prevalent in the financial sector, where the future behavior of time series is often intricately linked to information derived from various textual reports and a multitude of economic indicators. In practice, the key challenge lies in constructing a reliable time series forecasting model capable of harnessing data from diverse sources and extracting valuable insights to predict the target time series accurately. In this work, we tackle this challenging problem and introduce a novel multimodal transformer-based model named the \textit{Modality-aware Transformer}. Our model excels in exploring the power of both categorical text and numerical timeseries to forecast the target time series effectively while providing insights through its neural attention mechanism. To achieve this, we develop feature-level attention layers that encourage the model to focus on the most relevant features within each data modality. By incorporating the proposed feature-level attention, we develop a novel Intra-modal multi-head attention (MHA), Inter-modal MHA and Target-modal MHA in a way that both feature and temporal attentions are incorporated in MHAs. This enables the MHAs to generate temporal attentions with consideration of modality and feature importance which leads to more informative embeddings. The proposed modality-aware structure enables the model to effectively exploit information within each modality as well as foster cross-modal understanding. Our extensive experiments on financial datasets demonstrate that Modality-aware Transformer outperforms existing methods, offering a novel and practical solution to the complex challenges of multi-modal financial time series forecasting.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper introduces the Modality-aware Transformer (MAT), a novel multimodal transformer-based model for financial time series forecasting. MAT incorporates feature-level attention layers, Intra-modal MHA, Inter-modal MHA, and Target-modal MHA, enabling the model to focus on relevant features within each data modality and foster cross-modal understanding.

Key Results

- MAT outperforms existing transformer-based time series forecasting methods (Transformer, Informer, Reformer, Autoformer) and a classical time series forecasting method (Elastic-Net) on U.S. interest rates datasets with varying maturities (2 years, 5 years, 10 years, and 30 years).

- The model demonstrates significant performance improvements, especially for long-term maturities, which are more challenging to model.

- MAT's flexibility in aligning data modalities at the time sample level contributes to superior forecasting performance compared to state-of-the-art methods.

- The model effectively harnesses information from individual modalities while facilitating cross-modality learning.

Significance

This research is significant as it presents a practical solution to the complex challenges of multi-modal financial time series forecasting, which is crucial for decision-making in the financial sector. The proposed Modality-aware Transformer (MAT) model can potentially advance the field of multimodal time series forecasting in domains where multimodal data sources are prevalent.

Technical Contribution

The key technical contribution of this work is the development of the Modality-aware Transformer (MAT), which incorporates feature-level attention layers and novel multi-head attention mechanisms (Intra-modal MHA, Inter-modal MHA, and Target-modal MHA) to effectively exploit information within each modality and foster cross-modal understanding.

Novelty

The novelty of this work lies in the introduction of a modality-aware transformer architecture that combines feature-level attention with Intra-modal, Inter-modal, and Target-modal multi-head attention mechanisms, enabling more informative embeddings and superior performance in financial time series forecasting compared to existing transformer-based methods.

Limitations

- The paper does not discuss potential limitations or challenges encountered during the model's development or evaluation.

- No specific limitations are explicitly mentioned in the provided content.

Future Work

- Explore the application of MAT in other domains with multimodal time series data, such as climate science or healthcare.

- Investigate the model's performance with additional data modalities or more diverse financial datasets.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Time Series Forecasting using CNN and Transformer

Manuela Veloso, Tucker Balch, Rachneet Kaur et al.

CAMEF: Causal-Augmented Multi-Modality Event-Driven Financial Forecasting by Integrating Time Series Patterns and Salient Macroeconomic Announcements

Yang Zhang, Jun Wang, Qiang Ma et al.

No citations found for this paper.

Comments (0)