Authors

Summary

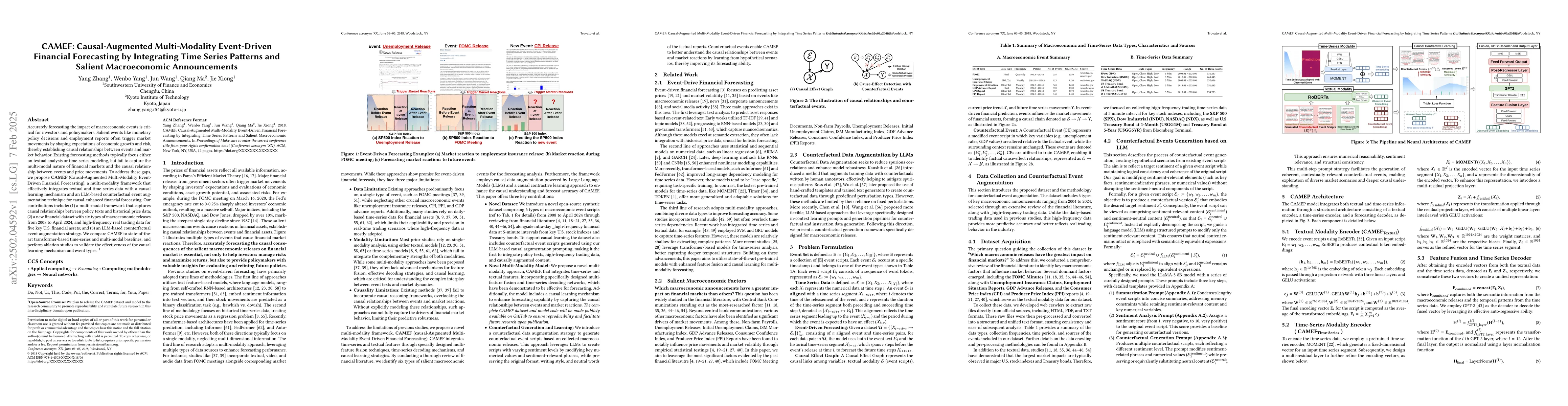

Accurately forecasting the impact of macroeconomic events is critical for investors and policymakers. Salient events like monetary policy decisions and employment reports often trigger market movements by shaping expectations of economic growth and risk, thereby establishing causal relationships between events and market behavior. Existing forecasting methods typically focus either on textual analysis or time-series modeling, but fail to capture the multi-modal nature of financial markets and the causal relationship between events and price movements. To address these gaps, we propose CAMEF (Causal-Augmented Multi-Modality Event-Driven Financial Forecasting), a multi-modality framework that effectively integrates textual and time-series data with a causal learning mechanism and an LLM-based counterfactual event augmentation technique for causal-enhanced financial forecasting. Our contributions include: (1) a multi-modal framework that captures causal relationships between policy texts and historical price data; (2) a new financial dataset with six types of macroeconomic releases from 2008 to April 2024, and high-frequency real trading data for five key U.S. financial assets; and (3) an LLM-based counterfactual event augmentation strategy. We compare CAMEF to state-of-the-art transformer-based time-series and multi-modal baselines, and perform ablation studies to validate the effectiveness of the causal learning mechanism and event types.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes CAMEF, a multi-modality framework for event-driven financial forecasting that integrates textual and time-series data with a causal learning mechanism and an LLM-based counterfactual event augmentation technique.

Key Results

- CAMEF outperformed other models in 24 out of 30 forecasting settings, achieving first-place rankings and ranking second in the remaining 6 settings.

- CAMEF demonstrated superior performance across all forecasting lengths for stock market indices (SPX, INDU, NDX), except for short-horizon forecasting on INDU.

- For treasury bonds, CAMEF achieved the best results across all forecasting lengths for the 1-month treasury bond (USGG1M) and ranked second for the 5-year treasury bond (USGG5YR).

Significance

This research is important as it introduces CAMEF, a model that effectively leverages multi-modality information for significant performance gains, especially for stock market indices and treasury bonds, and outperforms classical models and other transformer-based methods.

Technical Contribution

CAMEF's superior training and feature fusion strategies establish it as the most effective method for event-driven financial forecasting tasks.

Novelty

CAMEF integrates causal learning and an LLM-based counterfactual event augmentation strategy, which distinguishes it from existing time-series and multi-modality forecasting methods.

Limitations

- The study did not explore the impact of additional event types, such as political events or corporate market-sensitive news.

- The dataset's time range (2008-April 2024) might not capture all potential market dynamics.

Future Work

- Leveraging advanced LLMs for enhanced textual encoding to extract deeper semantic information.

- Refining cross-modality causal inference mechanisms.

- Expanding the dataset to include additional event types.

Paper Details

PDF Preview

Similar Papers

Found 4 papersModality-aware Transformer for Financial Time series Forecasting

Xuan-Hong Dang, Yousaf Shah, Petros Zerfos et al.

Multimodal Language Models with Modality-Specific Experts for Financial Forecasting from Interleaved Sequences of Text and Time Series

Xifeng Yan, Nicholas Andrews, Ross Koval

Retrieval Augmented Time Series Forecasting

Samet Oymak, Ege Onur Taga, Kutay Tire et al.

Enhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

No citations found for this paper.

Comments (0)