Authors

Summary

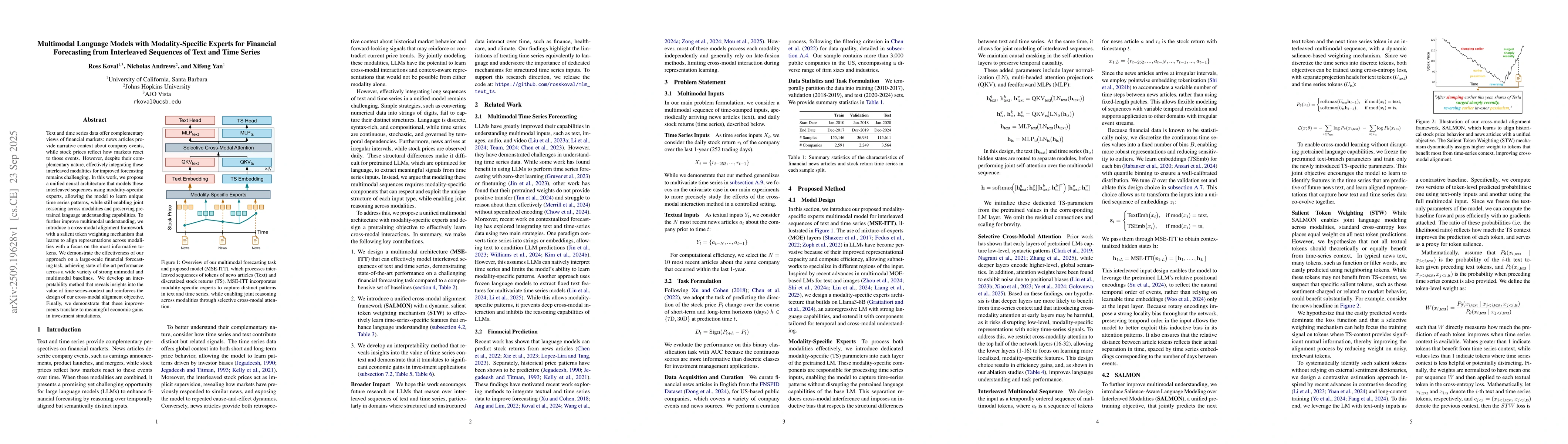

Text and time series data offer complementary views of financial markets: news articles provide narrative context about company events, while stock prices reflect how markets react to those events. However, despite their complementary nature, effectively integrating these interleaved modalities for improved forecasting remains challenging. In this work, we propose a unified neural architecture that models these interleaved sequences using modality-specific experts, allowing the model to learn unique time series patterns, while still enabling joint reasoning across modalities and preserving pretrained language understanding capabilities. To further improve multimodal understanding, we introduce a cross-modal alignment framework with a salient token weighting mechanism that learns to align representations across modalities with a focus on the most informative tokens. We demonstrate the effectiveness of our approach on a large-scale financial forecasting task, achieving state-of-the-art performance across a wide variety of strong unimodal and multimodal baselines. We develop an interpretability method that reveals insights into the value of time series-context and reinforces the design of our cross-modal alignment objective. Finally, we demonstrate that these improvements translate to meaningful economic gains in investment simulations.

AI Key Findings

Generated Sep 29, 2025

Methodology

The research employs a multimodal approach combining news articles and stock return time series data. It uses a pre-trained language model with a custom architecture (MSE-ITT) to process interleaved financial news and stock price data, incorporating time series discretization and cross-modal alignment techniques.

Key Results

- The MSE-ITT model achieves significant improvements in financial forecasting compared to baseline models, with better performance in both short-term (7D) and long-term (30D) predictions.

- The study demonstrates that incorporating temporal information through time series discretization enhances model performance across multiple financial metrics.

- The model effectively captures complex relationships between news events and stock price movements, showing superior prediction accuracy in market-neutral portfolios.

Significance

This research advances financial forecasting by demonstrating the effectiveness of integrating textual and numerical financial data through a novel multimodal architecture. The findings have practical implications for investment strategies and risk management in financial markets.

Technical Contribution

The paper introduces a novel architecture (MSE-ITT) that effectively integrates and processes interleaved financial news and time series data through time series discretization and cross-modal alignment techniques.

Novelty

This work presents a unique combination of time series discretization with multimodal financial data processing, along with a specialized architecture (MSE-ITT) that enables effective cross-modal alignment for financial forecasting tasks.

Limitations

- The model's performance is dependent on the quality and representativeness of the news data used for training.

- The study focuses on specific financial instruments and may not generalize well to other market conditions or asset classes.

Future Work

- Exploring the application of this methodology to other financial instruments and market conditions

- Investigating the impact of incorporating additional financial data sources (e.g., social media sentiment)

- Developing more sophisticated temporal modeling techniques for financial time series

Paper Details

PDF Preview

Similar Papers

Found 4 papersModality-aware Transformer for Financial Time series Forecasting

Xuan-Hong Dang, Yousaf Shah, Petros Zerfos et al.

Enhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

LeMoLE: LLM-Enhanced Mixture of Linear Experts for Time Series Forecasting

Ziyue Li, Lingzheng Zhang, Fugee Tsung et al.

Large Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

Comments (0)