Summary

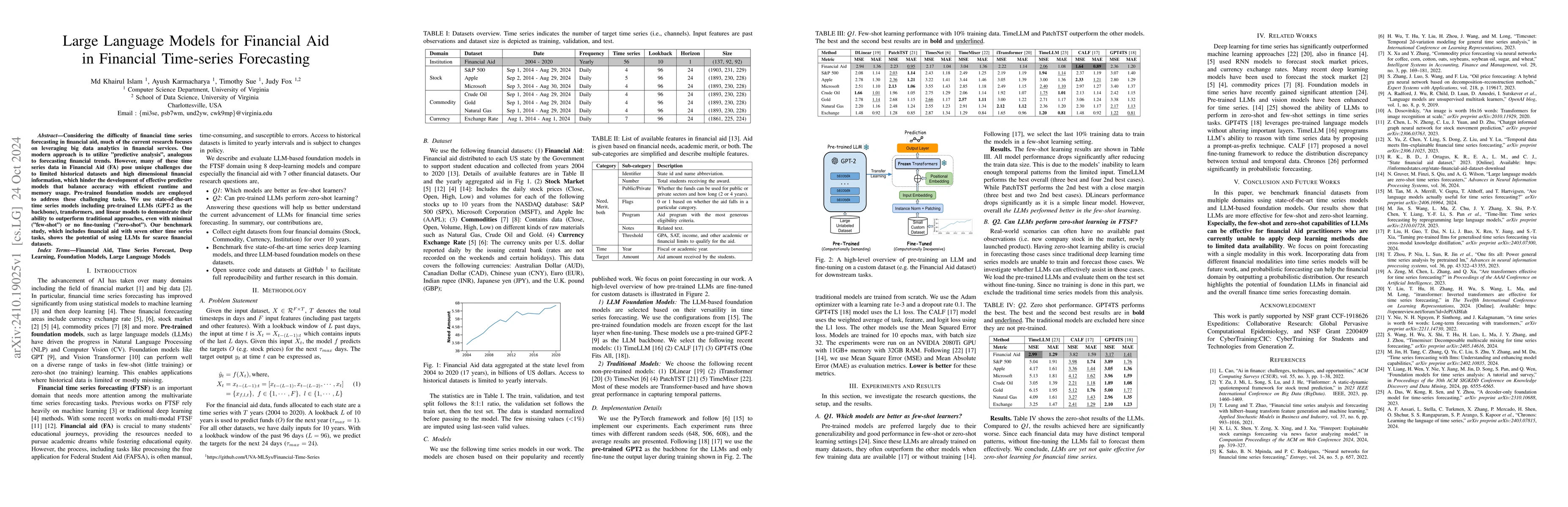

Considering the difficulty of financial time series forecasting in financial aid, much of the current research focuses on leveraging big data analytics in financial services. One modern approach is to utilize "predictive analysis", analogous to forecasting financial trends. However, many of these time series data in Financial Aid (FA) pose unique challenges due to limited historical datasets and high dimensional financial information, which hinder the development of effective predictive models that balance accuracy with efficient runtime and memory usage. Pre-trained foundation models are employed to address these challenging tasks. We use state-of-the-art time series models including pre-trained LLMs (GPT-2 as the backbone), transformers, and linear models to demonstrate their ability to outperform traditional approaches, even with minimal ("few-shot") or no fine-tuning ("zero-shot"). Our benchmark study, which includes financial aid with seven other time series tasks, shows the potential of using LLMs for scarce financial datasets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

LLM4FTS: Enhancing Large Language Models for Financial Time Series Prediction

Zian Liu, Renjun Jia

Causality-Inspired Models for Financial Time Series Forecasting

Xi Lin, Mihai Cucuringu, Yutong Lu et al.

No citations found for this paper.

Comments (0)