Authors

Summary

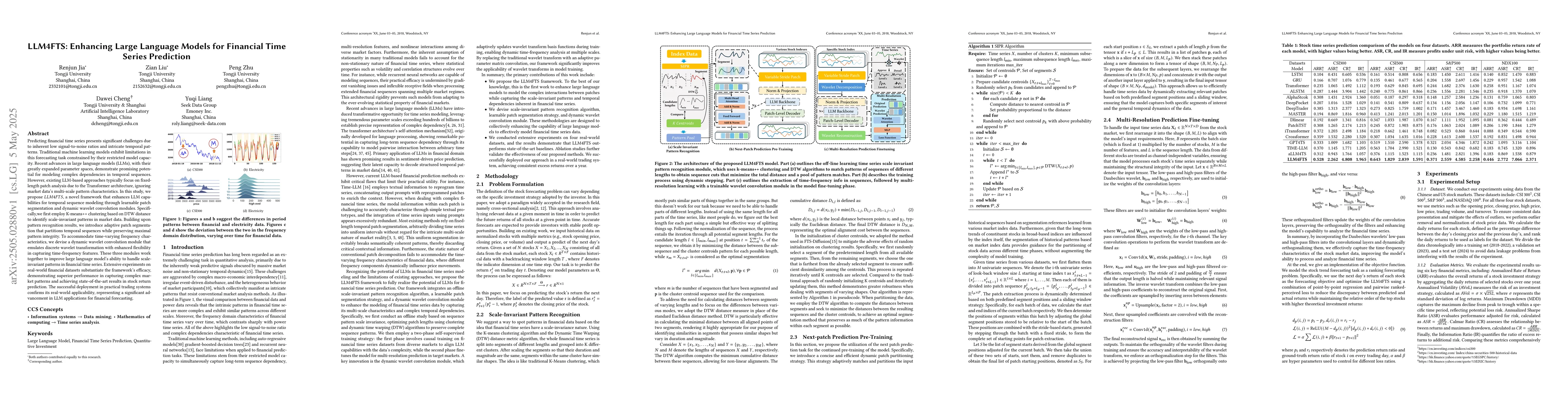

Predicting financial time series presents significant challenges due to inherent low signal-to-noise ratios and intricate temporal patterns. Traditional machine learning models exhibit limitations in this forecasting task constrained by their restricted model capacity. Recent advances in large language models (LLMs), with their greatly expanded parameter spaces, demonstrate promising potential for modeling complex dependencies in temporal sequences. However, existing LLM-based approaches typically focus on fixed-length patch analysis due to the Transformer architecture, ignoring market data's multi-scale pattern characteristics. In this study, we propose $LLM4FTS$, a novel framework that enhances LLM capabilities for temporal sequence modeling through learnable patch segmentation and dynamic wavelet convolution modules. Specifically,we first employ K-means++ clustering based on DTW distance to identify scale-invariant patterns in market data. Building upon pattern recognition results, we introduce adaptive patch segmentation that partitions temporal sequences while preserving maximal pattern integrity. To accommodate time-varying frequency characteristics, we devise a dynamic wavelet convolution module that emulates discrete wavelet transformation with enhanced flexibility in capturing time-frequency features. These three modules work together to improve large language model's ability to handle scale-invariant patterns in financial time series. Extensive experiments on real-world financial datasets substantiate the framework's efficacy, demonstrating superior performance in capturing complex market patterns and achieving state-of-the-art results in stock return prediction. The successful deployment in practical trading systems confirms its real-world applicability, representing a significant advancement in LLM applications for financial forecasting.

AI Key Findings

Generated May 28, 2025

Methodology

The research proposes LLM4FTS, a framework enhancing large language models for financial time series prediction by integrating scale-invariant pattern recognition, adaptive dynamic patch segmentation, and trainable wavelet convolution operators for multi-resolution temporal dependency modeling.

Key Results

- LLM4FTS outperforms state-of-the-art baselines in forecasting accuracy and generalization capability across four heterogeneous markets.

- Empirical results demonstrate superior performance in capturing complex historical patterns in financial data through hierarchical feature extraction.

- Real-world integration into a production-grade algorithmic trading infrastructure shows significant improvements in cumulative returns compared to existing investment strategies.

- The approach maintains robustness in extracting time-sensitive market patterns and executing effective trading signals under various market conditions.

Significance

This research is significant as it introduces a novel framework that leverages large language models (LLMs) for financial time series prediction, addressing the limitations of traditional machine learning models in handling complex dependencies in temporal sequences.

Technical Contribution

The integration of K-means++ clustering based on DTW distance for identifying scale-invariant patterns, adaptive patch segmentation, and dynamic wavelet convolution modules for capturing time-frequency characteristics in financial time series data.

Novelty

LLM4FTS stands out by focusing on multi-scale pattern characteristics in financial time series, which existing LLM-based approaches often overlook due to their fixed-length patch analysis constraints.

Limitations

- The study does not explore the applicability of LLM4FTS on other financial instruments beyond stocks.

- The model's performance may be influenced by the quality and volume of available financial data.

- The computational resources required for training and deploying LLM4FTS could be a limiting factor for some users.

Future Work

- Investigate the applicability of LLM4FTS on other financial instruments like bonds, commodities, and cryptocurrencies.

- Explore methods to reduce computational resource requirements for training and deploying the model.

- Study the impact of varying data quality and volume on the performance of LLM4FTS.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

Text2TimeSeries: Enhancing Financial Forecasting through Time Series Prediction Updates with Event-Driven Insights from Large Language Models

Yue Zhang, Pruthwik Mishra, Litton Jose Kurisinkel

Large Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

AI Analyst: Framework and Comprehensive Evaluation of Large Language Models for Financial Time Series Report Generation

Manuela Veloso, Rachneet Kaur, Zhen Zeng et al.

No citations found for this paper.

Comments (0)