Summary

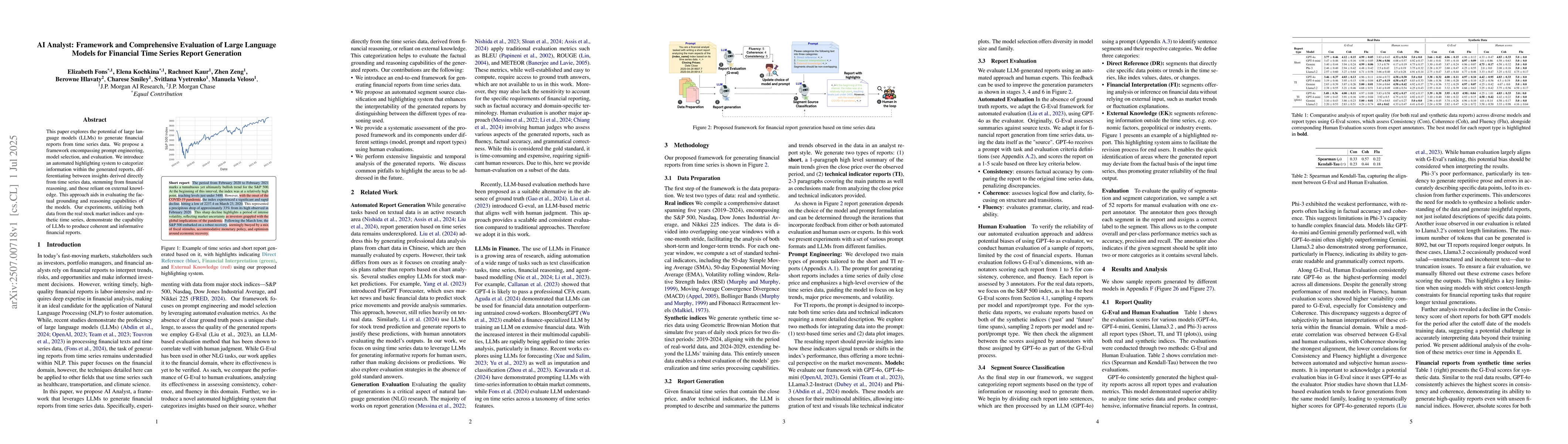

This paper explores the potential of large language models (LLMs) to generate financial reports from time series data. We propose a framework encompassing prompt engineering, model selection, and evaluation. We introduce an automated highlighting system to categorize information within the generated reports, differentiating between insights derived directly from time series data, stemming from financial reasoning, and those reliant on external knowledge. This approach aids in evaluating the factual grounding and reasoning capabilities of the models. Our experiments, utilizing both data from the real stock market indices and synthetic time series, demonstrate the capability of LLMs to produce coherent and informative financial reports.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Financial Time-Series Forecasting with Retrieval-Augmented Large Language Models

Zhengyu Chen, Jimin Huang, Sophia Ananiadou et al.

LLM4FTS: Enhancing Large Language Models for Financial Time Series Prediction

Zian Liu, Renjun Jia

Large Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

Advanced Financial Reasoning at Scale: A Comprehensive Evaluation of Large Language Models on CFA Level III

Srikanth Jagabathula, Parth Mitesh Shah, Pranam Shetty et al.

No citations found for this paper.

Comments (0)